Online retail sales growth slowed in May following a fairly strong April

Insight

A temporary easing in rules around equity capital raisings has helped a surge in activity and this is expected to continue as companies shore up their balance sheets.

Equity capital raisings have been a major focus for corporate Australia in the first half of 2020, as companies looked to shore up their balance sheets as a direct response to COVID-19. With guidance being retracted, earnings facing sharp declines and dividends being cut, it quickly became apparent that fresh equity capital was required across the market.

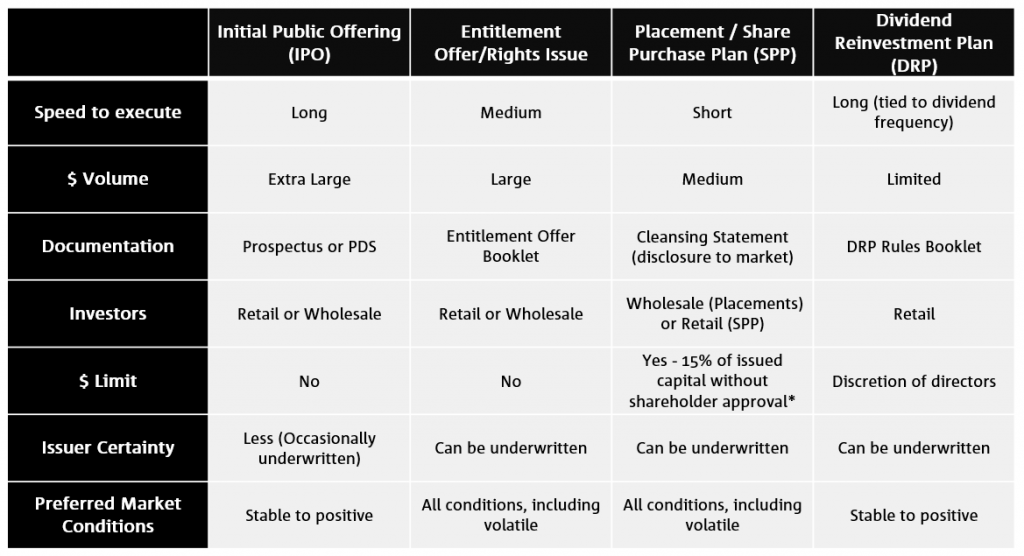

There are four main ways for companies to raise equity capital on the ASX:

*Note: ASX listing rule 7.1 has temporarily been lifted from 15% to 25% of issued capital.

Figure 1 below presents a breakdown of all equity capital raisings on the ASX (excluding SPPs and DRPs) from 2006 through to 30 June 2020.

This data provides some interesting trends. During times of high uncertainty and market volatility, IPO activity is close to zero whereas placements are more prevalent. Rights issues tend to be event-driven as a direct response to M&A (such as Transurban’s acquisition of WestConnex in 2018), company specific issues (recapitalising balance sheets post the GFC in 2008/2009) or regulatory changes (such as banks recapitalising in anticipation of regulatory capital changes in 2015).

Figure 2 below provides a good visual summary of the number, value and average deal size of each type of equity raising.

Placements are the most frequent form, but also raise the smallest amount of capital per deal. Placements can be executed quickly (normally within 24 hours) and are targeted at institutional investors. They are often also underwritten, providing certainty to issuers. Entitlement Offers/Rights issues are less frequent but raise almost double the amount of placements on average. All investors are treated in the same way, and receive a pro rata allocation. However, while there is no cap on the amount raised, they take longer to execute.

IPOs are the least frequent, but on average raise over double the amount of capital versus a placement. IPOs are highly sensitive to market conditions and the individual circumstances of the company.

The first half of 2020 was a very active period. When reviewing the data, it is clear that corporate Australia reacted more quickly than the rest of the world to the impacts of COVID-19 by raising capital to strengthen balance sheets. According to the Australian Investor Relations Association, Australia typically runs at 3-5% of global issuance. In the first weeks of the pandemic, Australia was running at 15-20% of global issuance¹.

In the first half of 2020, Corporate Australia has raised over two-thirds of the equity raised in all of 2019. The 10 largest ECM raisings have all been placements and five have taken advantage of the temporary increase in placement capacity from 15% to 25% of issued capital allowed by the ASX, as shown in Figure 3.

While capital raisings have occurred across all sectors, there was a much heavier focus on consumer discretionary companies due to uncertainty of earnings and cash flows.

For the rest of 2020, the outlook for capital raisings is driven by a number of key factors:

1) The continued uncertainty of COVID-19 will result in further equity raisings

The economic impact of changes to the “Job Keeper” support package and adjustments to the major banks’ loan deferral program is difficult to quantify. However, it is clear that further economic shocks could prompt companies to raise more equity capital. Placements and entitlement offers/rights issues will be the primary mechanism.

2) Investor demand

With interest rates expected to remain “lower for longer”, investors will continue to seek opportunities for assets and companies with attractive growth prospects and cash flow generation, ultimately driving higher equity values and P/E multiples.

3) Information technology and healthcare remains in focus

A shift in working practice, increased cybersecurity risk, increased information flow and greater health awareness is expected to drive S&P/ASX 200 Information Technology Sector (^XIJ) and S&P/ASX 200 Health Care Sector (^XHJ) indices, which are already trading at historically high forward P/E ratios.

4) Private Equity to capitalise on opportunities

Having recently undertaken a series of fundraising rounds, PE firms have a record amount of dry powder to deploy as they seek opportunities to unlock value and drive merger & acquisition activity.

As we head into the second half of 2020, it is expected that Placements, Entitlement Offers and Share Purchase Plans will continue to feature prominently as companies strengthen their balance sheets to navigate through the uncertainty created by COVID-19.

Heightened execution risk and volatile equity markets will mean that IPO activity will remain relatively low. Nonetheless, as equity markets stabilise, NAB expects a large pipeline of companies to list, particularly those backed by financial sponsors as they look to assess exit opportunities.

Speak to a specialist

This publication is published by National Australia Bank Limited ABN 12 004 044 937. The information provided is not intended to be comprehensive and does not constitute investment, legal or tax advice, nor does it constitute an offer or solicitation for the purchase or sale of any financial instrument or a recommendation for any investment product or strategy. It is general in nature and does not take into account your objectives, financial situation or needs. The information in this publication has been derived from several sources believed to be reliable and accurate at the time of publication. NAB does not accept any liability for losses either direct or consequential caused by the use of this information. NAB is neither making any investment recommendation nor is it providing any professional or advisory services relating to the information. Any opinions constitute NAB’s judgement at the time of issue and are subject to change. Neither NAB or any of the NAB group of companies, nor their employees or directors give any warranty of accuracy, nor accept any responsibility for errors or omissions in this document.

© 2020 National Australia Bank Limited. All rights reserved.

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.