Robust growth for online retail sales observed in June

Insight

Positive soundbites from Biden and McCarthy give hope a debt deal can be reached.

JN: GDP (q/q%), Q1: 0.4 vs. 0.2 exp.

AU: Wage price index (q/q%), Q1: 0.8 vs. 0.9 exp.

AU: Wage price index (y/y%), Q1: 3.7 vs. 3.6 exp.

US: Housing starts (k), Apr: 1401 vs. 1400 exp.

US: Building permits (k), Apr: 1416 vs. 1430 exp.

US equities have more than reversed their losses incurred in the previous day with positive soundbites from President Biden and House Speaker McCarthy increasing hopes a bipartisan debt deal may be reached avoiding a government shutdown and US credit default. Main US equity indices have closed the day comfortably above 1% while UST yields have extended their recent rise with the curve showing a bear flattening bias. Sentiment has also been supported by encouraging deposit news from Western Alliance Bancorp and better than expected results and guidance from Target. The USD has extended its rise for a second consecutive day with gains in JPY and EUR only partially offset by gains in commodity linked currencies.

Speaking at the White House, just before departing to Japan, President Joe Biden said he was confident “we’ll get the agreement on the budget and that America will not default,”, the positive soundbite from the president were reinforced by House Speaker McCarthy who said he remained hopeful a deal could be reached, adding that he planned to stay engaged with negotiations

Markets have chosen to be optimistic, embracing the positive soundbites from both parties. Also playing into the positive vibes, both parties agreed to new smaller group of staff-level talks increasing hopes a bipartisan deal may be reached. History of course tells us that a deal is more likely than not to be reached on the 11th hour, suggesting there is still room for a few bad headlines before a deal is finally reached. Yesterday we published a note on US Debt Disputes and Market Dynamics, noting how a spike in market volatility is a common theme across previous disputes, We also highlight that in the six episodes examined, in the month leading up to dispute resolution, the USD (DXY) has more often than not fallen (5 out of 6 occasions), Treasury yields mostly fell (5/6) and gold rose (5/6). AUD and US equity performance was more mixed. See here for here for more.

Sticking with the debt ceiling news, overnight the US Treasury updated its financial position, noting that its cash balance fell over $50b between Friday and Monday to just $87b, after larger than expected outflows, increasing the chance of the “X-date” being in early June. Treasury has almost run through all of its authorised extraordinary measures to keep paying the bills.

