Fiscal stimulus likely too late to boost 2024 growth, but may add some upside to 2025 forecasts

Insight

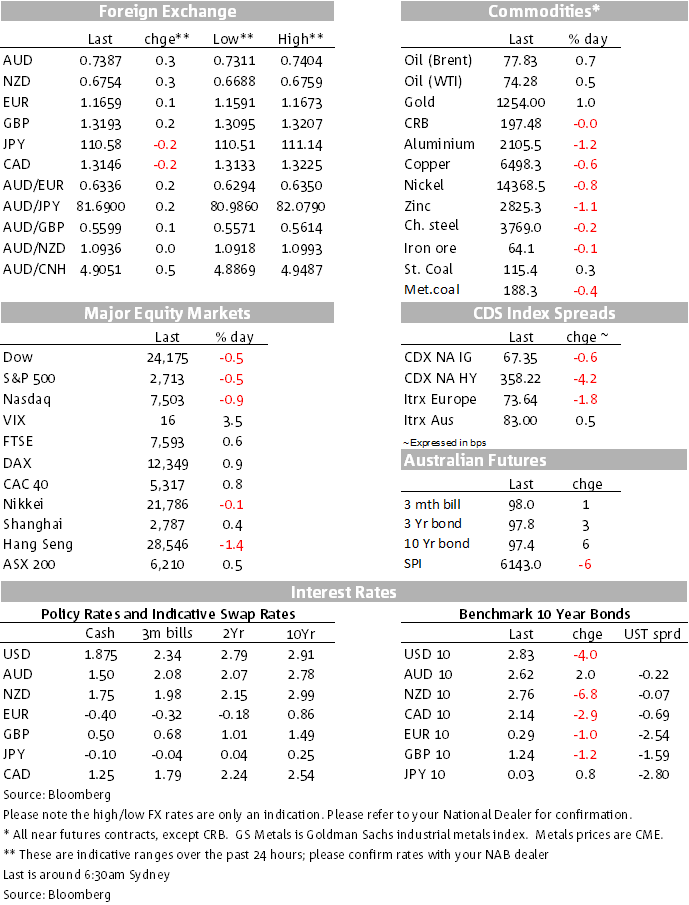

Overnight we saw US stocks fall and bond yields up, but the real action has been in China with a weakening of the Renminbi reportedly kept under control by lots of buying from state banks.

https://soundcloud.com/user-291029717/a-strong-and-stable-yuan-a-less-stable-plan-for-brexit

The market has been rightly besotted with trade tension news with July 6 looming for the imposition of those additional tariffs from the US and China. There’s also payrolls on Friday, so it’s going to be interesting to see how it pans out. But in the past 24 hours, the USD has been on the defensive in the wake of yesterday’s comments from PBoC Governor Yi Gang that the market has taken as a halt/slowing to CNY deprecation that’s been evident over recent weeks and weighing on EM FX, the AUD and the NZD.

PBoC Governor Yi Gang said yesterday that China will keep the yuan exchange rate basically stable at a reasonable and balanced level, in equilibrium and with monetary policy prudent and neutral. The comments came after USD/CNY breached 6.70, so there was speculation this level might represent a line in the sand for the PBoC. CNY saw a swing of about 1% after the comments. After trading as high as 6.72 earlier in the day, USD/CNY finished at 6.6425. The comments followed three weeks of unusually significant CNY weakness which the PBoC attributed to a stronger USD and external uncertainties. There were also reports from traders of state banks aggressively buying the Yuan. Another PBoC official stated that China won’t use the Yuan as a tool in trade conflicts.

And so now barely more than 24 hours on from when the AUD was testing 73 cents and the intervention of the PBoC Governor lifted the AUD back toward 0.74, trading this morning at 0.7380/85, the currency not damaged at all by the RBA rates on hold announcement, one more month stretching that to two years.

The NZD hit a fresh 2-year low of 0.6688 near the nadir in CNY weakness, yesterday’s quarterly survey of business opinion offering no support, the survey showing business confidence falling to a 7-year low, with the market putting more weight on the soft activity indicators than the survey’s evidence of rising inflationary pressure. The Kiwi also reversed course after the PBoC comments, with the currency trading near its highs for the day despite a weak GDT world dairy auction overnight. The GDT price index fell by 5.0%, with whole milk powder down 7.3%, larger falls than expected.

Adding to the reversal of the USD was an out-performing Swedish Krona after the Swedish Riksbank delivered a more hawkish than expected policy statement, with two out of the six voters calling for an earlier tightening. Sterling was supported after Saunders, a known hawk and one of the three that voted for a rate hike at the last BoE meeting, said that the central bank needed to raise rates faster than the market expects. Also helping the Pound was ITV’s Peston, a veteran British political reporter, who cited government insiders in saying that PM May’s Brexit plan is the “softest possible exit”. He outlined some of May’s plans to support his case. May is presenting her plan to her Cabinet colleagues at Chequers on Friday.

Meanwhile, further new from the Chinese side and in the US suggest that the trade issue remains unresolved with the atmospherics remaining testy. A Chinese court has temporarily banned chip sales of US tech company Micron Technology, ruling in favour of a Taiwanese competitor. While the case was part of a broader dispute between the two companies, the announcement came soon after the US moved to block China Mobile from entering the US market on national security grounds, fuelling speculation the decisions were part of the tit-for-tat trade war. Adding to the negative trade tension mood music, China’s customs agency unexpectedly issued trade data that showed growth in exports to the US slowing.

If it had not been for the Chinese Governor’s comments yesterday, the AUD could have easily been testing even lower levels. And with July 6 looming and beyond, it’s not hard to envisage further AUD and NZD trade tensions headwinds picking up in pace .

As this note was written, the England and Colombia saw England win in a penalty shoot-out 4-3 for anyone out there that hasn’t yet heard. No doubt the pubs around the mother country will be ringing from renditions of Jerusalem and other favourites. The question is, is there any beer left?

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.