Robust growth for online retail sales observed in June

Insight

A flurry of global economic data but relatively modest market movements.

GE ZEW survey expectations, May: -9.4 vs previous 6.4

GE GDP, Q1 P:0.1% (1.3%) vs fcst 0.1% (1.3%) previous 0.1% (1.3%)

UK Avg weekly earnings 3m/YoY, Mar: 5.8% vs fcts 5.8%, previous 5.8%

UK Unemployment rate, Mar: 3.9% vs fcst 3.8%, previous 3.8%

US retail sales, Apr: 0.4% vs 0.8% fcst, previous -0.7%

US retail sales ex auto and gas, Apr: 0.6% vs 0.2%, previous -0.5%

US retail sales control group, Apr: 0.7% vs fcst 0.4%, previous -0.4%

US Industrial production, Apr:0.5% vs fcst 0%, previous 0.4%

CAD CPI, Apr: 0.7% (4.4% YoY) vs fcst 0.4% (4.1%), previous 0.5% (4.3%)

CAD core CPI, Apr: 4.2% YoY vs fcst 4.1%, previous 4.4%

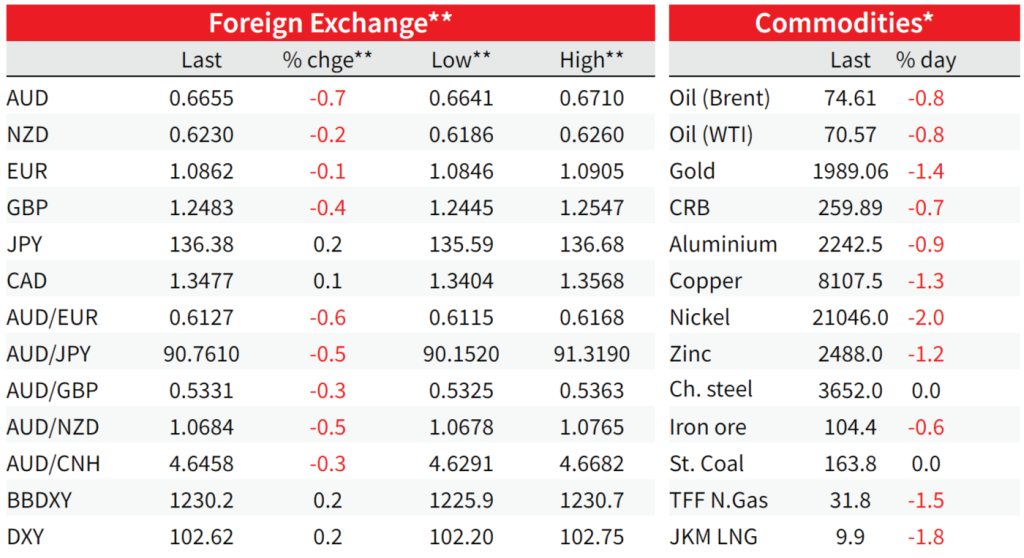

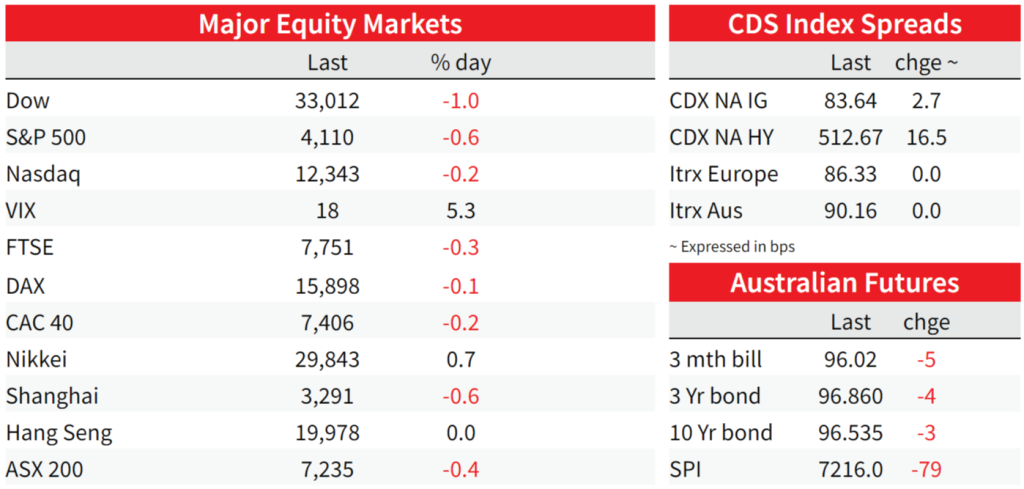

The debt ceiling continues to dominate attention amid concern disagreements won’t be bridged before early June. Equities were lower and the US dollar edged a little higher as the gap between the White House and House Republicans did little for risk sentiment. US yields were generally a little higher. There was also a host of economic data overnight, and a chorus of Fed speakers that continued to emphasise the near-term bias is to still higher rates, with cuts some way off.

