Coming in for landing in a heavy cross wind

Insight

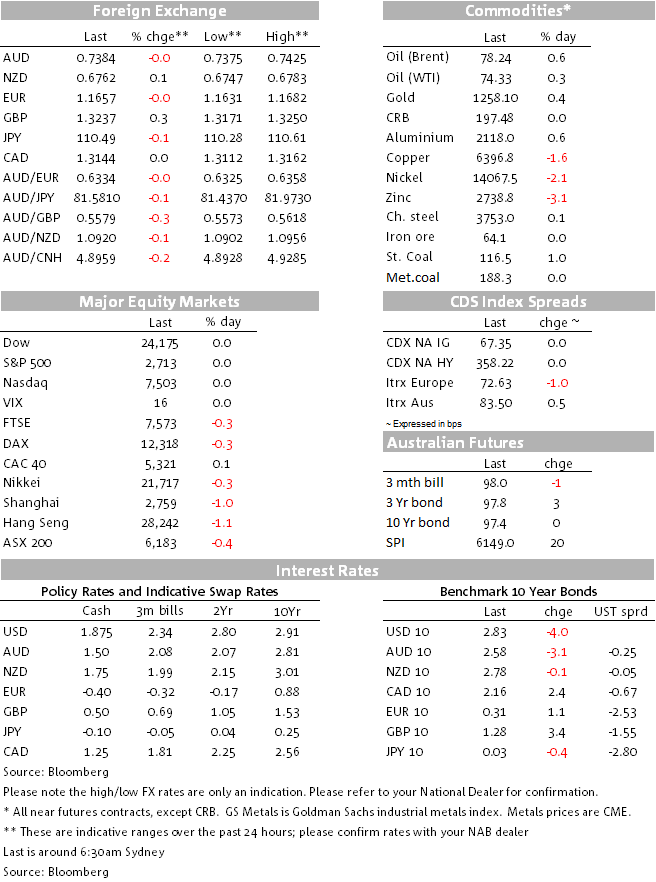

On an otherwise quiet day there was some volatility in the Yuan on reports that China is happy with a weakening currency.

https://soundcloud.com/user-291029717/chinas-currency-conundrum-trade-tariff-timing

Unsurprisingly, not a big night in global market with the US out for Independence Day, leaving my sub-editing skills (read: thinking up a song title) wanting. A somewhat uninspired (but pretty great) Donna Summer track it is then.

It has been a narrowly mixed Wednesday as far as European stocks go, US stock index futures have traded up by about 0.3%, European bond yields are a touch lower and in currencies, the only notable movers have been the Swedish Krone (up over 0.5% against the US dollar) and the British Pound (+0.3%).

Moves up in both currencies are due to shortening odds on central bank policy tightening this year. In Sweden, this is after Riksbank governor Skinsley reinforced the case for a rate hike towards the end of the year, and in the UK on a stronger than expected June services PMI (55.1 up from 54.0 in May). For all the Brexit uncertainty, business services have been going gangbusters it seems, while the apparently wonderful early summer weather has boosted consumer spending. And this before the effects of England’s easy cruise to victory against Columbia on Tuesday and the now almost certain prospect that the Word Cup will soon be ‘Coming Home’. What could possibly go wrong? (Um, perhaps the British Cabinet showdown commencing at Chequers tomorrow – Ed?)

The Euro has recovered from an early European day dip to be little changed, after a Bloomberg source report suggesting that some ECB Council members were unhappy about market speculation that the first ECB rate rise wouldn’t come until as late as December 2019. This is after what is generally seen as a beautifully choreographed ECB council meeting last month in which President Draghi managed to placate both the hawks, with a commitment to ending QE this year, and the doves by suggesting no first rate rise before the end of summer 2019 (the precise definition of which was left suitably vague).

In our part of the world, the sound of the clock ticking down to the 6th July deadline for the imposition of tariffs by both the US and China on $34bn of each country’s imports from one another gets louder, with not the merest hint anywhere that there could be a stay of execution from the White House. Speculation that China could actually move 12 hours ahead of the US, given the time difference between Beijing and Washington, have been scotched by Chinese authorities’ overnight, saying that China will only ever retaliate against US tariff actions, not move in front of them.

Conflicting reports about China’s intentions with regard to the currency have circulated in the last 36 hours. After Tuesday’s comments directly sourced to PBoC Governor Yi Gang that the currency would henceforth be maintained at a ‘stable’ and ‘balanced’ level – a reference presumed to refer to the CNY basket but which created the strong impression that 6.70 on USD/CNY was now something of a line in the sand, a Reuters report overnight, based on talks with insiders, says that “China is comfortable with a weakening yuan, intervening only to prevent any rapid and destabilising declines or to restore market confidence, as the economy loses momentum and faces further risks from a heated trade dispute with the United States”.

For now, USD/CNY sits where it was shortly after yesterday’s fix – and reported selling of USD/CNY by state-owned banks – near 6.64.

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.