A private sector improvement to support growth

Insight

Softer US data saw recession concerns to the fore, with yields lower over the day but some safe-haven dynamics supporting the USD.

Softer US data saw recession concerns to the fore, with yields lower over the day and some safe-haven dynamics supporting the USD despite. Equities were a little lower, the S&P500 down 0.2%. The RBNZ yesterday drove home the contrasting approaches by the antipodean central banks, surprising markets with a 50bp increase.

The US Services ISM surprised sharply lower than expected , falling to 51.2 from 55.1, remaining in expansion territory but only just and undershooting expectations for 54.4. One word of caution is that a short-lived dip to 49.2 back in December had reversed by January. Outside December, the Services ISM had been broadly flat since September. Declines in the month were led by the more forward-looking new orders component, which fell 10.4pts to 52.2 while Business Activity dipped just 0.9pts to 55.4. Prices paid saw its fifth consecutive decline, falling to 59.5 from 65.6, while the employment subindex fell back to 51.3 after rising to 54.0 last month. The survey responses would have mostly come in through late March and so may show some early impact of the banking ructions.

As markets look to Payrolls on Good Friday, ADP employment figures may suggest some downside risk, coming in at 145k vs 210k expected, though the newly refashioned series has form in undershooting the eventual payrolls number in the 7 months it has been available. But it is not the only indicator suggesting some slowing in Payrolls growth from strong January and February prints. Consensus looks for +240k on Friday.

By contrast, German factory orders rose by a much stronger than expected 4.8% m/m in February, the third successive increase and a sign of a healthier manufacturing sector. The report noted the move was driven by large-scale orders for vehicles and a significant increase in domestic demand.

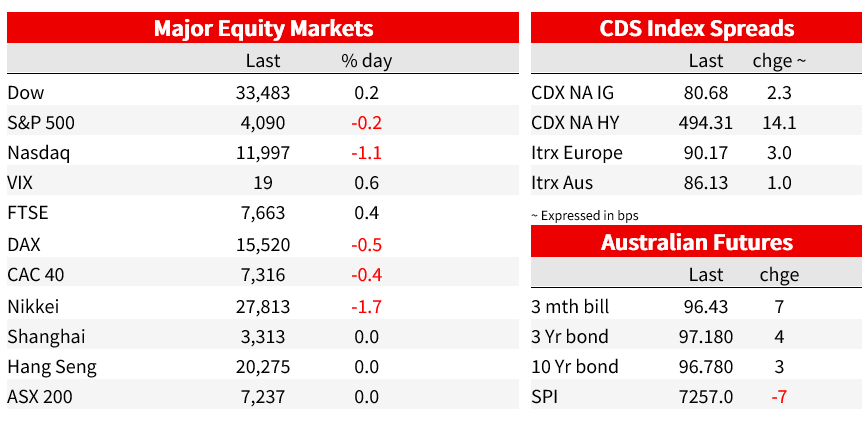

Equities were a little lower. The S&P500 slipped 0.2%, after recovering from a 0.7% decline earlier in the session. Despite the lower US yields, the NASDAQ underperformed, down 1.1%. Within the S&P500, consumer discretionary, industrial, and IT saw the largest declines, while utilities, healthcare and Energy stocks gained. In Europe, the Euro Stoxx 50 lost 0.4%.

