We expect growth in the global economy to remain subdued out to 2026.

Insight

There was a sharp reaction to higher than expected CPI figures overnight but they have been tempered by weaker than expected retail figures.

Phil Dobbie asks NAB’s David de Garis whether the market had paid too much attention to the retail numbers. They also look at European data, the inexplicable growth in the pound, a leap in the Rand and what we can expect from Australia’s employment data this morning.

https://soundcloud.com/user-291029717/markets-pulled-each-way-on-us-cpi-and-retail-figures

Much of the anticipation for markets for the past week or so has surrounded whether, after the larger than expected gain in average hourly earnings, the CPI would present a similar picture of emerging US inflation. And it did. Headline and core CPI came in stronger than expected, headline by three tenths and the core by a tenth. Higher energy prices in January was an important element of the headline story on the back of higher oil prices, gasoline prices up 5.7%. But the Core CPI that leaves out food and energy inflation rose 0.3% m/m for steady annual growth of 1.8% (last January was also 0.3%) against expectations of a 0.2% increase. Apparel prices rose 1.7%, plus more elsewhere. Adding more to the upside surprise, unrounded the core CPI was 0.347% m/m, within a whisker then of being 0.4%, optically a larger overshoot. So it was a higher print.

This print gave the USD an initial shot in the arm sending it higher by around 0.5%, US Treasury yields too as the market moved to price in a confirmed March 21 FOMC further hike and the US/global reflation trade. For the USD though, just as quickly as it spiked higher it then immediately started to reverse course as the market absorbed a much weaker than expected US Retail Sales report for January. Retail sales fell 0.3% when the market was expecting a gain of 0.2% for the month after December’s 0.4% gain. Not only did the print for January miss the mark, but there was a sizeable downward revision, December’s previously reported 0.4% gain revised away. It was a similar story for the various “underlying” measures of retail sales, the control group measure used to compile those elements of consumption in GDP also flat after a now-reported -0.2% for December. In the wake of the Retail Sales report, the Atlanta Fed revised down its estimate for Q1 GDP from 4.0% to 3.2%.

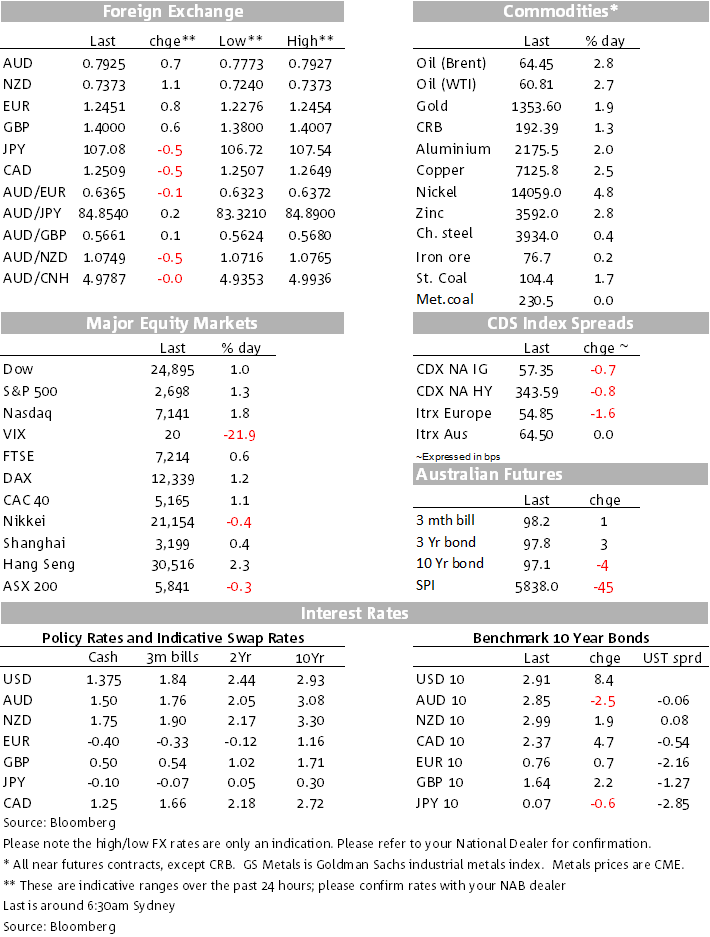

The market has in the wash up embraced the reflation trade with some gusto and not like the wobbles evident after payrolls. While the USD reversed course mid-session, US Treasury yields did not, jumping after simultaneous release of CPI and Retail Sales, and making further incremental gains higher. The US 10y Treasury was trading at 2.82% just before the data was released, it jumped to 2.88% and through the NY morning session has increased further to over 2.9%, to the highest yields this year with the big 3% now in sight. Yesterday, the market was pricing in 73 bps of Fed rises by the time of the December 19 FOMC; that’s now been bumped up to over 80 bps, the market and the Fed dots now in rare alignment.

The reflation trade saw bond yields higher, commodity prices also supported. Part of this stems from the fade in the USD, but underlying prices have pushed on further. WTI is up 2.8% to $60.81, gold +2% to $1356.60 and the LMEX base metals index up 2.36%, copper up 2.50% to $7,163/t. (In thin pre-Lunar Year trade, iron ore was higher in China yesterday too.) Ahead of this morning’s January labour market report, the AUD has poked its head back above 0.79 again with all major currencies making gains against the USD. NAB is looking for another better-than-expected print of employment of 35K, matching last month’s and more than double market expectations of a 15K gain. The NAB forecast for the unemployment rate is 5.4%, down a tenth against market expectations of a steady 5.5% rate.

The surprise is that equities are moving higher along for the reflation/higher yields ride – the VIX is down below 20 – equities also closing higher in Europe after some mid-session short-lived jitters. Into the last hour, US equities are trading at intra-day highs. The Bloomberg spot dollar index is down 0.68%. The Euro has also made a similar overall gain, coming also with the confirmation of a solid but as-expected print of Eurozone Q4 GDP at 0.6%/2.7% and industrial production in December finishing the year up a strong 5.2%. Those reports had little impact. It was all about the USD

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.