Australian carbon project developers see a maturing of institutional financing as key to scaling the market and taking it on a similar trajectory as renewable energy.

Headlines of impending Ueda nomination for BoJ Governor see volatile yen..

Friday was a busy day in terms of news flow, with a bumper Canadian employment report helping the CAD outperform and reports of a surprise appointment for BoJ Governor seeing a volatile yen. But overall it was a week that existed largely in the shadow of the prior Friday’s Payrolls and Services ISM surprise. US CPI on Tuesday is the near-term focus as we head into the new week.

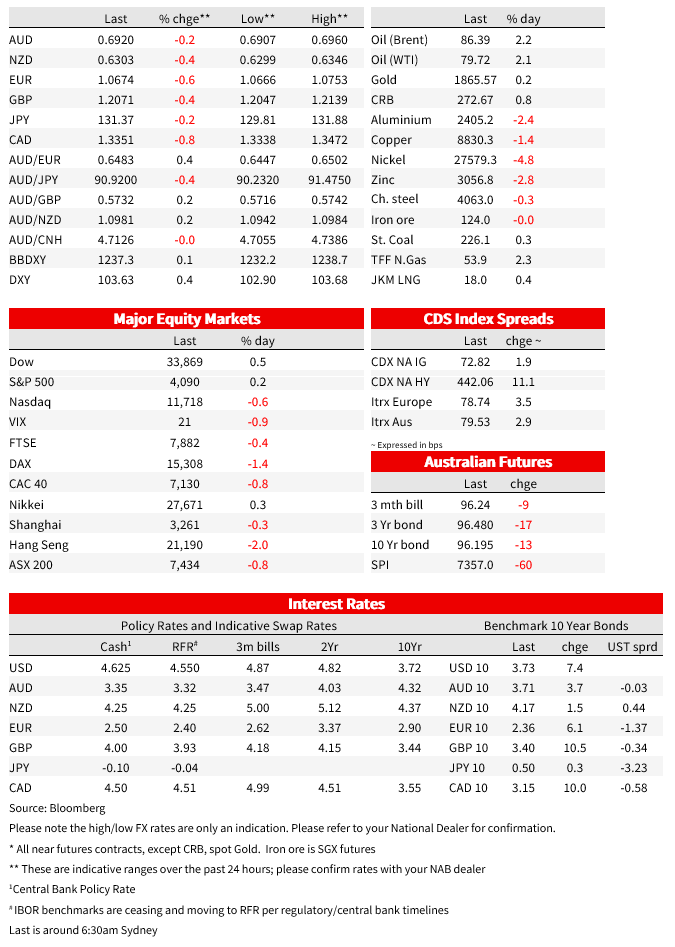

The selloff in rates extended on Friday, with US yields up 4-8bp across the curve. Equities were largely directionless, the S&P500 managing a 0.2% gain but losing 1.1% over the week. In currencies, the US dollar was stronger, up 0.4% on the DXY to be 0.7% higher over the week, in both cases the gains largely coming at the expense of the euro.

In terms of the data flow, US Consumer Sentiment from the University of Michigan rose to 66.4 from 64.9 on the preliminary read, beating consensus for 65.0. That was the third consecutive increase and took the index to its highest level in over a year. The improvement was in the current conditions index, up to 72.6 from 68.4, helped by higher stock prices, while the outlook eased to 62.3 from 62.7. The key 5-10 years ahead series was unchanged at 2.9%, stuck in the middle of the range it has been in over the past couple of years. Also of note was revisions to CPI seasonal factors that pointed to a slower pace of inflation in Q2 and a faster pace in Q4 on the updated seasonal factors, challenging some of the apparent deceleration. On a 3m-annualised basis, core CPI is now running at 4.3% in December, versus the previous estimate of 3.1%.

There was cautious optimism from the Philadelphia Fed’s Harker, but nothing the jars with other recent Fed commentary. He said in an interview Friday that “we actually are increasing the odds — we can get a soft landing. That doesn’t mean we’re out of the woods.” Harker favours ‘a couple more 25bp increases to get above 5% before a pause, “ How much above five? We’ll see.”

Canadian Employment proved more market moving, surprising sharply higher in January. Employment rose 150k, where consensus was for just 15k and the unemployment rate remained at 5.0% (consensus 5.1%). Hourly wages growth did slow from 5.2% to 4.5% (consensus 4.4%), but the surprising strength in the labour market in January belied expectations for a slowdown in activity. The BoC guided in January that “ if economic developments evolve broadly in line with the MPR outlook, Governing Council expects to hold the policy rate at its current level.” While one labour market print doesn’t derail that assessment, it does add to the risk the BoC is not yet done. The CAD rose 0.8% against a generally weaker US dollar on Friday.

