Online retail sales growth slowed in May following a fairly strong April

Insight

Turmoil in financial markets can have a dramatic impact on superannuation funds’ currency hedging strategies, the recent Association of Superannuation Funds of Australia conference heard.

The Australian superannuation fund industry is putting in place a range of foreign exchange hedging strategies following last year’s extreme volatility across financial markets to help protect against future downturns, a recent conference was told.

In a session on managing currency during times of crisis, the Association of Superannuation Funds of Australia conference on 10-12 February heard that superannuation funds came under pressure when lockdowns spread around the world in early 2020 — not only from the slump in equity and bond markets but also a sudden 10-cent collapse in the Australian dollar.

“It’s important that we go back to look at what we learned during that period and to think about the techniques that some of the more successful managers used to smooth cash flow demands and manage liquidity, and to manage currency exposures,” said Jamie Bonic, Head of Investor Sales APAC, at National Australia Bank.

Superannuation funds have boosted exposure to international assets over the past decade as they increasingly look offshore to diversify their investments and seek attractive returns. This shift has increased fund exposure to movements in currencies when translating returns back into Australian dollars.

Superannuation funds had on average 41% of their assets offshore as at June 2019, according to a NAB survey. When asked about future allocations, 72% of respondents planned to boost the share of their investments in international assets.

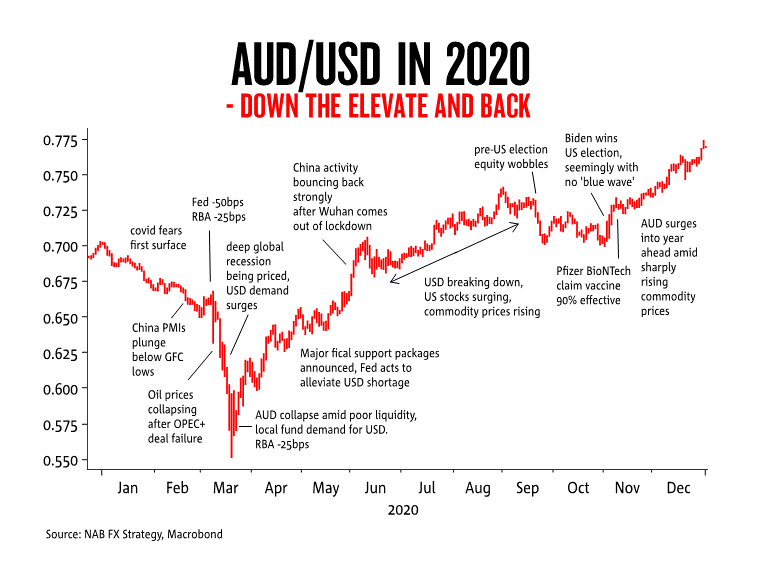

When global pandemic fears took hold in March 2020, markets snapped into “risk-off” mode and the Australian dollar dived 17 per cent over a 10-day period to a low of 55.10 U.S. cents, its lowest point in nearly two decades.

Superannuation funds were then sitting on foreign exchange losses in their hedging books that had to be financed from the broader fund.

This meant underlying hedges were out of the money (i.e., trading at a loss) on a mark to market basis, which added pressure on fund managers already struggling to find liquidity as equity markets tumbled and credit markets froze. Additional cashflow pressures came from member redemptions, as the federal government allowed early access to super balances in cases of hardship.

The conference heard that in times of crisis, it’s important for fund managers to hold their nerve.

“Some clients were forced to reduce or even exit some of their hedges due to cashflow pressure –but markets rebounded pretty quickly and the Aussie rallied 34% from its lows,” Bonic told the panel.

“Funds that came out of that COVID downturn with less hedging than when they went in may have found it very hard to get back into hedges at the higher levels. Staying in your hedges if that is what your benchmark requires is incredibly important so that you’re not forced to make decisions under duress.”

Funds that were able to extend existing hedges gained valuable breathing space to manage liquidity demands.

The ASFA conference panel also heard that flexible and agile governance structures are vital for funds to reduce uncertainty and avoid reactionary behaviour during periods of market dislocation.

Media Super Chief Investment Officer Michael McQueen told the conference having mechanisms in place that could be quickly activated in times of turmoil helped the fund to navigate the crisis.

“Media Super has a market disruption subcommittee in place, which is separate from the investment committee and has standing delegations. The subcommittee is enacted when the market falls more than 7% and can get together at very short notice to make decisions on asset allocation and hedging issues.

“It’s a very robust piece of governance to have and a good mechanism to express the latent flexibility in some small and mid-size funds. Even if the outcome is to take no immediate action, going through a pre-defined, rules-based approach is really valuable,” McQueen added.

Turning to specifics, NAB’s Bonic said a “vast array” of clients are seeking hedging strategies to cope with extreme market volatility. Options-based strategies are especially helpful for larger funds.

Other techniques include:

It’s also important for super funds that are increasingly bringing investment expertise in-house to ensure the operational capabilities and infrastructure to support complex hedging strategies, he said.

Internal investment teams are playing a much more influential role in setting the strategy for currency decisions. Medium and larger sized funds have been building investment capability and these teams are more influential than ever in currency decisions.

Speak to a specialist

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.