Total spending grew 0.9% in June.

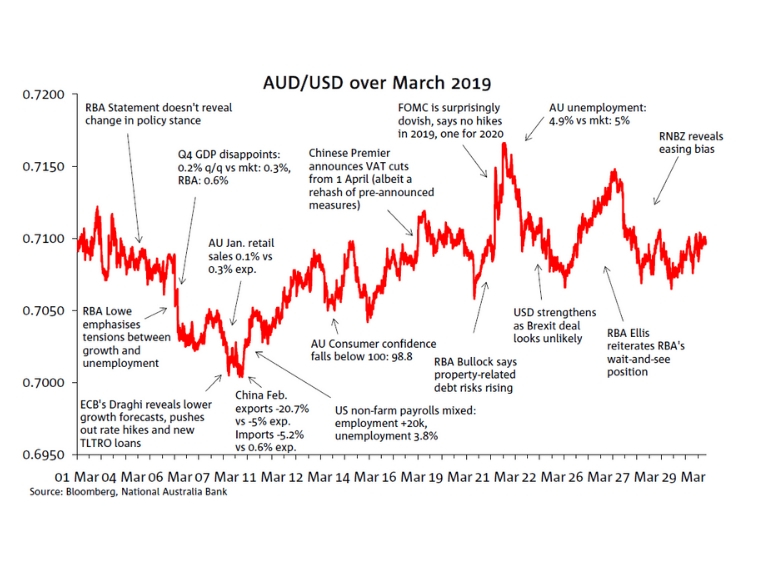

The AUD/USD traded in a tight range of just 1.65 cents in March, the narrowest range since August 2014 and closed the month at 0.7096, essentially right back to where it started.

Monetary policy was the focus of the month, as a number of central banks downgraded their outlooks. Dovish signals from the RBA, ECB and RBNZ weighed on the AUD/USD; while a dovish Fed helped the AUD/USD reach its monthly high of 0.7168 on March 21th. Earlier in the month the currency tested the 70 cents level, hitting a low of 0.7003 on March 8th.

The AUD/USD began the month at 0.7097, trading sideways over the next few days as the RBA meeting came and went without a shift in policy stance. However, RBA Lowe’s speech a day after the Board meeting revealed a more uncertain Bank – trying to decipher the tension between weak growth and improving unemployment. On the same day a weak Q4 GDP (0.2% q/q, mkt: 0.3% q/q), followed by soft January retail sales figures (0.1% vs 0.3% exp.) a day after, weighed on the AUD/USD. Then a dovish ECB revealing a downgrade to its economic outlook dented risk sentiment which was further compounded by disappointing China February trade figures (exports -20.7% y/y vs a consensus -5%). All of the above combined and drove the AUD/USD to its monthly low of 0.7003 on March 8th.

Over the next couple of days the currency was supported by buoyant equity markets and higher commodity prices led by WTI oil, before central banks were back in focus. On 21 March (AEST) the Fed surprised markets, revealing it expected to be on hold for the rest of 2019. The AUD/USD rose sharply, boosted even further when, hours later, Australia’s labour data revealed a 4.9% unemployment rate; and the currency hit its monthly high of 0.7166.

Some of this strength unwound as Brexit disarray bolstered the USD. But then on March 27th, it was the RBNZ’s turn to surprise the market, and the AUD/USD fell to 0.7103 as the New Zealand central bank revealed an explicit easing bias. Despite the shift in central bank expectations, the AUD/USD ended the month little changed at 0.7096.

Similar to the movements in AUD/USD spot, our AUD/USD Short Term Fair Value (STFV) estimate ended the month of March pretty close to where it started. So as it has been the case since early January, the AUD/USD continues to trade comfortably inside its fair value range defined by +/- 1.5 standard deviation band.

Solid gains in iron ore and oil prices in March were not enough to offset the decline in gold and coal prices resulting in a small drag on the model estimate from commodities. The AU-US rates spread was also a small negative contributor, but it could had been bigger had it not been for a dovish Fed repricing post the FOMC meeting. Meanwhile positive risk sentiment added to the model estimate with the VIX index closing the month below 14.

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.