Coming in for landing in a heavy cross wind

Insight

As for the data itself, US CPI was ever so slightly above consensus.

“Could you find a way to let me down slowly? A little sympathy, I hope you can show me” – Alec Benjamin

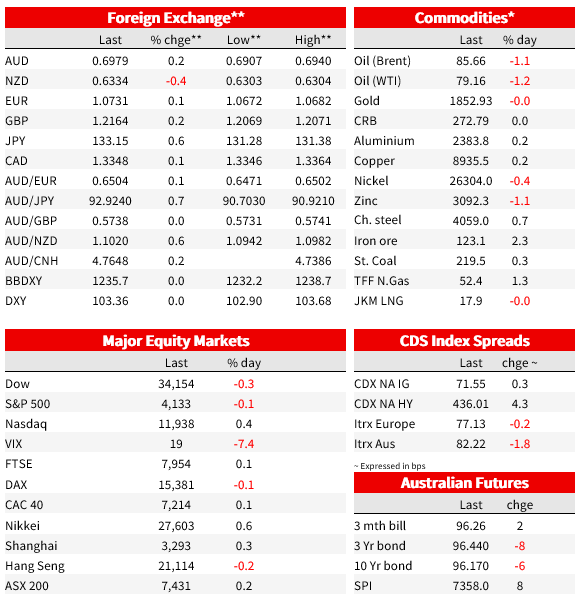

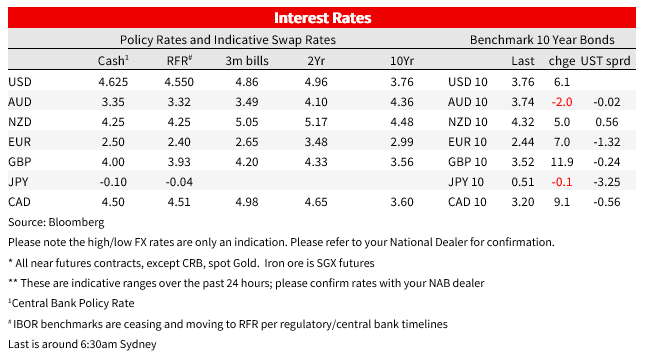

US CPI was poised to be the key data of the week and after some volatility following the release the verdict from rates markets at least is it suggests stickier inflation and a higher path for rates. The US 2yr yield was 10bp higher and the curve slipping further into inversion with the 10yr up 6bp. The selloff was seen across rates markets. With the German 10yr 7bp higher and stronger wages data helping UK 10yr gilts up a larger 12bp. In contrast, looking through some gyrations FX market moves are relatively muted, and the equity market has taken the data in its stride. The S&P500 rallying back from a 0.8% loss to be currently sit little changed.

As for the data itself, US CPI was ever so slightly above consensus. To be sure the core and headline reads were in-line with the median forecast at 0.4% m/m and 0.5% m/m, but they slowed less than expected on a year-ended basis. Headline fell to 6.4% from 6.5% and against expectations for 6.2%, while core fell to 5.6% y/y from 5.7% (consensus 5.5%). After some initial volatile immediately after the data, the reaction across markets suggested the data was read as more evidence of higher-for-longer rates. Yields were higher, the dollar stronger, and equities lower. US 2yr yields are 10bp higher to 4.62%, now 52bp higher than where they were before the payrolls/ISM surprise a little over a week ago. The 10yr was 6bp higher to 3.76%.

While the thematics of inflation may be little changed as goods drivers slow or reverse, services inflation remains sticky, and shelter is high but poised to slow, the data is stickier than hoped and disinflation to date less apparent than the data suggested just last month. A month ago, before revised seasonal adjustment and today’s data, core inflation was 3.1% on a 3m-annualised basis. It is now 4.6%. For ‘super core’ excluding food, energy, shelter and used cars, it was 1.8% 3m annualised but is now 3.7%.