President Biden began negotiations with House Speaker McCarthy overnight. McCarthy said “it is possible to get a deal by the end of the week. It’s not that difficult to get to an agreement,” but the sides are still far apart. In a sign there is still a lot of ground to cover, news a couple of hours ago is the Biden’s Asia trip has been shortened. While a US default remains very much a tail event, prospects for a highly disruptive shutdown are much more material.

US Yields were higher. The 2yr gaining 7bp and the 10yr was 4bp higher at 3.54%. Of some note it the 30yr yield, which touched 3.90% intraday, its highest since the banking turmoil from early March, though is now back around 3.86%. Also weighing on the market was a Pfizer selling $31 billion of bonds, spanning 2yrs to 40yrs, the fourth-biggest US sale ever. In equity markets, the S&P500 lost 0.6%, with the Nasdaq fared a little better, down 0.2%.

Fed speak continued to make clear the near-term bias is to still higher rates and cuts are some way off. Cleveland Fed’s Mester made this explicit, “I can’t say that I’m at a level of the fed funds rate where it’s equally probable that the next move could be an increase or a decrease, ” but that she would want to take into account all the data in the 4 weeks until the June Meeting. Richmond’s Barkin is still looking to be convinced inflation is defeated and would be ‘comfortable’ increasing rates further if that’s what’s needed. He, and New York’s Williams, emphasised the need to evaluate how actions taken so far affect the economy. Chicago’s Goolsbee said he doesn’t yet know if the Fed has put in enough restraint, but it was premature to talk about the rate move at the June meeting, and Dallas’ Logan emphasised “a slower pace of tightening shouldn’t signal any less commitment to achieving the inflation goal.” Near-term pricing for cuts was pared, with 59bp of cuts priced by year end, from 65bp yesterday

US industrial production data was stronger than expected, rising 0.5% m/m (0% expected). Manufacturing output defied the softness in manufacturing indicators, rising 1% m/m on strength in auto production, though revisions to recent months, means the April rise overstates the strength a little. Retail sales disappointed expectations at 0.4% m/m (0.8% expected) on the headline read, through ex autos and gas beat expectations, up a healthier 0.6%, while the control group was 0.7% higher. Canada’s CPI unexpectedly ticked up to 4.4% yoy in April but the average of the two key core measures were in line, down from 4.5% to 4.2%.

UK labour market data showed some easing in labour market tightness with a fall in employment and an increase in unemployment, but a wages growth backdrop that is among the highest among advanced economies and just too high for comfort for the BoE. The 3m/3m employment change was near consensus at 182k vs 160k expected, but the April month fall a sharp 136k (25k expected), the first fall sine February 2021, and the claimant count rate ticked higher to 4.0% from 3.9% in the month. Average weekly Earnings were broadly in line with expectations, 5.8% 3m/y/y (from 5.9%) and 6.7% (from 6.6%) on the excluding bonuses measure. Softening in the labour market should weigh on wages growth in time, but there is a long way to go to levels consistent with the BoE’s inflation target. Markets price a 78% chance of a June hike, from 85% the day prior. 2yr Gilts outperformed, losing 1bp while 2yr German Bunds were 5bp higher to 2.64%.

Chinese activity data for April showed misses across the board. Industrial production rose 5.6% y/y (10.9% expected). Domestic consumption continued to outperform, with reopening momentum in the Chinese consumer brighter than the broader activity backdrop. But Retail Sales at 18.4% y/y disappointed expectations for a 21.9% rise. Upward revisions to a year ago as much the culprit as a sharp surprise to the level of sales in April. With inflation subdued, the PBoC has room for further easing. The CNH was down 0.6% on the day, USD/CNH stalling just shy of 7.0 at 6.999, with CNY at 6.977.

The softer China data also weighed on the AUD, down 0.7% to 0.6655. In contrast, the NZD was just 0.2% lower to 0.6230. The DXY gained 0.2%, with the Euro little changed, down 0.1% over the day, while the yen was 0.2% lower.

The RBA Minutes for May yesterday confirm coming RBA meetings are very live with extensive discussion around the need for productivity growth to pick up “to ensure consistency of the wages growth forecast with the Bank’s inflation forecast”. We get the key Q1 wages update today but note productivity estimates are published alongside the Q1 GDP figures on 7 June, a day after the 6 June RBA meeting. By the July meeting, the RBA will have also seen the outcome of the Minimum/Award Wage decision.

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets. Read our NAB Markets Research disclaimer.

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.