Coming in for landing in a heavy cross wind

Insight

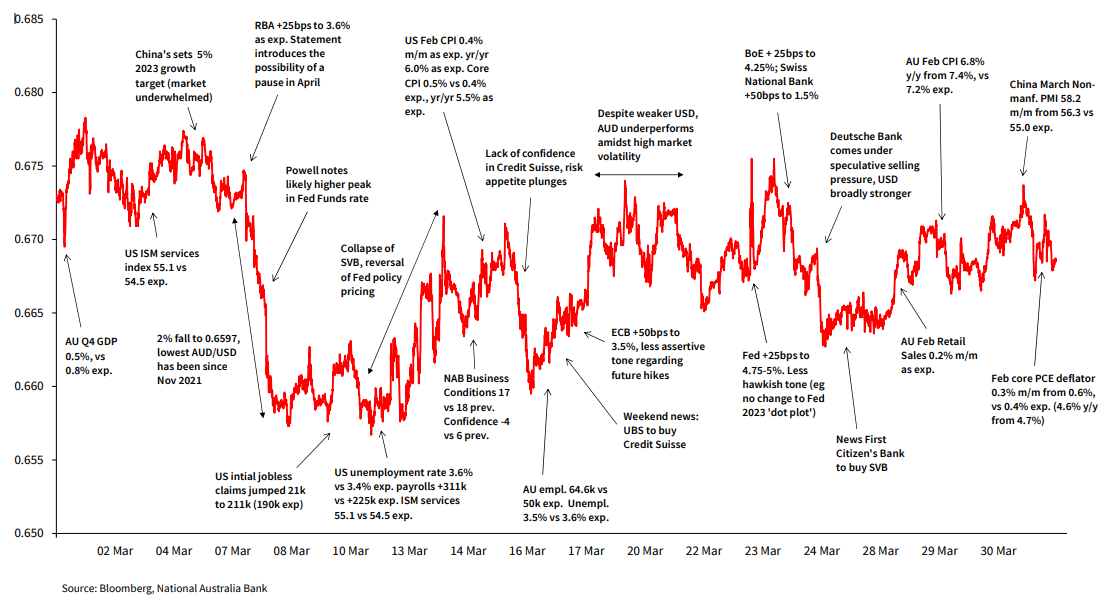

After reducing to just a 2.2 cents range in March, April’s AUD/USD range was little different – 2.3 cents

After reducing to just a 2.2 cents range in March, April’s range was little different – 2.3 cents, with a high of 0.6806 on 14 April and low of 0.6574 on the last day of the month. A (failed) test of 68 cents right at the start of April, following a surprises announcement of OPEC+ oil production cuts and surge in oil prices, gave way to a softer AUD after the RBA refrained from raising rates on April 4 – following 10 consecutive hikes since May 2022. The juxtaposition of the RBA going on pause while the RBNZ unexpectedly hiked by 50bps the following day helped push AUD/NZD to a new YTD low just beneath 1.06, itself weighing on AUD/USD.

Mixed signals from incoming US economic data produced a fair amount of day-to-day USD volatility in the first half of April but without this generating sufficient AUD/USD volatility to see the prevailing range seriously challenge. Rather, the top side test (to the 0.6805 April high) came shortly after a stronger than expected local labour market data (53k rise in unemployment and unchanged 3.5% unemployment rate against an expected rise to 3.6%). This, plus the subsequent release of the April RBA meeting Minutes, suggested that May was ‘live’ for a resumption of RBA tightening, supporting AUD, but such thinking was later scotched by the softer than expected Q1 CPI report (Trimmed Mean 1.2% QoQ against an expected 1.4%).

Pricing out of RBA tightening, accompanied by weaker commodity prices in the latter part of the month (including sharp falls in iron ore futures) as well as some AUD cross rates making multi-year lows (e.g. AUD/EUR) conspired to see AUD/USD revisit sub-0.66 levels at month-end, albeit sparing the pair a retest of the 0.6565 March low.

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.