Asset finance and leasing is in a growth phase in Australia as organisations seek a capital-effective way to modernise and upgrade across a broad range of asset classes and industries.

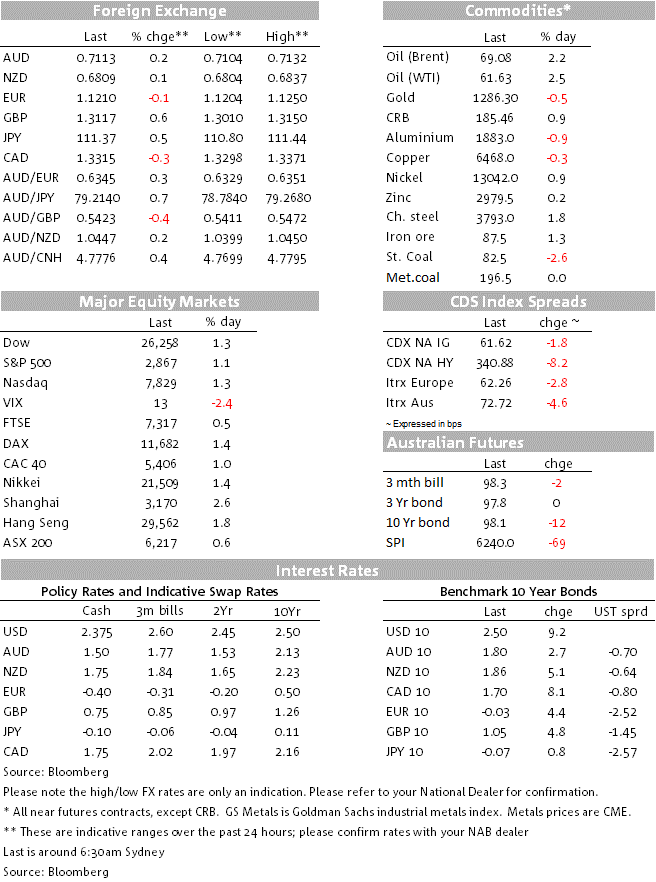

There was continued optimism in the markets overnight with more strong data reads from China and the US.

https://soundcloud.com/user-291029717/has-the-global-slowdown-bottomed-out-already

The Doors, 1969, in case you were wondering. The UK parliament is about to cast indicative votes on a number of Brexit options, all of which fall into the ‘soft’ category.

Our BNZ colleague Jason Wong’s observations on overnight markets are particularly apposite and bear repeating by this (lazy) scribe: “In March we saw global growth fears intensify, driving global bond rates significantly lower, the latter supporting equity markets. As April begins global growth fears recede, global bond rates reverse course, but the former supports equity markets. Just buy equities, seems to be the mantra. After mega returns in Q1, the S&P500 is currently up nearly 1%, while the Euro Stoxx 600 rose by 1.2%”.

Instrumental to the risk-on market tone since the weekend has been the series of better than expected and outright positive China PMI numbers (official manufacturing and non-manufacturing ones at the weekend, and Caixin manufacturing yesterday – the latter’s’ service sector reading is due today) and then the US manufacturing ISM, the latter rising to 55.3 from 54.2 and the 54.5 consensus estimate. Particular strength was noted in the new orders and employment sub-readings. This has gone some way to assuage the recession fever that gripped the commentariat after the 3m/10yr yield curve went negative last week. The latter is back in positive terrain thanks to an 9bps jump in 10 years Treasury yields, while the Atlanta’s Fed’s GDPNow tracker puts Q1 GDP growth at a respectable 2.1% up from a (far from dire) 1.7% previously.

Less respective were the February US retail sales numbers with negative readings for the headline and all the core numbers: -0.2% headline, -0.4% ex autos and -0.2% for the ‘control’ group that ties most closely to the consumption component of GDP. However positive revisions to January were substantial which left the ‘net net’ numbers not far from expectations.

Even less respectable was the Eurozone data. Headline and core inflation were both one-tenth below expectations – core at 0.8% y/y against 0.9% expected; headline at 1.4% y/y against 1.5% expected. Final Eurozone Manufacturing PMI also downwardly revised to 47.5 from 47.6. Worryingly the German Manufacturing PMI was revised substantially lower to 44.1 from 44.7. The details of the report showed a sharp fall in new orders, with respondents in the survey noting “uncertainty surrounding Brexit and trade tensions, a weak automotive sector and generally softer global demand”.