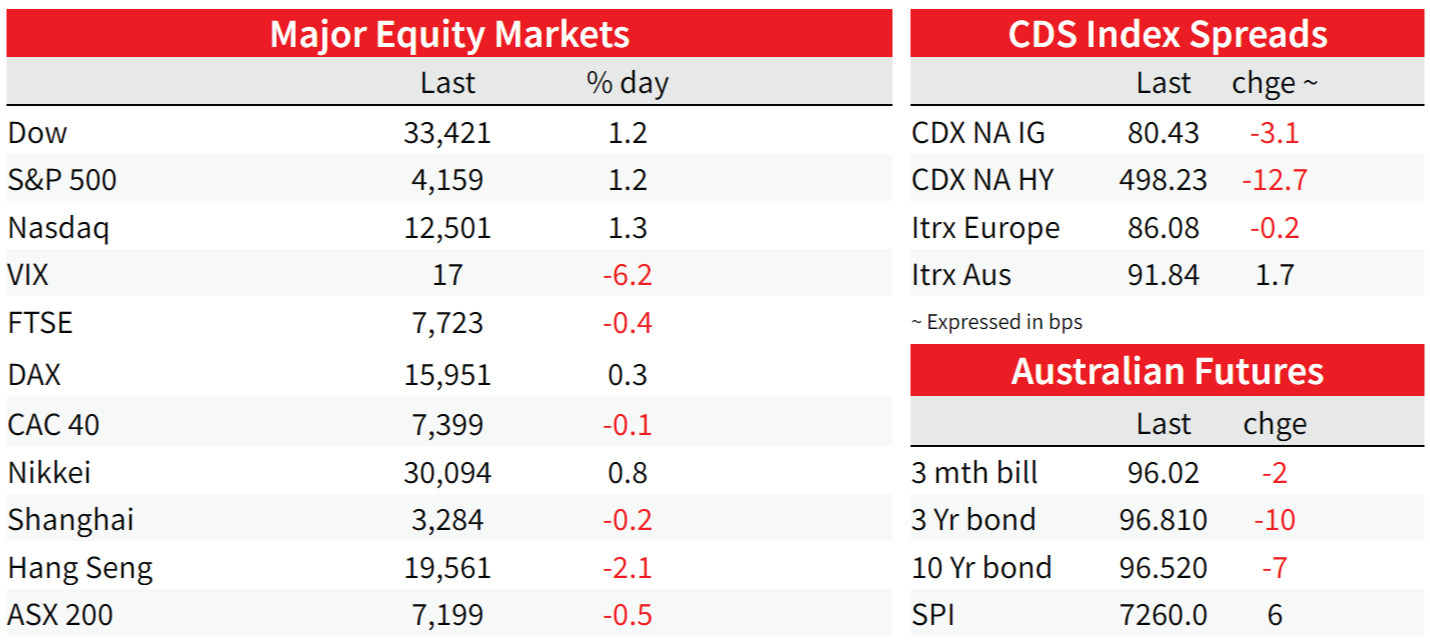

The positive debt ceiling soundbites contributed to a rebound in US equities with main indices more than reversing their losses incurred in the previous day. The S&P 500 closed 1.18% higher while the NASDAQ was +1.28%. Of note regional US banks had a good day , buoyed by encouraging news from Western Alliance Bancorp. The bank reported another $200m rise in deposits over recent days, following the $1.8b increase from the end of the quarter reported over a week ago. The KBW banking index closed 3.74% higher and the regional banking index gained 5.7%. Meanwhile on the consumer sector, and after underwhelming figures and outlook from HomeDepo yesterday, overnight Target stuck to its positive outlook, posting higher-than-expected profit in the first quarter, although it did caution that “softening sales trends” may hinder short-term results. Target shares closed above 3%.

Core yields had a mixed night. European yields eased a couple of bps with 10y Bunds down 1.6bps to 2.33% while 10y UK Gilts climbed 2.2bps to 3.831%. Of note, overnight the 10y Bund sale of bonds was the most oversubscribed in almost three years (2.30x bid-to-cover, the highest since August 2020).

Positive political vibes seemingly contributed to the move up in UST yields with the curve showing a bear flattening bias. The 2y Note gained 6.5 bps to 4.15% while the 10y climbed 3.9bps to 3.58%. The 2Y/10Y UST curve was 3bp flatter at -58bp. The 20Y UST auction saw indirect bid back above 70% and cleared a little through market, albeit as yields has sold off on the day.

On economic news, US Home building approvals have perked up a little . Total housing starts rose 2.2% to a 1.4m-unit in April. A rise in single-family permits drove the headline higher suggesting single-family construction could be at an early stage of a rebound supported by low inventories, apartment market conditions remain challenging.

