We expect NAB’s Non-rural Commodity Price Index to fall by 4.9% in Q2

Insight

President Biden visited Ukraine, where he pledged ‘unwavering support’ for the country as the Russia’s invasion nears the one-year mark.

It has been a very quiet start to the week with little in the way of data flow and the US out for the Presidents Day holiday. The big news of the past 24 hours was on the geopolitical front with a surprise visit from President Biden in Kyiv.

President Biden visited Ukraine, where he pledged ‘unwavering support’ for the country as the Russia’s invasion nears the one-year mark. That comes amid signs that Russia is preparing for a larger offensive which will involve more air power than used to date and reports, since denied to EU officials by State Councillor Wang Yi, that China may be planning to provide arms to Russia. Developments in Ukraine are a less significant driver for markets than earlier in the conflict, though the developments underscore that geopolitical risk remains elevated and that almost one year after Russia’s invasion, there is no endgame in sight.

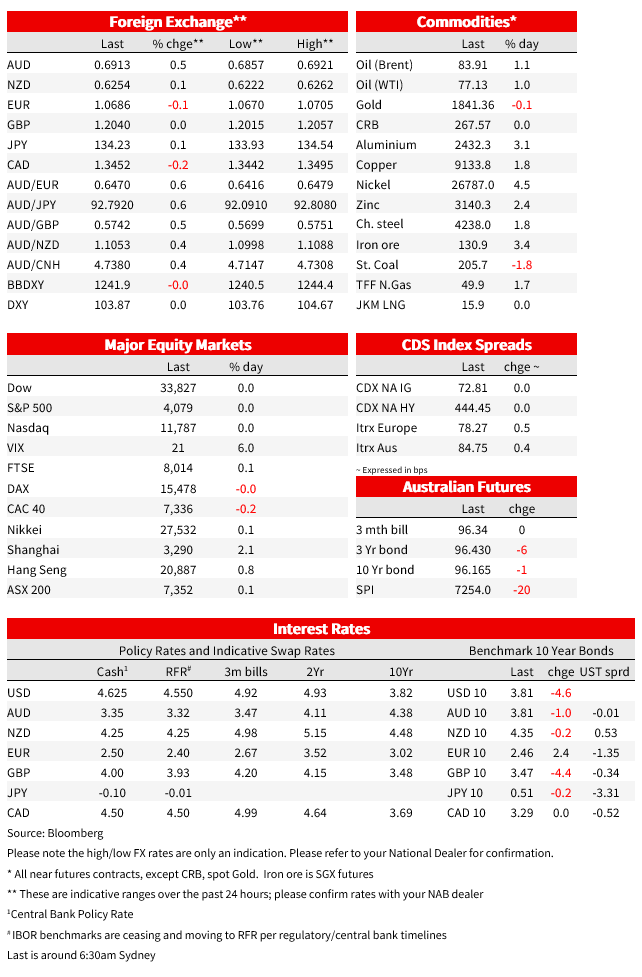

In terms of market moves, the US was out for President’s day, but futures markets suggest no break from the recent trend of higher yields and marginally softer equities into the new week. S&P futures are currently down 0.3% while Treasury futures are weaker as well, pointing to a modest lift in yields. German 10yr yields were up around 2bp. ECB Governing Council member Olli Rehn said in an interview that “with inflation so high, further rate hikes beyond March seem likely, logical and appropriate,” adding that “ I assume that we will reach the terminal rate in the course of the summer.” Markets currently price a peak around 3.6% from July.

European equities were little changed, with a fall in consumer and technology stocks offsetting a rise in commodity-exposed equities. In what was elsewhere a quiet 24 hours, Chinese equities were an outperformer, the CSI 300 was up 2.5% for its best one-day performance since November. In FX markets, the dollar was flat on the DXY and moves against most major currencies were small. The AUD, though, did manage a 0.5% gain against the dollar to trade around 0.6913.

The only data of note was Euro area consumer confidence, which rose in February to -19 from -20.7. That’s in line with consensus and takes confidence to its highest level in a year. Confidence has rebounded from a trough of -28.7 in September, but remains mired at levels well below long run averages. A relatively mild winter, receding energy fears and slowing headline inflation have helped boost the index.

Attention for markets now turns to an update on growth momentum in the form of February flash PMIs tonight. On the growth outlook, the Bundesbank monthly report suggested the German economy may fair ‘a little better’ than its December prediction for -0.5% growth over 2023 but cautioned “there’s no significant improvement in sight. ” The report offered a more pessimistic outlook than the European Commission’s forecast last week for growth of 0.2%. Stubborn underlying inflation remains a clear concern in Europe, and underlying inflation pressures are likely to ease only slowly with the report noting that “noticeable second-round effects on prices can be expected.” That comes after comments late last week from the ECB’s Schnabel that “a broad disinflation process has not even started in the euro area” and that there is “a risk that inflation proves to be more persistent than is currently priced by financial markets”

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets. Read our NAB Markets Research disclaimer.

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.