Fiscal stimulus likely too late to boost 2024 growth, but may add some upside to 2025 forecasts

Insight

It’s a big week for global markets as well as the AUD.

https://soundcloud.com/user-291029717/more-equity-sell-offs-and-where-now-for-the-aussie-dollar

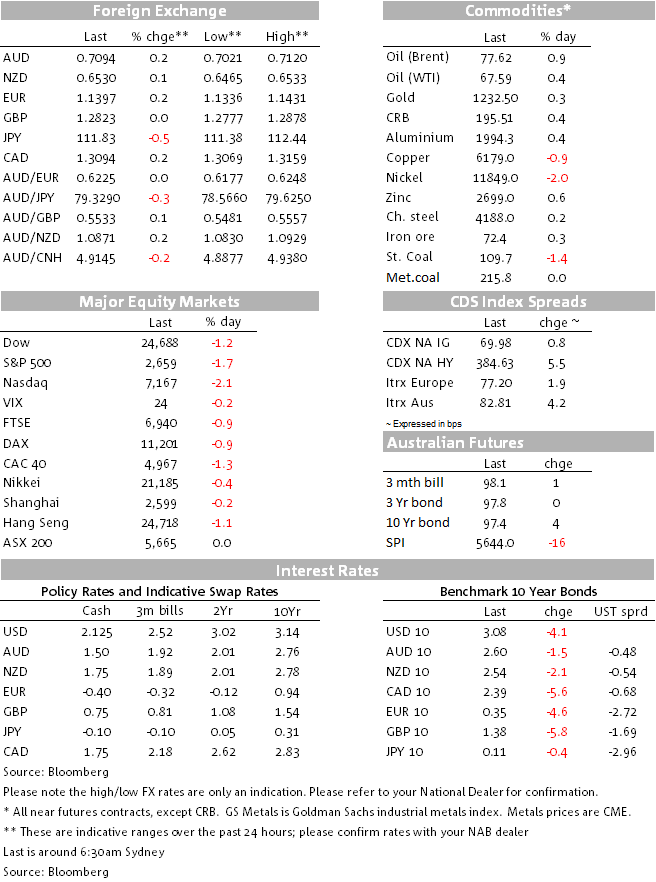

The combination of a softer US dollar out of Friday’s Q3 GDP data, a seemingly officially orchestrated pull-back in USD/CNH and strong gains for several Emerging Market currencies meant that AUD/USD pulled up from what was looking like a potential test of 0.70 when we went home to nearer 0.71 by the NY close. US stocks finished well back from their intra-day lows but all the major indices are now in ‘correction ‘mode if defined as falls of more than 10% from prior highs.

An intra-day rally in US stocks on Friday failed to hold, after sharply lower openings led by Alphabet and Amazon’s after hours sell-offs on Thursday evening, post their results. The S&P nevertheless managed to close down ‘just’ 1.7% having been 2.9% lower in morning trade. NASDAQ again underperformed other indices, -2.1% with the Dow off 1.2%. Consumer discretionary (-3.6%) and Real Estate (-3.1%) were the worst performing sectors in the S&P. Q3 GDP coming in 3.5% against the 3.3% consensus failed to excite, with the breakdown not as impressive as the headline (big support from inventories and drag from net trade combined with relatively weak business investment) while the core PCE deflator undershot expectations at 1.6% down from 2.1% in Q2 and 1.8% expected.

For those defining a ‘correction’ as a fall of more than 10%, the S&P met the definition on Friday (-10.7% from its 3rd October record high) before closing down 9.6% from its highs and off 8.8% month to date. The NASDAQ is off 10.9% month to date. The smaller-cap Russell 2000 is now 15% off its September highs:

From an intra-day low in mid-morning London trade of 0.7023 (a new Post February 2016 low) AUD/USD staged a decent comeback to close at 0.7090 and so +0.1% on the day. Among the drivers for the recovery was firstly a small rebound in the Yuan (CNH from above 6.97 to 6.9550 with state bank buying suspected). Reuters late Friday cited ‘unidentified policy insiders’ as saying that China would use its ‘vast’ FX reserves to defend CNY against a move above 7. Let’s see, but if we see evidence of this in coming days and weeks, AUD might yet be spared an early trip onto a ‘6’ handle.