Elsewhere, the BoJ was back in focus. Reports on Friday evening Sydney time that Japan’s PM Kishida would select Kazuo Ueda, a professor and former BoJ board member, to be the next BoJ Governor saw some volatility into the yen. Deputy Governor Amamiya had firmed as the strong favourite, though reportedly did not want the role. The news initially saw USD/JPY drop around 1.3% to 129.81. An external appointment could be seen as boosting the odds of an end to YCC, though that initial move was almost entirely unwound, helped by comments from Ueda that ” under current circumstances, I believe it is necessary to continue monetary easing.” (See WSJ for more background on the reported nominee). Current Governor Kuroda’s two deputies are also set to be replaced in coming months, with the nominations for the three positions due Tuesday.

Rounding out the data flow, UK Q4 GDP was flat, as expected, following Q3’s 0.2% q/q decline, year-ended growth of 0.4%. That sees the economy skirt a recession (at least by the 2 consecutive quarters of negative growth definition) for now. China inflation data remained low by global standards and did nothing to warn authorities against keeping policy stimulatory. CPI rose to 2.1% y/y from 1.8%, in line with expectations. New loan growth and aggregate financing figures were strong, as they normally are at the start of the year, with an additional boost from the government’s encouragement to front-load credit extension to support economic growth. Lending to households remained subdued.

FX Performance

In FX, the USD was stronger over the weak, up 0.7% on the DXY. Those gains were largely expressed against the euro, which lost 1.1%. Looking across the week, changes elsewhere where comparatively muted on net. At the top of the G10 leader board was SEK, more hawkish commentary, including a desire to see a stronger currency, out of the Riksbank meeting on Thursday from new Governor Thedeen, though that outperformace was pared on Friday. Higher oil prices and data surprises (Employment for CAD, Inflation for NOK) also saw CAD and NOK stronger performers against the dollar over the week.

The AUD fell 0.3% on Friday to 0.6920, just 0.1% shy of where it ended the prior week after the strong payrolls and Services ISM surprise knocked the AUD from around 0.7050 prior to that data. Over the week, the AUD ranged from a low of 0.6856 on Monday to an intraday high of 0.7011 on Thursday.

US Treasuries over the past week

US yields were higher over the week, as the task for the Federal Reserve was reckoned with in the shadow of the strong Payrolls and ISMs services the prior Friday. The selloff in global bonds extended on Friday, US 10yr yields were 8bp higher on the day to 3.73%, their highest since 6 January and taking the weekly rise to 21bp. Curves were steeper on Friday, with the 2yr up 4bp to 4.52%, and the 2s10s spread narrowing to -79bp after plumbing as deep as -87bp on Thursday. Elsewhere, core yields in Europe where also higher, German 10yr Bund yields were 6bp higher on Friday and 17bp higher over the week.

Australian rates underperformed over the week, with more hawkish commentary surrounding the as-expected 25bp move from the RBA on Tuesday. Yields implied by 10yr futures were 34bp higher over the week, while at the 3yr were 42bp higher to 3.52%. Much of that move came on Tuesday, though the selloff continued through the rest of the week. Markets now price a terminal RBA cash rate of 4.14% in August, from 3.72% ahead of the February meeting. Governor Lowe is in front of Parliamentary committees twice this week, on Wednesday and Friday.

Equities Performance

The S&P500 managed a small gain on Friday, up 0.2% but still lost 1.1% over the week. The That was the worst week of 2023 in a test of the optimism for the softest of landings evidence that had boosted equities over the past few weeks. As with rates, digesting the prior Friday’s US data seemed to be the major theme. Nasdaq was 0.6% lower on Friday and 2.4% lower over the week. About 70% of S&P500 companies have now reported results. 58 companies have issued a negative profit outlook for the first quarter, while just 13 have issued a forecast that topped analyst expectations, according to FactSet.

Commodities Performance

Mixed fortunes for commodities over the week. Oil was stronger , while elsewhere in the commodity complex prices tended to be flat to lower. WTI posted its biggest weekly gain since October, up 8.6% to $79.72, while Brent was 8.1% higher to $86.39. Russia will cut output by 500m barrels, or 5% of January output, with authorities saying the production cut is voluntary and a response to western price caps. Also supportive was Saudi Arabia’s decision to increase prices to Asian countries on a combination of supply disruptions in Turkey, Norway and Kazakhstan and stronger demand from China.

Today

This Week

For further FX, Interest rate and Commodities information visit com.au/nabfinancialmarkets. Read our NAB Markets Research disclaimer.

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.