Firmer consumer and steady outlook

Insight

Fresh from the annual Private Placement Industry Forum in Miami, we consider the options for investors looking to add a rock-solid asset to their portfolio.

Our team recently returned from the Private Placement Industry Forum in Miami, Florida. I always enjoy this annual event because it is a great gauge of investor sentiment. Over the course of two days we filled three conference rooms with back-to-back meetings with over 150 investors and 21 clients from 11 different companies from around the world. This, after coming off the largest issuance volume in our team’s history for the year ended December 2017. As you can imagine, we had a lot to talk about. Geoffrey Schmidt, GM Corporate Finance North America, NAB

A lot has changed since we established the team at the end of 2006: world economic events, three different US Presidents and digital currency have affected the markets in ways we could not have imagined a decade ago.

A lot has changed at NAB as well. Over the past 10 years we’ve added significant bench strength locally and globally, climbed the league tables and built our expertise across key sectors such as infrastructure, utilities and property. Above all, we aim to be pedantic about delivering superior outcomes for our customers in everything that we do. It is in our DNA, and is our primary reason for being.

In that spirit, we thought we’d share this article that analyzes the issues from the investor perspective.

Most articles about US Private Placements are focused on the benefits of the market to the issuer. They highlight long tenors, great pricing and constructive “bank-like” relationships that exist between issuer and investors.

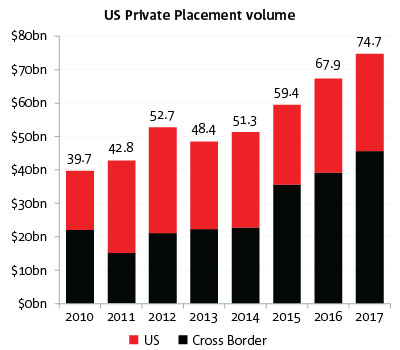

But what about the investor? If the “size of the pie” is finite, as is traditionally the case between the buyer and seller of a financial instrument, then an improvement for one side of the transaction should mean a less favorable outcome for the other. The difference with the US Private Placement market, however, is that the pie is not finite at all. In fact it is continuously growing – like the Magic Pudding — so that a win for an issuer is often a win for an investor as well.

The investor’s goal is to place a rock-solid asset in the firm’s investment portfolio, dust it off a few times a year for review, and then place it back on the shelf until next time.

What is a “rock solid” asset? It is one where:

In the United States, the alternative to the US Private Placement market is the 144(a) market. The 144(a) instrument caters to similar investors with similar investment horizons; however, it has evolved into 1) a market for issuers that either need more capital than a US Private Placement can provide (greater than US$2-3 billion), or 2) who come to market so frequently that documentation costs will actually go down if they issue off a 144(a) shelf registration. Most times, the issuer meets both conditions.

A true “frequent issue” 144(a) is poetry in motion. The offering launches mid-morning, bids are taken at midday and the transaction is priced by mid-afternoon; the deal is complete in just a few hours. This speed to market is great for issuers and bankers because it reduces market volatility risk from weeks to hours and it allows the debt syndicate team to launch (and price) at precisely the right time in most cases. From an investor’s perspective, however, this pace can be challenging.

Many investors will have just finished doing their analytics when bids are due. The funding department will have yet to make the internal commitment that the capital is actually available, and the portfolio manager will still be assessing whether the offering will fit into the portfolio. Time is not a friend for a 144(a) investor. Even infrequent issuers who complete a modest sized 144(a) offering take days, not weeks, to get through the market. While the additional time helps, it does not provide the comfortable timeline that a US Private Placement affords an investor.

By contrast, a US PP transaction takes about three weeks from launch to pricing. During this time the transaction documents are sent to the investment team where they are reviewed at multiple levels. The issuer will often roadshow, visiting key cities and meeting investors face to face and then fielding further questions the following week. This level of analysis is not possible in any other investment-grade debt capital market. The end result is that the investor has a deep understanding of the issuer, its industry and the competitive environment.

Unlike the bigger brother 144(a), where the investors may never be known to the issuers, the US Private Placement market fosters stronger bank-investor relationships. This is a mutually beneficial arrangement where investors, big or small, will meet with key treasury staff at the companies where they invest. This closer relationship fosters better communication between the company and the investor during good times and more importantly, during turbulent times. It is the latter that highlights why US Private Placements have the highest recovery rate in the fixed income asset class when things go wrong.

The offering documentation for a 144(a) typically contains numerous pages of legalese around risks, accounting, reliance on information, etc. This is necessary because the offering could theoretically be sold to less sophisticated investors and a bank needs to fully discuss risks from a number of different perspectives. Far less would be said about the company itself: operations, industry, competition, innovation, marketing.

By contrast, the language on a US Private Placement offering memorandum is written in plain English. The same six to eight sections are contained in almost all traditional Private Placement offering memorandums, laid out in the same order, covering information that is both standardized and quantifiable. Most importantly, the document is delivered in final form before the deal is launched.

Most Private Placements have covenants. That means more to an investor than just about any other attribute of the investment. Covenant protection means that the investor does not need to heavily monitor the company (and its industry) for news and activity. It means that they can analyze the investment and potentially participate in offerings where they would not have participated in the past. And on the rare occasion that something starts to go wrong, the covenants facilitate a conversation before a dire event. Why? Because issuers do not wait until a covenant is breached before they contact the investors. Most times, they reach out to investors far ahead of any trigger events.

Rarely do things work as they should when a business hits hard times. Sometimes the industry is in turmoil, other times it’s the company itself. Competitors are undercutting the business, customers are leaving, or costs are out of control — sometimes all three. This makes debt service harder and the risk of default greater. If an investor with covenants is engaged during the lead up to trouble, they can work with the company to provide headroom to get through until the issues are worked through.

Striking a modified agreement gives all parties time to address the challenge constructively. The fact is, almost all problems can be worked through unless a business is in permanent decline (think Smith-Corona typewriters, circa 1995). That is rare.

The final element of this market is the close relationship between issuers and investors. The “value” of this relationship spans more than money. Investors are some of the best sources of business advice for issuers in the world. Many investors are happy to give constructive (and free!) advice so that their investments stay on track. That’s the definition of “growing the pie”.

Maintaining these relationships also helps the investors understand the risk when a repeat issue comes to market, a scenario that will ultimately help a new issue.

US Private Placements play a major role in the portfolios of many US pension funds and insurance companies. These long-tenored assets match the liability book of an insurance company nicely, and they provide protections that many other financial instruments cannot. Most importantly, US Private Placements can create a mutually beneficial relationship between debt investor and company management that is rarely seen in any other capital market.

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.