Second was an outsized rally in BRL in front of the second round Presidential election run-off on Sunday (currently in train) where a comfortable victory for populist/right wing candidate Jair Bolsonaro was being discounted). BRL jumped by 1.73%, with good gains too for TRY (+0.74%) and MXN (+0.64%). This meant that the JPM Emerging Market Currency Index (EMCI) to which AUD has been highly corrected this year, rose by 0.5%.

Also relevant was generalised USD weakness out of the US GDP data, including a pullback in EUR/USD to (just) back onto a 1.14 handle from sub-1.1350 earlier. Most of the gain came before S&P announced – an hour prior to the NY close – that it was maintaining its BBB rating on Italy (two notches above ‘junk’) while putting the rating outlook onto negative from stable. In sporting parlance this was a ‘result’ for Italy – Italian PM Conte certainly seemed to think so in emailed comments late Friday. This news should further support Italian bonds and with that EUR/USD at the European open today, against which the bloody nose meted out to both the CDU and SPD in Sunday’s Hesses State elections exposed the fragility of the grand Coalition government and so is a potential euro negative.

Together with the move back below ¥112 in USD/JPY to an (intra-day low of ¥111.38 and Friday’s strongest G10 currency) the DXY index ended down a third of a percent at 96.36. So the effective 94-97 DXY range lives to fight another day.

FX futures positioning data published on Friday for the week through last Tuesday shows only very small reductions in the net speculative short positioning in the NZD and AUD, amid a still very long aggregate USD position – reason perhaps not to be getting overly bearish on Aussie and Kiwi here.

A fairly uniform decline in yields across the Treasury curve Friday in conjunction with ongoing equity weakness, 2s and 10s both off just a touch over 4bp. On the week 2s are 9.8bps down and 10s off 11.7bps. 10yr BTPs were 4.6bps lower Friday in front of S&Ps ratings pronouncement and should rally further at Monday’s European open. .

A very mixed performance for commodities Friday, with oil recovering some of its recently lost poise, base metals very mixed, gold up smalls and coal little changed. On the week, iron ore is the best performing commodity (+1.4%) and oil the worse (both benchmarks off over 2%):

US Q3 GDP 3.5% (3.3%E, 4.2%P)

US Q3 core PCE deflator 1.6% (1.8%E, 2.1%P)

University of Michigan final October consumer sentiment 98.6 (99.0E, 99.0 preliminary)

UoM 5-10 year inflation expectations 2.4% up from 2.3% preliminary

CoreLogic reported a preliminary all capital cities weekend auction clearance rate of 50.2. Last week’s final was 46.0% and this week’s will probably be similar. Auction volumes were up, to 2,919 from 2,199 previously. Melbourne cleared a preliminary 49.8% against a final 45.7% and Sydney 50.6% versus a final 44.6%.

It’s a big week for global markets as well as the AUD. Apple’s earnings on Thursday will be one of the undoubted highlights of the reporting season, given Apple represents some 4% of the S&P500. We also have US payrolls and manufacturing ISM data. Locally Q3 CPI and retail sales (monthly and quarterly) both have potential to move the dial at least slightly one way or another on RBA rate expectations and local yields. China official PMIs on Wednesday are also of interest.

Potentially more important for AUD than any of this will be month-end portfolio rebalancing flows given the scale of this month’s US (and European) equity sell-off. This is ostensibly AUD negative as asset managers need to buy back foreign currencies against AUD to pull hedge ratios back to benchmark.

Against this, a lot of this may have already occurred intra-month, while there is also a suggestion some funds may be taking advantage of AUD near 0.70 to raise strategic hedge ratios, in which case they would be natural buyers not sellers of AUD. Wednesday’s 4pm London FX fix will be a particularly interesting one.

Today, we just have Japan retail sales, UK money supply and the September monthly US Personal Income, Spending and Deflator data, the latter not of huge interest given we’ve already had the quarterly readings.

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.