In contrast, the UK manufacturing PMI blew the lights out, superficially at least, printing at 55.1 from 52.1. But this was driven almost entirely by stockpiling. A similar picture was evident in the Irish PMI data a few hours earlier, indicative of course of corporate Britain and Ireland getting on with provisioning for a no deal Brexit, including the need to re-impose a border on the island of Ireland. Meanwhile the jokers in Westminster continue to bicker as though they are inside a vegan restaurant deciding which cut of steak they are going to order. The latter includes reports of 200 Tory MPs (out of a total of 314) having signed a letter calling for a managed no deal Brexit. If they want that, they’ll have to manage it between now and April 12th.

We are heading into the latest series of so called ‘Indicative Votes’ by the British Parliament, all of which for within a spectrum of soft to very soft to no Brexit following a 2nd referendum. If one (or more) of these get up, they might then be pitched against PM May’s withdrawal agreement on Wednesday. Watch to see of ‘Common market 2.0’ get a majority. This is the very softest of Brexit (the so called ‘Norway +) and which would put the UK inside the single market (a la EEA and EFTA members Norway, Iceland, Lichtenstein and Switzerland), abiding by the four freedoms and ‘paying to play’. Very GBP positive were that to be the way forward, though note that today’s votes are non-binding on the government (and which is of high risk of splitting if the PM wants to take this back to Brussels as the basis for an extension of Article 50).

So equities are ending New York with the S&P +1.15%, NASDAQ and the Dow both +1.25%. Financial and industrial lead the gains, both sub-sectors up more than 2% (there’s a steeper yield curve and the manufacturing ISM for you).

In bonds, 10-year Treasuries are now up 9bps to 2.50% (and versus a recent low of 2.34%). 2s are up by 6bpsa and the 30-year by 8bps. Benchmark 10yr Eurozone and UK yields ended up by 4-5bps on average.

In commodities oil has jumped by $1.50 for both the WTI and Brent benchmarks, on more reports of OPEC+ compliance with agreed production cuts and Iran saying it will be easy to extend the current agreement at least through June.

In FX, This has added to support for the likes of NOK, already boosted by a better PMI reading at the start of their day – and CAD (+0.22%), with some earlier gains for the loonie given back after BoC Governor just now says that the outlook continues to warrant rates below the neutral range.

GBP (+0.6%) has been buoyed by the fact that all the options on offer in the indicative votes process about to start are ‘soft’ and/or include a second referendum. EUR/USD is struggling to hold key support around 1.12, hurt more by the positive dollar reaction to the ISM data than the earlier EZ CPI and final German manufacturing PMI.

AUD did well yesterday on the back of the China PMI numbers and to a lesser extent the rise in the Business Conditions index of the NAB survey, but has struggled to build on those gains given intervening USD strength, currently at 0.7115 which is pretty much where it was this time yesterday.

The RBA is centre stage for local rates market and the AUD this afternoon, with potential to amplify Monday’s sell-off across the rates spectrum and small-scale lift off in the AUD following the rebound in China PMIs and to a lesser extent the rise in the headline Conditions reading of the NAB Business Survey.

Given this and the fact that labour market indicators since the March meeting showed a drop in the unemployment rates and rise in job vacancies, there is a decent case for the Board not changing the last paragraph of the post-meeting statement.

The soft Q4 GDP outcome the day after the March meeting was implicitly acknowledged in the March statement when the RBA said “indicators suggest growth in the Australian economy slowed over the second half of 2018”. Of note though will be whether they re-iterate their view of growth rising by 3% this year or whether they instead remove it, in doing so flagging a possible downgrade at next month’s SoMP.

Pre-RBA, building approvals are likely to show the downtrend in residential approvals continuing in both apartments and houses, particularly in New South Wales and Victoria. NAB expects a monthly rebound in apartment approvals to result in a flat outcome in overall approvals (mkt: -1.5%).

The main offshore economic event tonight is US February durable goods orders.

JN: Tankan large manuf. Index, Q1: 12 vs. 13 exp.

AU: NAB business conditions, Mar: 7 vs. 4 prev.

CH: Caixin PMI manufacturing, Mar: 50.8 vs. 50.0 exp.

UK: Markit PMI manufacturing, Mar: 55.1 vs. 51.2 exp.

GE: Markit PMI (final), Mar: 44.1 vs. 44.7 exp.

EC: Unemployment rate (%), Feb: 7.8 vs. 7.8 exp.

EC: CPI core (y/y%), Mar: 0.8 vs. 0.9 exp.

US: Retail sales x auto, gas (m/m%), Feb: -0.6 vs. 0.3 exp.

US: ISM manufacturing, Mar: 55.3 vs. 54.5 exp.

US: Construct. spending (m/m%), Feb: 1.0 vs. -0.2% exp.

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.