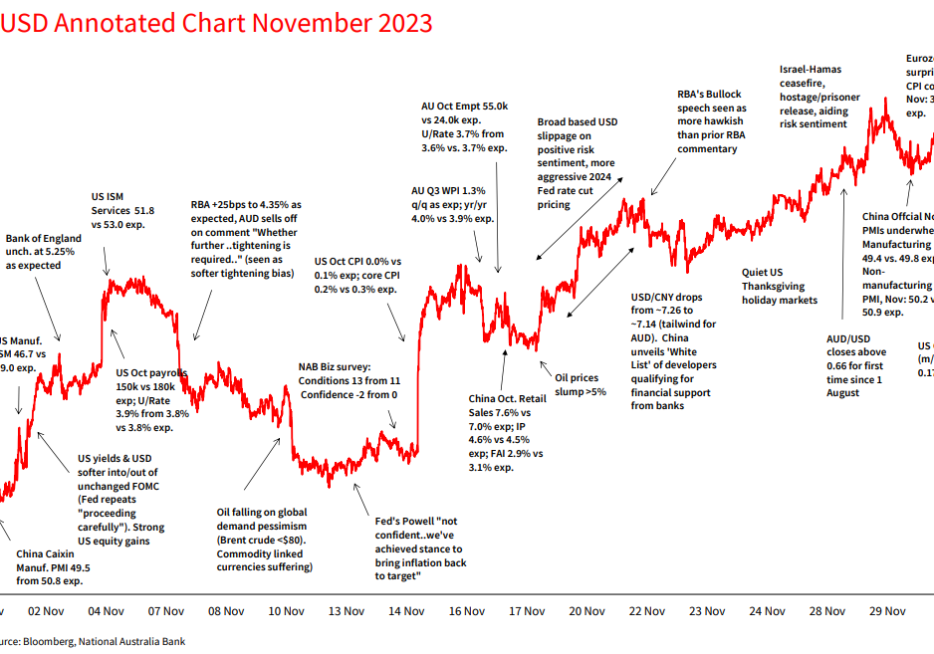

The AUD in November AUD/USD returned to ‘normal’ levels of monthly volatility in November.

Author

Rodrigo is a Currency Strategist and member of the FX strategy team at NAB. In this role, he contributes to the creation of trade ideas and research publications, and advises our internal and external clients on developments in global foreign exchange markets.

Rodrigo has lived and worked around the world. Before coming to Australia, he worked in London for Henderson Global Investors, firstly as the Head of Risk Measurement and then as a Quantitative Analyst in the Global Fixed Income Hedge Team. In 2009, Rodrigo made his move to NAB as an investment strategist within the private wealth division. He then worked in Rate Strategy for four years, before taking on his role today as Currency Strategist.

Rodrigo was born in Chile, and holds a Bachelor of Commerce, Honours and Masters in Economics from the University of the Witwatersrand in South Africa. He’s also a CFA charter holder, and has a diploma of Financial Markets (AFMA).

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.