Asset finance and leasing is in a growth phase in Australia as organisations seek a capital-effective way to modernise and upgrade across a broad range of asset classes and industries.

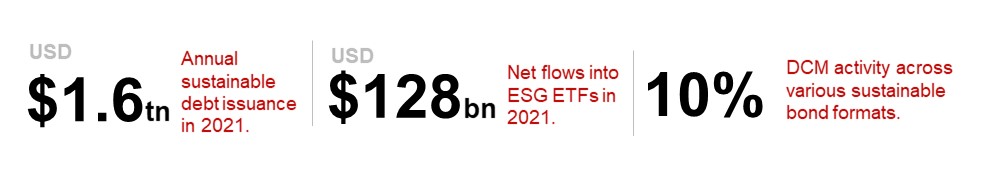

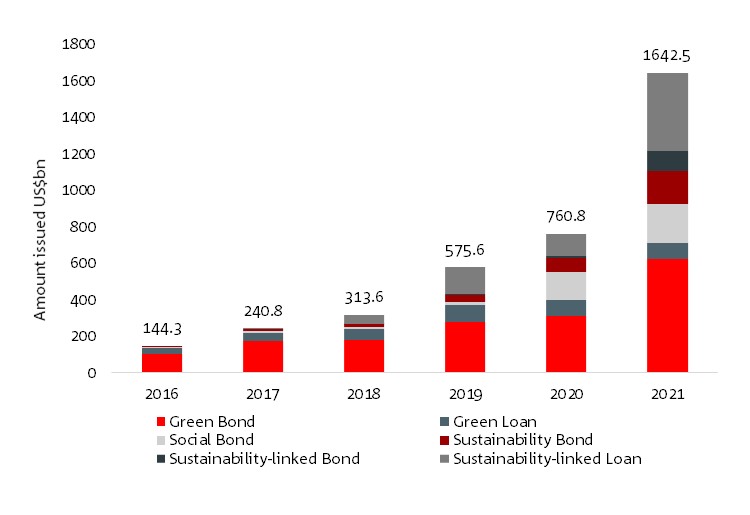

A look at what's been happening in the sustainable finance market in Australia and abroad.

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.