Alternate core measures also painted a picture of sticky inflation. The Cleveland Fed median CPI was 0.7% m/m and the trimmed mean 0.6% (both one tenth higher than December). The Atlanta Fed’s sticky CPI was up 0.5% m/m, matching December and reaching a new high of 6.7% y/y. For a guide to a favourite core measure of the Fed, services ex-energy and housing in the PCE, the analogous subset in the CPI data rose 0.4% for the second month in a row. In terms of the detail, used car prices fell 1.9% (there was some risk of a smaller drag this month with auction prices higher but this looks set to flow through in February and March) and shelter rose 0.7% after 0.8% m/m, still elevated with the slowing evident in new rents yet to flow through.

Speaking shortly after the CPI data, the Richmond Fed’s Barkin’s characterisation was “inflation is normalizing but it’s coming down slowly.” He warned that “I just think there’s going to be a lot more inertia, a lot more persistence to inflation than maybe we all want.” Barkin and Dallas Fed President Lorie Logan warned rates may need to go higher than earlier thought if inflation doesn’t moderate, while Patrick Harker said “we are not done yet… but we are likely close. ” Overall, little nuance to the recent chorus of Fed messaging. There is one more Payrolls and CPI print to come before the Fed’s 23 March meeting. Markets currently price a peak fed funds rate of 5.28 in July, from 5.2% prior to CPI.

Elsewhere, UK wages ex bonuses rose faster than expected. Average earnings excluding bonuses rose 6.7% y/y (consensus 6.5%) from an upwardly revised 6.5% y/y. The series including bonuses fell more than expected to 5.9% from 6.5% (6.2% consensus) on base effects due to large bonuses a year ago. The unemployment rate remained at a historically low 3.7%. The BoE had the door open to a pause at its March meeting in its February guidance, saying more tightening would be required only if there were evidence of ‘more persistent pressures.’ Even so, markets were already pricing about a 90% chance of a March move ahead of the data and now price 29bp and a peak of 4.6%. The 2yr UK gilt underperformed the broader rates selloff, up 18bp to 3.80%. UK CPI tonight is the next test

Looking through the volatility in the immediate aftermath of the US CPI report, most currency movements have been modest. The US dollar is flat on the DXY at 103.36. The GBP was at the top of the G10 leader board but up just 0.2%. The AUD oscillated alongside the fortunes of US equities and broader risk sentiment following CPI. The currency rose as high as 0.7029 after the report, before swinging to an intraday low of 0.6922 but has since recovered to be 0.2% higher at 0.6982. Higher yields globally saw the yen a little softer, USD/JPY up 0.6% to 133.15.

US equities were initially higher after the CPI before swinging negative alongside the move higher in yields, but have since clawed back to be little changed on. The S&P500 was down as much as 0.8% but is currently flat. European equity moves were also muted, the Eurostoxx 50 down 0.1%, while in Asia the Nikkei managed a 0.6% gain

In Australian data yesterday, the NAB Survey showed a rebound in Business Conditions, up 5pts to +18 , a level well above its long run average. The increase was led by trading conditions, rebounding 8pts to +28, but profitability and employment also rose in the month and are well above average. In the more forward-looking components, Confidence rose 6pts to +6, around returning to around its long runs average, while capacity utilisation and forward order also rose. Measures of cost growth also rose after easing through the second half of last year – though they remain well below their mid-2022 peaks. The result contrasted consumer confidence, also out yesterday, which say confidence fall back near recent November lows.

As revealed in press reporting at the end of last week, Kazuo Ueda was nominated to Head the BoJ by Prime Minister Kishida. Parliamentary hearings to scrutinize Ueda’s current views will start on Feb. 24. BOJ veteran Shinichi Uchida and former financial regulator Ryozo Himino were nominated as deputies. Also of note in Japan was weaker-than-expected preliminary Q4 GDP numbers. GDP rose 0.2% q/q vs 0.5% expected. Domestic travel spending helped support a recovery in consumption, though businesses spending fell more than forecast and inventories were a drag.

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets. Read our NAB Markets Research disclaimer.

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.