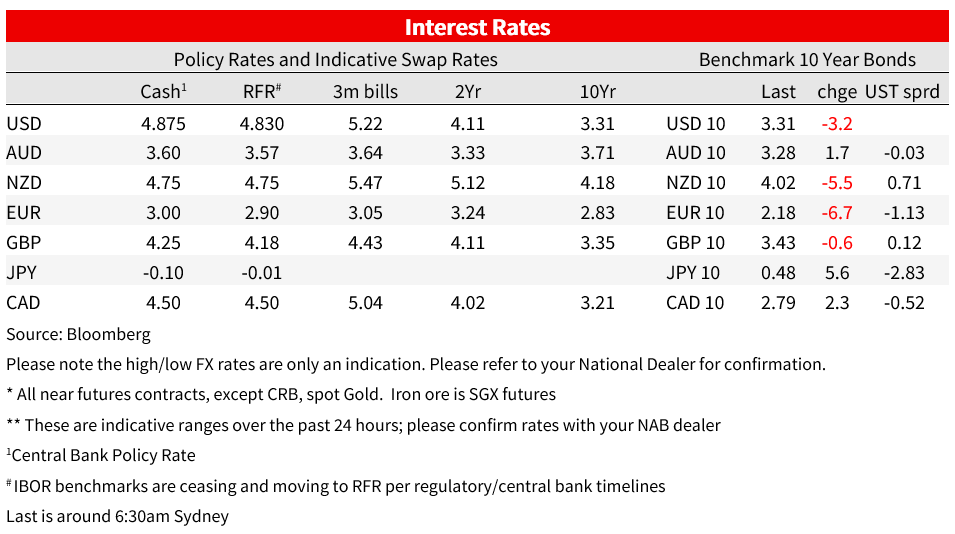

US Treasury yields were lower. While the chances of a 25bps hike at the Fed’s May meeting remained finely balanced (11bps priced), pricing for cuts was deepened and the 2-year rate was down 5bps to 3.78%, after spiking down to as low as 3.64%. The 10-year rate is down 3bps to 3.31% after reaching a fresh seven-month low of 3.26%. That was despite comments from the Cleveland Fed’s Mester who said that “ I think we’re going to have to go a little bit higher from where we are” and “hold there for some time in order to make sure inflation is on that sustainable downward path to 2%.”

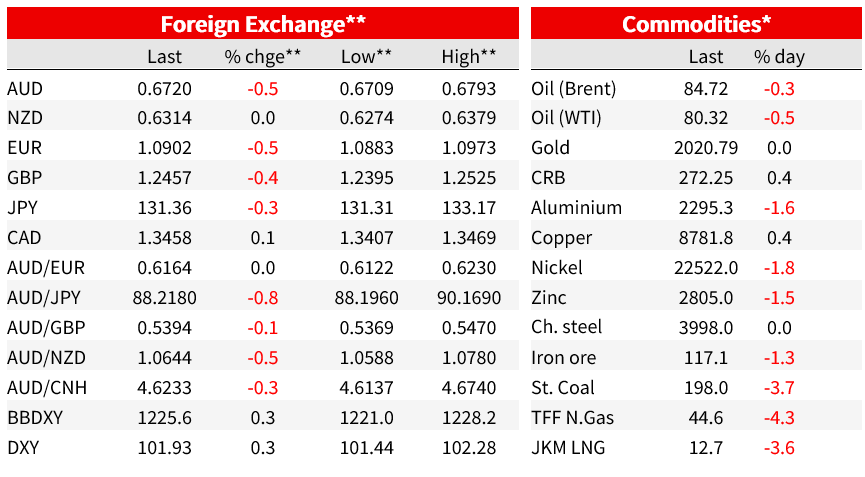

In currency markets, the dollar was 0.3% higher on the DXY . The euro lost 0.5% against the dollar to be back around 1.090, while the GBP lost 0.4% to 1.2457. The yen was 0.2% higher, supported by lower global yields. While the move against the euro came on the back of the softer services ISM data, the AUD move happened earlier grounding from an intraday high of 67.80 down to 66.77 beginning in our afternoon yesterday. The AUD over the day was 0.5% lower to 0.6720. The NZD spiked 1.1% higher on the back of the surprise 50bp hike from the RBNZ before giving those gains back to end flat against the dollar on the day, though gaining on each of the G10 crosses bar the JPY.

As for the RBNZ, the Bank raised rates 50bps yesterday to 5.25%, against a strong market consensus for a smaller 25bps hike and with the OIS market priced at +28bps. Following the recent fall in swap rates, the Bank appeared keen to prevent lending rates doing the same, and thereby opted for the larger hike, with the committee not yet confident that the level of rates was sufficient to bring inflation back into the 1-3% target range. My BNZ colleague Jason Wong notes that the Statement didn’t give any clarity on the RBNZ’s next move, with its comment that the extent of the expected moderation in domestic demand, core inflation and inflation expectations “will determine the direction of future monetary policy”. The reaction in the rates market was relatively modest given the surprise. Higher rates were led by the short-end and with significant curve flattening. The 2-year swap rate ended the day up 10bps to 5.12% but forward swaps like 1y1y were barely higher, with my BNZ Colleague Jason Wong noting that suggests little buy-in from the market on the Bank’s updated view that interest rates needed to be higher than what had already been priced.

Domestically yesterday, RBA Governor Lowe spoke following Tuesday’s decision to pause. He made the point that “the decision to hold rates steady this month does not imply that interest rate increases are over” and that “at our next meeting, we will again review the setting of monetary policy with the benefit of an updated set of forecasts and scenarios ” It is clear that the May meeting is very much live and the Bank will continue to watch the data closely, the Q1 CPI on 26 April the key release ahead of the May meeting and forecast update. Lowe was also more explicit that the RBA is taking a different approach to some other central Banks in tolerating a slower return to the inflation target. This had been clear from their actions, but it does underscore comfort with the 2025 timeline for inflation to get back to the target band, so the incoming data should be interpreted with a lens to how it affects that outlook.

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets. Read our NAB Markets Research disclaimer.

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.