Join us as we discuss interest rates, general economic conditions, and the NAB AUD/USD forecast

Webinar

Join us as we discuss interest rates, general economic conditions, and the NAB AUD/USD forecast

Webinar

Join us as NAB Markets break down the week of Trump tariff market volatility.

Webinar

Join us as we discuss the impact of Trump's tariff policy on the Australian Dollar.

Webinar

NAB Markets discuss the outlook for the Aussie Dollar in a Trump 2.0 World

Webinar

The NAB FX Small Business team discuss how Trump's second term as U.S. President could influence the AUD.

Webinar

NAB Markets discuss the recent Q2 CPI print, what is driving inflation, and what this means for the interest path ahead.

Video

Currency strategy to achieve a better outcome for idle cash that may be awaiting deployment and earning little or no returns

Article

A major global investment fund is using NAB’s financial innovation for derivative portfolios to help incentivise sustainability goals in a new deal for the Australian market.

Article

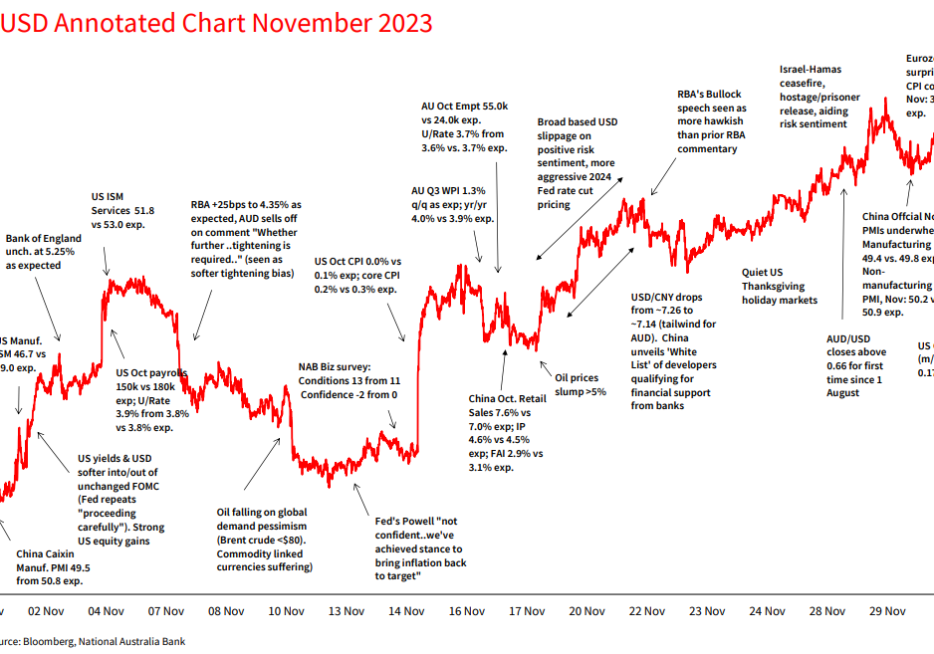

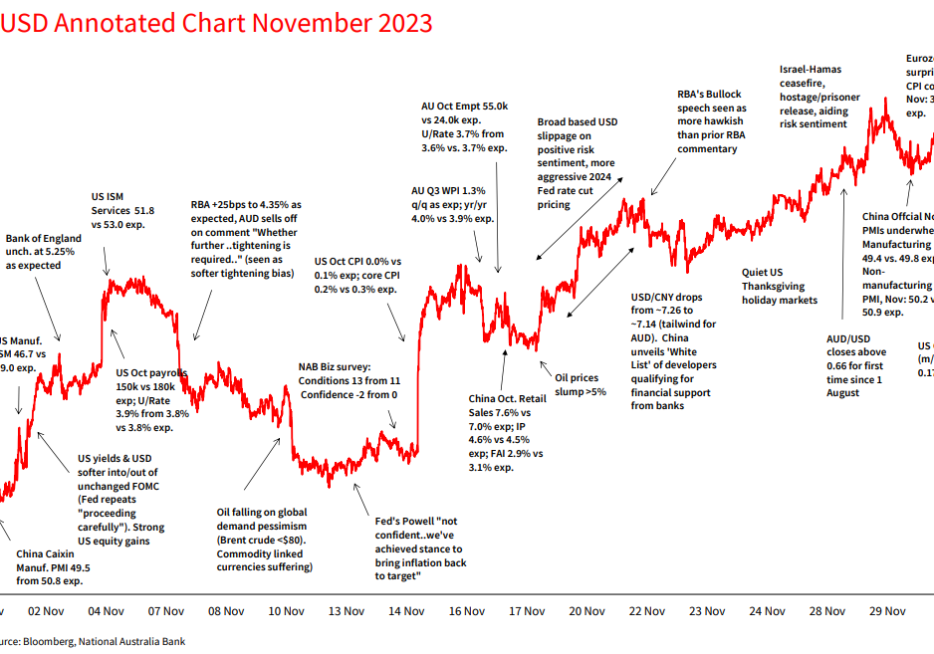

The AUD in November AUD/USD returned to ‘normal’ levels of monthly volatility in November.

After what has been a solid month for equities and bond investors, month end flows have probably play their part in the price action overnight, US equities have lost momentum, UST have led a rise in core global bond yields and the USD is stronger. US and European inflation releases favoured the notion the Fed and ECB are done with their respective tightening cycles.

Bond markets have been supported by some market-friendly data and while Fed speakers were again mixed, it was the more dovish remarks that captured attention.

Fed's Waller inches open the US rate cut door

Podcast

US and European markets have begun the new week a subdued mood. But core global bond yields are showing some life, lower across the board while the USD is a tad softer too

The Aussie dollar came within kissing distance of 66 US cents on Friday

UK best Eurozone on the PMI front in Thanksgiving- thinned markets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.