A soggy start to 2025

Insight

NY Fed’s Williams stressing importance of financial conditions in policy reaction function..

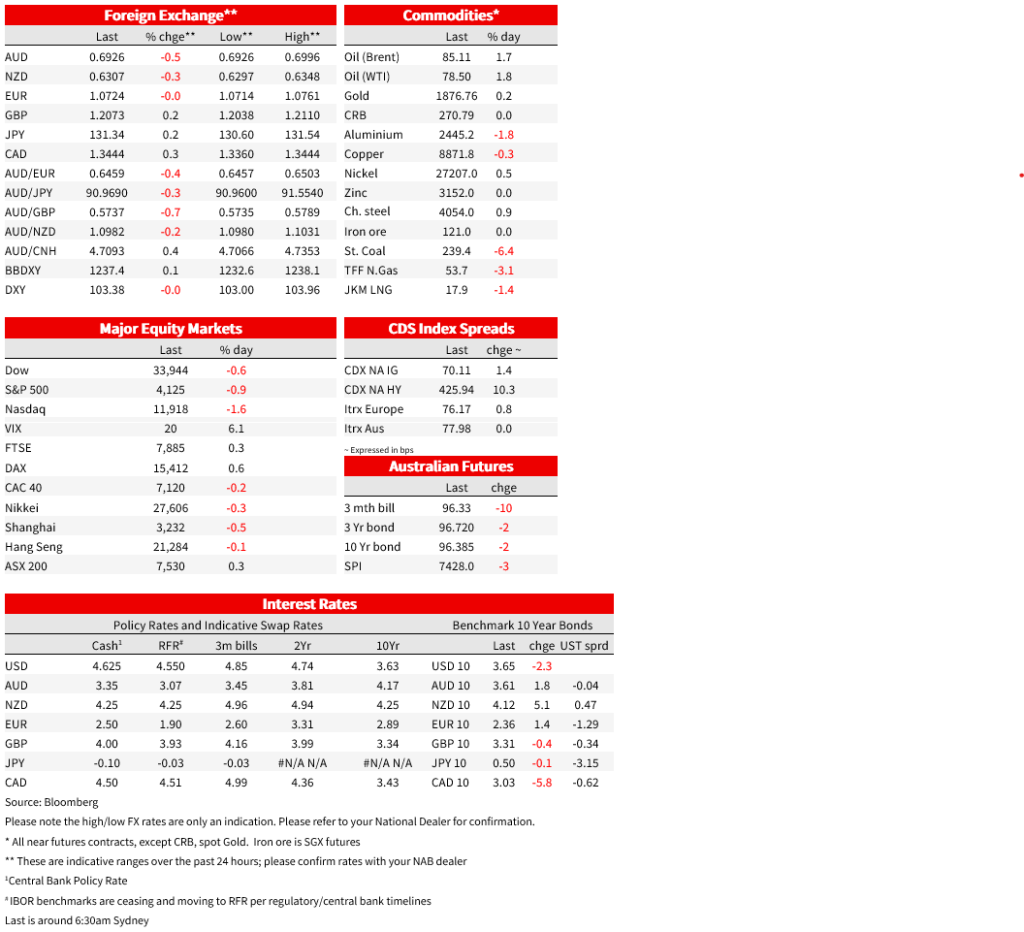

US equities are dancing to a different tune to bonds or currencies just at the moment, with stock markets lower for the second day running (tech-sector led) post Fed chair Powell’s interview Tuesday and now a raft of comments from other Fed officials, plus too some consistently hawkish messaging from ECB Governing Council members. Bond market for now though look to have already done what they want to on Fed speak and last Friday’s strong US numbers, with yields a touch lower – aided by a stellar US 10-year note auction – while the US dollar is very narrowly mixed on where it was at Tuesday’s New York close, AUD/USD is bobbing around inside a 0.69-0.70 range and barely changed on where it was just in front of Tuesday’s RBA announcement. It’s a light calendar in the day ahead.

Central bankers have been out in droves since we left off on Wednesday. The NY Fed’s John Williams says 5%-5.25% still a reasonable view for now (of the Fed terminal rate) but that if financial conditions loosen, higher rates may be needed . He ‘broadly’ sees financial conditions as being tighter, and again cites ‘core service ex housing’ as a key inflation metric the Fed is focussing on, in which respect he still sees a supply demand imbalance. The Fed could move faster than 25-point moves of the situation changes, he adds.

There are of course plenty of ways to skin a financial conditions cat (which Mohamed El-Erian earlier this week reckoned are no tighter today than when the Fed started tightening a yar ago). The Fed reckons they are tighter, and our own US financial conditions indx agrees with that, though there is no doubt they have eased significantly in the past three months ago (principally on US equity market gains since last October) and which is evidently something the Fed is none too pleased about. Hence the unwillingness to give any succour to money market pricing that continues to see some 50bps of Fed easing, from an assumed 5.0-5.25% peak, by January next year.

Other Fed speakers overnight include the Fed’s Lisa Cook who endorsed the Fed moving in smaller (i.e. 25-point) steps as the Fed tightens but who says that inflation is still running too high and that we will need restrictive policy for some time to cool prices. Minneapolis Fed President Neal Kashkari says he expects the Fed Funds rate target to be above 5% at some point, that wages growth is too hot now to support 2% inflation (we agree that’s true while above 4%) and that there’s no evidence rate hikes are affecting the labour market.

Meanwhile over at the ECB, Klaus Knot says the ECB ‘still has some ground to cover’ and that another 50bps hike in May may be needed (i.e., beyond the already-flagged 50-point move in March) ‘if underlying prices don’t slow’ (though they may well have by then in NAB’s view). The ECB’s Nagel says, ‘more significant ECB rate hikes are needed’ and that the ECB mustn’t stop raising rates too soon. And for good measure, GC member Schnabel says the ECB intends to hike by 50bps in May and reckons monetary tightening is having little impact so far.

In equities, heading into the last hour of NYSE trade the S&P500 in down about 09.8% and the tech-heavy Nasdaq a BIGGER 1.5% (Alphabet is off some 8% on concerns about the accuracy of its AI driven chatbot, apparently.

US treasuries are having an okay night, with yields 1-3bps lower. The 10-year Note auction was good, awarded at 3.613%, more than 2bps though the 3.643% WI yield, with indirect bidders (sometimes seen as a proxy for foreign demand) up to a record 79.5% and with the bid-cover ratio of 2.66% its highest in a year. Earlier European bonds saw yield rise of 1-3bpos at 10-years,

FX price action has been minimal with USd indices little changed, though European currencies are generally a bit stronger (led by a 0.25% rise for GBP and where there does seem to be a bit of optimism around in regard to the UK and EU striking a new dal on the Northern island protocol 9and after a UK court threw out an appeal against the current protocol being illegal). APAC currencies re weaker though, led by a 0.4% loss for the AUD/USD and which at 0.6930 at 7am local time is pretty mush where it was before Tuesday’s RBA rate rise announcement and hawkish Statement flagging additional rate rises (plural) to come.

There have been no significant economic data releases overnight. Late in our day yesterday, the Japan Economy watchers survey showed the ‘Current’ situation reading down slightly to 48.5 from 48.7 but the ‘Outlook’ up to 49.3 from 46.8 – a bigger rise than expected.

For further FX, Interest rate and Commodities information visit com.au/nabfinancialmarkets. Read our NAB Markets Research disclaimer.

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.