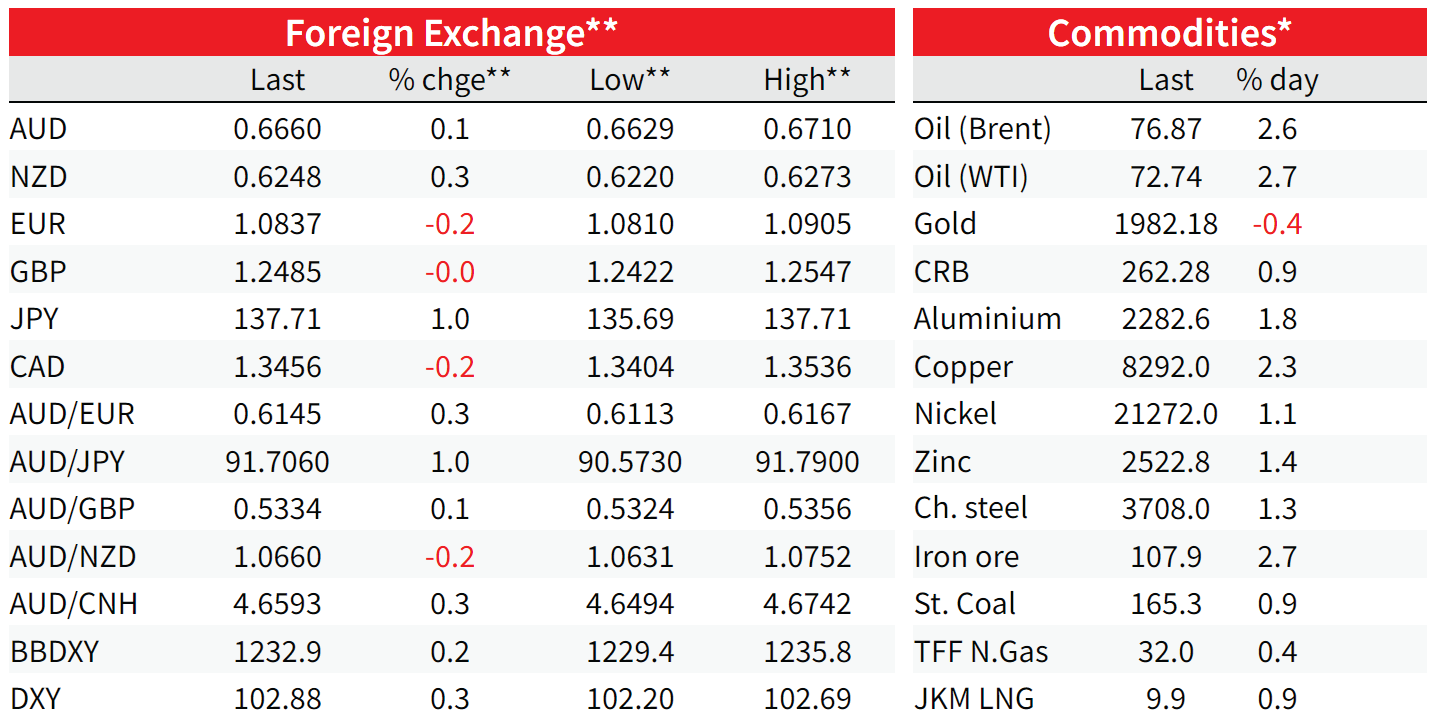

Moving onto FX, the USD is slightly higher in index terms with the DXY and BBDXY indices up 0.30% and 0.22% respectively. The big dollar has performed well against the majors with JPY the main underperformer (-0.9% USDJPY up to ¥137.6) while the euro is 0.21%. Contrasting fortunes in rates markets helping the moves, particularly USD/JPY gains given the BoJ YCC policy. On the latter, worth noting yesterday Japan GDP rose 0.4% q/q in Q1, ahead of market expectations. Friday’s CPI figures are likely to show yet another increasing in the core reading, suggesting Japan has an inflation problem while the economy is rebounding driven by domestic demand. The BoJ ultra-easy policy looks outdated.

Higher risk sentiment supported commodity currencies with the NZD, AUD and CAD performing the best overnight, but with only small gains. The NZD is currently 0.6260 and the AUD is at 0.6660. One hindering factor for all commodity linked currencies has been the recently underwhelming China data releases. China’s reopening recovery is clearly stalling driving further CNY weakness, yesterday USD/CNY broke up through 7 for the first time this year.

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets. Read our NAB Markets Research disclaimer.

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.