Jamie Bonic, Head of FX Investor Sales APAC, and Ray Attrill, Head of FX Research, joined ASFA to discuss the launch of NAB’s Super FX hedging survey.

Jamie Bonic, Head of FX Investor Sales APAC, and Ray Attrill, Head of FX Research, joined ASFA to discuss the launch of NAB’s Super FX hedging survey.

NAB presents detailed insights into superannuation investment behaviours and trends in our comprehensive survey of Australian Superannuation Funds undertaken every two years and opening again for 2023.

NAB and ASFA examine superannuation portfolio holdings disclosure data released this year as part of regulatory changes aimed at enhancing industry transparency.

Article

Head of FX Strategy, Ray Attrill and Director, Currency Overlay Solutions, Mike Symonds discuss the results of our 10th Biennial Superannuation FX Hedging survey with ASFA.

NAB's 2021 biennial Super Fund FX Survey highlighted that on average, close to 47% of funds’ assets are allocated offshore.

New NAB research shows how asset managers are working towards a more sustainable future through their investing activities and how companies can best embrace the change.

Our 10th biennial survey – the only survey of its kind to examine hedging techniques of Australian Super Funds – captures their shifting priorities in this rapidly changing landscape.

A new NAB report offers insights into how asset managers are incorporating sustainability metrics into their investing activities and what companies can do to develop best-in-class strategies.

The caps on super mean many of Australia’s wealthiest families are looking to park their savings elsewhere. So what are the options?

Article

Our Head of FX Investor Sales APAC and Head of FX Research joins ASFA CEO to discuss the 2021 survey.

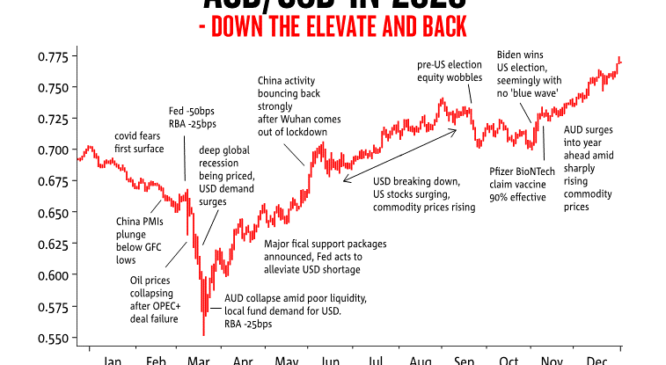

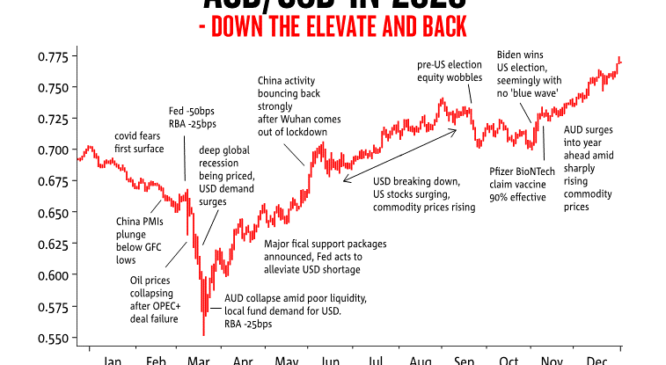

Turmoil in financial markets can have a dramatic impact on superannuation funds’ currency hedging strategies, the recent Association of Superannuation Funds of Australia conference heard.

Venture capital is too important for investors to ignore as it occupies an increasingly large part of the global economy and provides opportunities not available elsewhere, experts told the 2019 Association of Superannuation Funds of Australia.

Climate change is a long-term problem, but when it starts to affect asset prices it will happen very quickly, experts told the recent 2019 Association of Superannuation Funds of Australia.

Listed companies and superannuation funds can lift returns and boost Australia’s economic growth if they work together, the recent 2019 Association of Superannuation Funds of Australia heard.

Too many Australian business owners have less super than their employees. Watch this video to find out how you can better plan for your future.

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.