Robust growth for online retail sales observed in June

Insight

The downtrend in the AUD/USD took a pause in September, where the currency ended the month 0.3 cents higher than where it began.

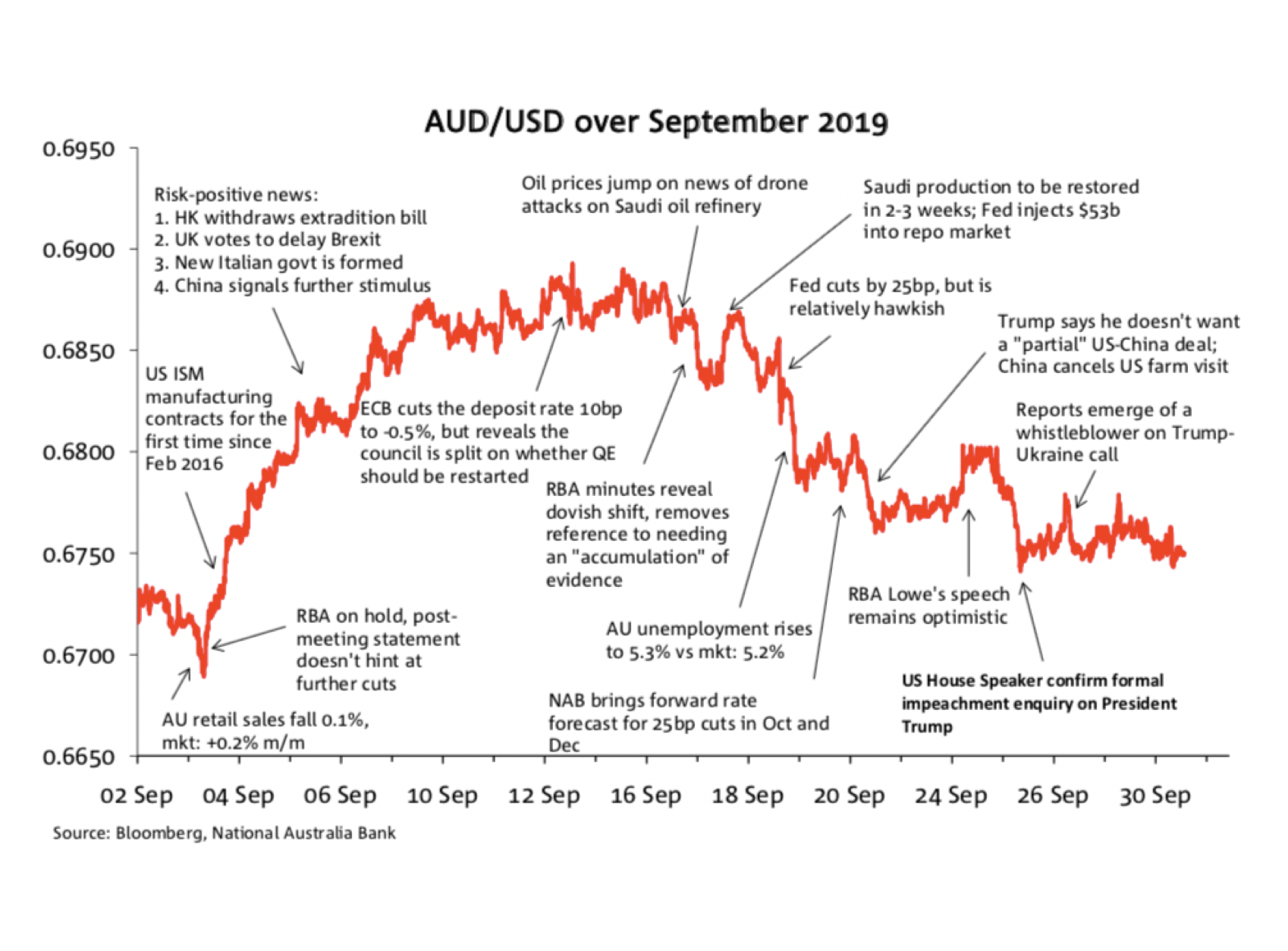

The downtrend in the AUD/USD took a pause in September, where the currency ended the month 0.3 cents higher than where it began. Global risk sentiment improved over the first half of the month, which saw the AUD/USD rally from its monthly low of 0.6688 on 3 September to its high of 0.6895 on 13 September, alongside a rise in global equities and bond yields. However, in the second half of the month, a more dovish RBA, alongside a reluctant easing by the Fed weighed on the currency. Geopolitical shocks in the month generated volatility, as another setback in the US-China trade negotiations, drone attacks on a Saudi oil refinery and the launch of an impeachment enquiry against US President Trump surprised markets. The AUD/USD traded in a range of 2.07 cents in September.

The AUD/USD began the month at 0.6720, under pressure from weak partial Q2 GDP data. Weak retail sales data added to the soft domestic outlook and the AUD/USD fell to its monthly low of 0.6688 on 3 September. Against a weak USD backdrop amid a contracting ISM manufacturing print, the AUD/USD fall quickly reversed helped along by the RBA staying on hold and remaining relatively optimistic.

The lift in the AUD/USD was extended as positive news boosted risk sentiment: Hong Kong withdrew the extradition bill, the UK voted to delay Brexit, a new Italian government was formed and China signalled further stimulus. Those developments saw a rally in global equities and a move up in core global yields. The currency remained around 0.6850 from 9 to 17 September.

In the second half of the month the AUD/USD came under pressure as the RBA revealed a dovish shift in its minutes and the unemployment rate rose to 5.3%, prompting the market to bring forward expectations for rate cuts. Geopolitical risk- off events generated further volatility including a drone attack on a Saudi oil refinery – which saw oil prices jump ~14%, before reversing – another setback in US-China relations and an impeachment enquiry against US President Trump. These events saw the AUD/USD end the month at 0.6750, a level that it had been range trading above for the past few days of September.

The NAB AUD Model

The AUD/USD was little changed in September (up 0.3c) while our Short-Term Fair Value (STFV) model estimate lost around 0.8c in the month. As a result, the gap between spot and our model estimate narrowed by one cent to 1.42c, meaning the AUD/USD has remained comfortably inside its fair value range of +/- 3.1c (Chart 2).

The decline in our STFV model estimate during September was largely due to a decline in gold and aluminium prices, with gains in oil, iron ore and coal prices only a small offsetting force. Overall commodities accounted for an 0.8c decline in the model estimate with a narrower AU-US rates differential counteracting gains from the improvement in risk appetite, measured by a 2.7 points fall decline in the VIX Index (our model proxy for risk sentiment).

For more detailed information download the The full report.

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.