Fiscal stimulus likely too late to boost 2024 growth, but may add some upside to 2025 forecasts

Insight

China’s PMI numbers over the weekend were better than expected.

https://soundcloud.com/user-291029717/china-data-brings-fresh-hope

Overview: In the mood

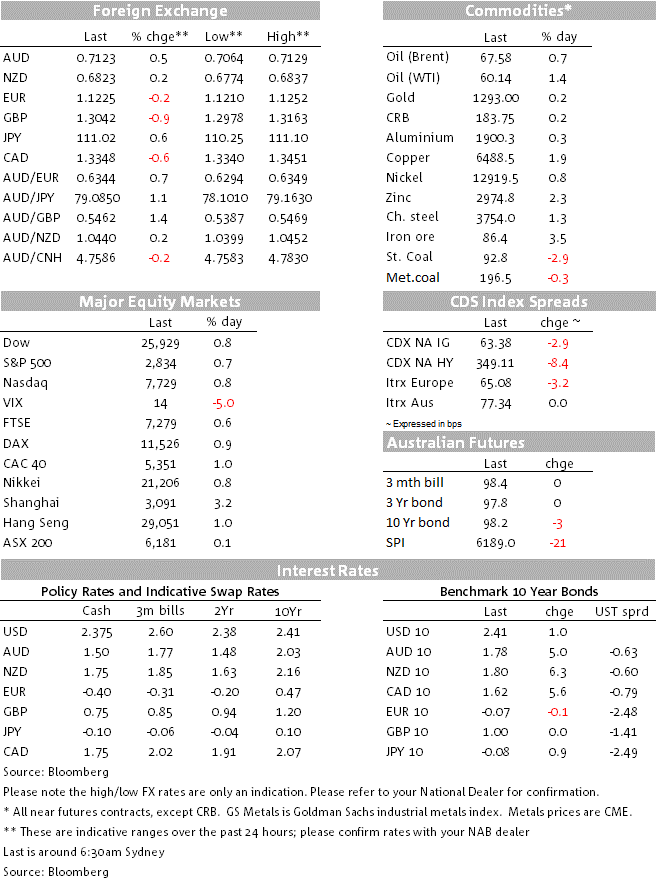

After markets closed with something of a risk on tone at the end of last week, release over the weekend of the official China PMIs for March seem to have added a little more to that mood, helped along with positive mood music around the continuing US-China trade talks. The AUD, NZD, and CAD have all opened a little higher in early Asia trade this morning, the AUD testing 0.7120 after closing last week at just under the figure.

Released yesterday, China’s Manufacturing and Non-Manufacturing PMIs both beat expectations, the Manufacturing PMI back into growth territory at 50.5 against February’s 49.2 and a much lower expectation of 49.6. While the improvement was no doubt aided by a bounce after the Lunar New Year (and for some might be discounted in part from that), such reasoning also means that the February reading under-clubbed Chinese activity. One aspect of the Manufacturing report that remained soft was new export orders remained in contractionary territory at 47.1, if up from February’s 45.2. New orders overall rose an index point to 51.6.

This is the first month in four that Chinese manufacturing activity has returned to growth and suggests a read through of Chinese macro policy growth support beginning to flow through into the economy.

The improvement in Manufacturing also came with a pick up in the Non-Manufacturing PMI to 54.8 from 54.3, also on the higher side of expectations (54.4 the consensus).

The US-China trade talks move to Washington this week after being in Beijing last week, meetings between Chinese Vice premier Liu He and US Treasury Secretary Mnuchin and Trade Representative Lighthizer. The US President spoke of “progress” being made but not accepting anything less than a “great deal”, while reports from China spoke of discussions over “relevant agreement documents”. No doubt there will be more news flow through the course of this week. Xinhua, a Beijing based official newswire, reported that Chinese and US negotiators had made “new progress” towards a trade agreement after a series of meetings in Beijing, matching the positive rhetoric from the US side, with Mnuchin calling the talks “constructive” and Kudlow saying the two sides made “good headway”.

The US dollar and US bond yields finished the week with a steadier to firmer tone in the wake of mixed reports on the state of the US economy. The January Personal Income and Spending report revealed only the very slightest increase in consumer spending in January after a soft December, real consumer spending rose 0.1% against the 0.3% expected.

What did take the market’s attention was yet another soft reading on consumer inflation, with both the headline and core PCE deflators lower than expected, buying the Fed more time to sit and review. The headline deflator came in at -0.1%/1.4% against 0.0%/1.4% expected (the year to rate in January was aided by a one tenth upward revision to December’s) with the core PCE deflator rising one tenth lower than expected both in the month and the year at 0.1%/1.8%, continuing to run just under the 2% target.

US ten year bond yields closed out the week at 2.405%, virtually unchanged on net, the somewhat softer than expected consumer spending and inflation report offset by much stronger than expected new home sales for February at 667k, up 4.9% after an 8.2% increase in January, aided by the affordability knock on effects from the bond market rally since last October. Mortgage applications have continued to grow through March.

The market will be paying attention to tonight’s US Retail Sales report for February, the consensus expectation looking for growth of 0.3% after January’s 0.2% and the “ex auto and gas” sales expected to rise by the same after a 1.2% January rise. On the US Manufacturing side, the ISM index is expected to inch higher to 54.5, notwithstanding the pull-back in the MNI Chicago PMI from 64.7 to 58.7.

In currency markets, CAD headed the leader board, with USD/CAD down 0.65% to 1.3350, with much of the move following monthly Canadian GDP data which were surprisingly strong. The risk-positive backdrop supported the AUD and NZD, closing the week just under 0.71 and just over 0.68 respectively.

Early on Friday, RBNZ Governor Orr gave his first speech on monetary policy. In the Q&A, responding to a question about the fall in rates and the NZD following the shock move to an easing bias on Wednesday, Orr effectively sanctioned the move, saying that he was pleased as “markets have shown that they understand what we are focused on and they are forward looking.”

The local market will be waiting with keen interest whether the RBA shows any such inclination after their Board meeting tomorrow. Governor Lowe spoke at length on housing and the economy the day after the March Board meeting playing to a housing soft landing theme and a RBA continuing to watch labour market developments closely as their preferred reading into the economy as opposed to the soft GDP readings in the second half of last year.

On the labour market front, the Feb list shows still low unemployment at 4.9% (if aided by a drop in participation), still solid employment growth, another quarter of growth in Job Vacancies to February, but emerging softness in Job Ads and a steady NAB employment index at 5. Still holding up.

GBP was the worst performer on Friday as the UK Parliamentary circus continued. GBP went sub-1.30 at one stage before ending the session at 1.3035. The UK Parliament rejected PM May’s Brexit Withdrawal Agreement for a third time. Time is running out before the new 12 April deadline. Over the coming week the UK Parliament will try to work on something a majority can agree on, while EU leaders have called for an emergency summit on 10 April ahead of that. Based on last week’s indicative votes, a customs union is the most favoured plan within the UK Parliament, albeit lacking a majority. It might come down to a final vote between May’s plan (again) and a customs union, given that “no-deal” remains undesirable and the UK Parliament must agree on something before the deadline. Another possibility remains an extended delay, with another referendum or general election still in the mix. In other words, and as my colleague Jason Wong has already noted this morning, the number of permutations remains numerous, but we maintain a constructive view of the ultimate outcome.

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.