Online retail sales growth slowed in May following a fairly strong April

Insight

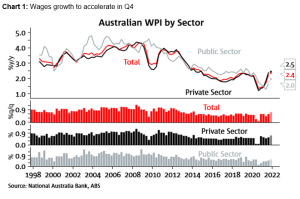

The Q3 result showed WPI wage increases broadly back to pre-pandemic patterns, and our forecast for Q4 sees an acceleration in private sector wages growth to 2.5% y/y.

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.