We expect growth in the global economy to remain subdued out to 2026.

Insight

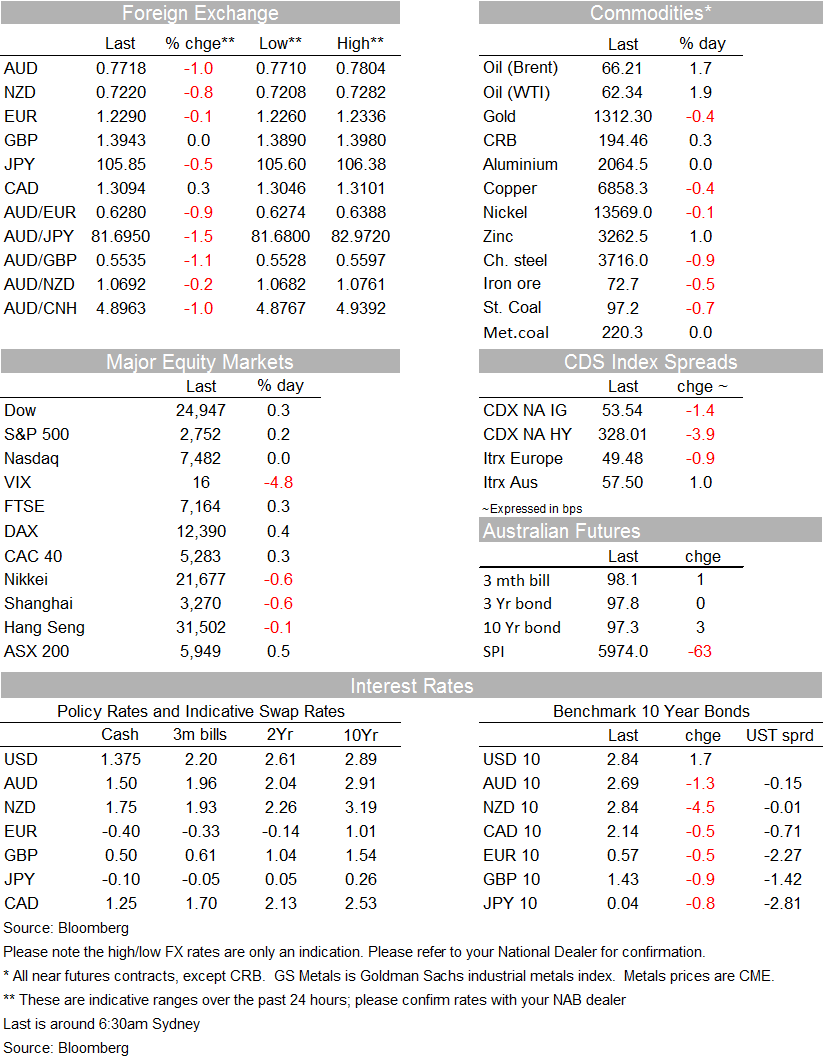

USD slightly extends Thursday’s gains, AUD makes new YTD low of 0.7710, -1.1% on the day.

As Phil Dobbie discusses with NAB’s Ray Attrill, this week we can expect the unrest to be on the inside, with Steven Mnuchin already firing the first salvo at the Chinese.

https://soundcloud.com/user-291029717/this-time-g20-unrest-is-on-the-inside

From an intra-low of 0.7771 during the APAC time zone on Friday, AUD/USD extended losses in offshore markets to post a new year-to-date low of 0.7710 (prior low was 0.7713 on March 1st). Friday’s losses take AUD clean through both the 100 and 200-day moving averages.

Latest AUD falls have come without any discernible deterioration in risk sentiment in other asset classes, the S&P 500 ending Friday 0.17% higher (underperforming both the Dow and NASDAQ). The VIX fell 0.8 to 15.8 and US bond yield were slightly higher across the curve.

US data was good, in particular the first consumer sentiment reading for March, from the University of Michigan, posting a post-2004 high of 102.0 – well above expectations – and February industrial production comfortably exceeding expectations with a 1.1% gain (0.4% expected). Despite this, the Atlanta Fed downgraded its Q1 GDP Nowcast forecast to 1.8% from 1.9% (consumer spending, net exports and inventory-driven).

On the day, European stocks outperformed US stocks which outperformed APAC stocks. On the week, the Nikkei is the best performing market, and the Dow and S&P the worst:

In FX, while its tempting to attribute USD gains in the offshore session to the better than expected US industrial production and consumer sentiment, the truth is that broad based USD gains got underway about half an hour in front of the US production data and over an hour ahead of the consumer sentiment release.

JPY gains weren’t enough to prevent the DXY and BBDXY posting small gains with the USD firmer against all other G10 currencies, AUD and NZD in particular (neither of which are part of the DXY). On the week NOK pipped JPY as best performer and CAD pipped AUD as worst.

US Treasury yields were uniformly higher across the curve on Friday (10s by 1.60bps to 2.845%) but the curve is flatter on the week, 2s +3.3bps and 10s -5.0bps. :

In commodities, oil was up but others down (including iron ore and steaming coal – see table below). According to Dow Jones, oil futures rose sharply Friday to end the week higher as investors focused on escalating geopolitical risk as President Donald Trump reshuffled his cabinet. Chatter about the fate of the nuclear deal that allowed Iran to boost its oil production ramped up this week after Mr. Trump fired Secretary of State Rex Tillerson, who had advocated for the U.S. to stick by the agreement even as Mr. Trump has attacked it. Analysts said a return in U.S. sanctions would likely curb foreign investment in Iran’s oil sector and could force refineries to buy less of the country’s oil.

This weekend preliminary auction clearance rate across the combined capital cities rose to 67.5% from a final 63.3% according to CoreLogic (though last week’s preliminary rate was 67.3% similar to yesterday’s). Auction volume was high (3,097 vs. 1,764) but this is largely due to the long holiday weekend in four states last weekend. Melbourne cleared a preliminary 68.9% vs. last weekend’s final 70.2% and Sydney 67.8% versus the final 62.2% previously.

University of Michigan preliminary March consumer sentiment 102.0 (99.3E, 99.7P)

UoM current conditions 122.8 from 114.9; expectations 88.6 from 90.0

UoM 5-10yr inflation expectations 2.5% – unchanged; 1yr 2.9% from 2.7%

US Fed industrial production 1.1% (0.4%E, -0.3%P revised from -0.1%)

US Feb manufacturing production 1.2% (0.5%E, -0.2%P revised from 0.0%)

US Feb housing starts -7.0% (-2.7%E, +10.1%P)

US Feb building permits -5.7% (-4.1%E, +5.9%P).

US JOLTS job openings 6,312k saar (5,917kE, 5,667kP revised from 5,811k)

Canada Jan manufacturing sales -1.0% (-0.9%E, -0.1%P)

Eurozone Feb HICP 1.1% (1.2% preliminary, 1.3%P); core 1.0% (unch. vs. prelim and Jan)

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.