Consumer spending is up 5.6% over the past 12 months.

Insight

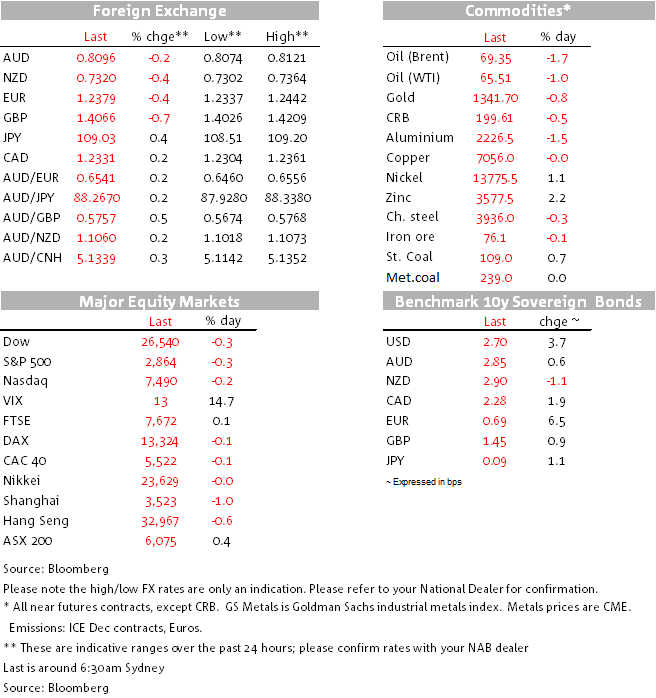

UST yields have led the sell-off in core global bond yields and for a change the USD has responded to the UST led rise in yields and outperforms across the board.

https://soundcloud.com/user-291029717/us-and-european-bonds-on-multi-year-highs

UST yields have led the sell-off in core global bond yields and for a change the USD has responded to the UST led rise in yields and outperforms across the board. Meanwhile equities have started the week on the back foot and notably the rate sensitive sectors ( utilities and real estate) are the underperformers in both Europe and the US.

10y UST yields jumped higher around midday Sydney time yesterday (from 2.6544% to 2.6879%) and then the move gathered further momentum overnight. The 10y note climbed above 2.70% for the first time since April 2014, it traded to an overnight high of 2.7254% and now it has settled just under the 2.70% mark. Meanwhile 10y Bunds briefly traded above 0.70% and 5y Bunds briefly traded in positive territory for the first time in 5 years.

There were no major news behind the move higher in yields, but given the recent break of key resistance levels core yields now have more freedom to move higher. Ahead of the FOMC meeting this week the move higher in yields also suggest investors are seemingly more sensitive to potential policy changes. Although there is a general consensus view that the Fed will stand pat this week, the FOMC is likely to take the opportunity to set the stage for a hike in March and many would argue that solid data releases along with the ease in financial conditions and softer USD are enough ammunition for the Fed/Yellen to highlight the risks of a fourth hike this year. Meanwhile, supporting the move higher in Bunds, ECB Governing Council member Klaas said on Sunday that there is not a single reason anymore to continue with the Central Bank’s QE program, raising question on the potential for an earlier than expected end to the programme.

For a change the USD has responded to the UST led rise in yields with BBDXY and DXY up 0.33% and 0.35% respectively. The USD has also outperform against EM and Asian currencies with ADXY down 0.20%. In G10, GBP is the underperformer, down -0.69% and currently trades at 1.4073, political pressure is seemingly building on PM Theresa May amid news that the UK is seeking powers to scrutinize new EU laws agreed by the rest of the bloc during the transition period, but Europe is unlikely to approve such terms. The AUD (-0.16%) and NZD(0.38%) have also succumbed to the USD, but both remain comfortably just under their respective recent highs. AUD currently trades at 0.8097 and NZD trades at 0.7321. Of note as well USD/JPY is trading just above the ¥109 mark, amid the BoJ’s Yield Curve Control policy 10y JGBs have lagged the move higher in core global yields and closed at 0.079%. Given the higher yield environment, the recent strength in JPY suggest the market may be looking for the BoJ to adjust its 10y yield target, but unless we see weaker yen it is difficult to envisage the BoJ making a move anytime soon.

The rise in dollar has also resulted in softer commodity performance with oil price down between 1% (Brent) and 1.7% (WTI). Gold (-0.8%) and Aluminium (-1.7%) have also followed the trend, but iron ore and coal prices are little changed. We think the inverse relationship between the USD and commodity prices is a theme worth keeping an eye on, particularly given the link between AUD and commodities. Early days of course, but a change in fortunes for the USD could be a double whammy for the AUD if commodities underperform.

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.