The latest NAB Regional & Agribusiness webinar provides insights on the Australian & Global Economies, and a regional and rural property update. Watch the webinar here.

The AUD/USD continued its downtrend in October, reaching a fresh low of 0.7023 on the 26th of the month, a level not seen since February 2016.

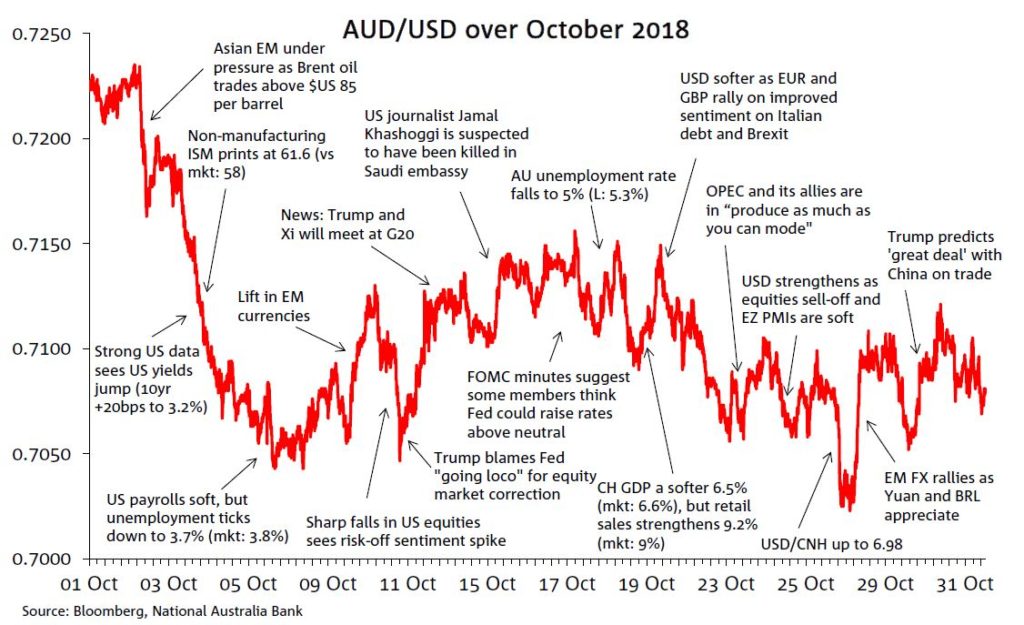

The AUD started the month on a positive note, reaching its monthly high of 0.7235 on October 2nd, before strong US economic data saw a sharp rise in US yields that dragged the AUD/USD down to 0.7043 over just a couple of days. US yields subsequently pulled back, but heightened risk aversion in conjunction with the correction in global equity markets – saw the currency remain under pressure. In the month, the AUD/USD traded a 2.1 cents range, ending at 0.7081.

The AUD/USD was dragged sharply lower early in October, as a stellar non-manufacturing ISM print (3rd Oct) saw US Treasury yields, and the USD, rise sharply – the 10y US Treasury yield jumped to 3.22%, from 3.08%. More strong US data saw US yields push higher over the next few days, keeping pressure on the AUD/USD.

However, despite US yields softening from their peak (9 Oct), the AUD/USD mostly range traded between 0.7050 and 0.7150 over the rest of the month. Risk sentiment, which had in recent months been concentrated on emerging markets (EM), broadened to developed markets (DM) following sharp falls in the US equity market. Over the next couple of weeks, corrections were seen across DM equity markets with investors showing a high degree of sensitivity to US company earnings reports.

In contrast, EM risk was mixed in the month. While the ongoing US-China trade war continued to weigh on the currency, EM FX overall lifted, with notable strengthening in the Argentine Peso, Turkish Lira and Brazilian Real.

The AUD/USD remained sensitive to shifts in US-China trade tensions: news of a planned Trump-Xi meeting in late November, mixed Chinese activity data and Trump’s hopes to strike a ‘great deal’ with China all swung the currency. Movements in the Yuan, which declined over the month, were also important. A sharp rise of the USD/CNH to 6.98 on 26 October saw the AUD/USD fall to its monthly low (0.7023), as the willingness of Chinese authorities to defend the key USD/CNY level of 7 was tested. The AUD/USD closed the month at 0.7081 supported by an improvement in risk sentiment evident in a recovery in global equity markets.

Early in October our AUD/USD fair value estimate briefly traded below its fair value range (roughly +/- 3.5 cents) suggesting a “Buy” signal could be in order. But the signal was not long enough to be credible and shortly after as US equities came under pressure and the VIX index jumped from 11.6 to 25, our fair value estimate embarked on a big correction, falling from 0.7689 on the 3rd of October to 0.7222 on the 11th of the month.

The VIX index, our measure of risk aversion in the model, ended the month at 21.23, 9.2 points higher and it was responsible for 2 of the 3.5 cent decline in our fair value estimate during the month. Softness in oil and metal prices contributed the bulk of the remaining 0.5 cent drag from commodities while higher US rates relative to Australia subtracted about a quarter of a cent. The AUD/USD now trades around 0.7110 with our fair estimate at 72 cents; so we can say that statistically the Aussie is currently fair valued.

Download the report for the full picture

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.