For further details, please see the NAB Online Retail Sales Index – April 2019

June 3, 2019

NAB Online Retail Sales Index, Monthly Update – April 2019

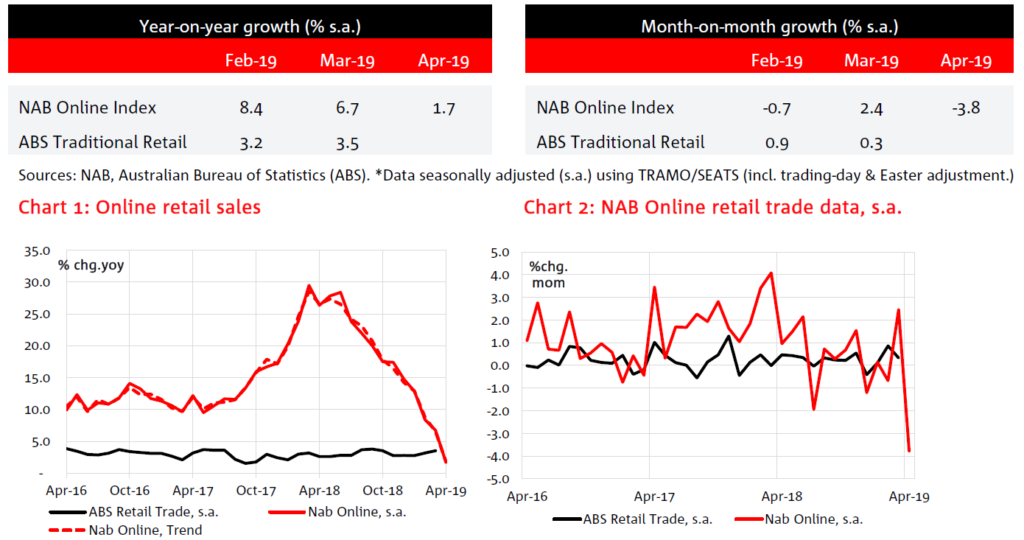

The NAB Online Retail Sales Index contracted -3.8% in April on a month-on-month, seasonally adjusted basis.

- The NAB Online Retail Sales Index contracted -3.8% in April on a month-on-month, seasonally adjusted basis. This follows an upwardly revised March result (+2.4%, was +1.7% mom, s.a). While not of the same magnitude, the April result is consistent with the broader retail sales weakness we have identified in our Cashless Retail ABS forecast for April (-0.5%).

- In year-on-year terms, the NAB Online Retail Sales Index remains positive, up 1.7% (y/y, s.a.) in April. However, this result is compared to April 2018, which was one of the strongest months recorded for online retail sales.

- After a strong March, all eight online retail categories recorded a contraction in month-on-month sales growth, with the largest sales category, Homewares and appliances (-6.9% mom, s.a.), the second weakest in the month behind takeaway food (-8.6%). In year-on-year terms, five of the eight NAB Online Retail Sales Index categories were lower compared to April 2018. Department and variety stores remains the fastest growing category in year-on-year terms (26.1% y/y). Games and toys performed best, albeit contracting, in month-on-month terms (-0.2% mom, s.a.). For more detail, see Charts 3, 5, 7 & 8 below.

- In month-on-month terms, all states and territories recorded a contraction in growth, led by Tasmania (-6.4%). The two largest online sales states, NSW (+0.5% yoy, s.a.) and Victoria (+1.6%), recorded considerably weak year-on-year growth in April.

- At +0.7%, international online retailers performed better in month-on-month terms relative to domestic competitors (-4.4% mom, s.a.). However, in year-on-year terms, from our series, considerable weakness in international online sales remains. See charts 13 and 14, and table 3 for category growth and share.

- We estimate that in the 12 months to April, Australians spent $28.98 billion on online retail, a level that is close to around 9% of the traditional bricks and mortar retail sector (March 2019, Australian Bureau of Statistics), and about 17% higher than the 12 months to April 2018.