Coming in for landing in a heavy cross wind

Insight

The Bank of England raised rates by 25bp as expected, while softer data out of China and the US weighed on risk sentiment

The US dollar is stronger and commodity prices generally weaker. Softer Chinese data added to concerns about the outlook, while softer US PPI data and a jump in initial jobless claims further fuelled optimism on the outlook for US disinflation. Over in the UK, the Bank of England raised rates by 25bp as expected, and guided that more tightening would be required if there was evidence of more persistent inflation pressures.

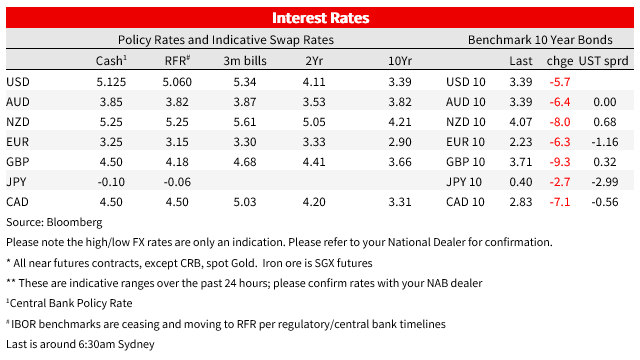

US economic data overnight continued the theme of tentative signs of a softening labour market and room for optimism about the inflation outlook. Core PPI inflation of 0.2% m/m in April (0.3% expected) supported the promising signal from CPI data yesterday on the outlook for further improvement in still too-high inflation. Initial jobless claims rose 22k last week to 264k, its highest level since October 2021. Caution on one week’s claims number is always well advised, but the incremental signal looks to be a more compelling trend higher. Market pricing for the remainder of 2023 was little changed, with just 2bp priced for June and a cumulative 77bp of cuts priced by year end. US yields were lower intraday, down as much as 10bp to 3.81% but recovered back up to 3.89% to be just 1bp lower on the day. The curve flattened, with the 10yr yield down 6bp to 3.39%

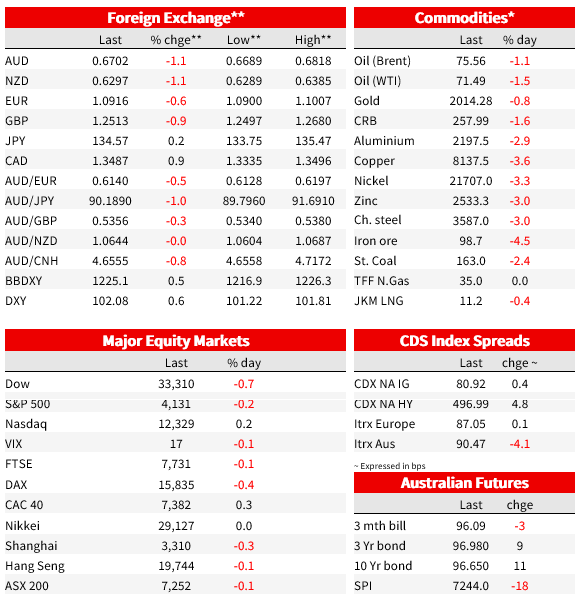

Chinese data yesterday also got some attention. Chinese inflation data showed PPI of -3.6% (consensus -3.3%) and CPI slowed 0.1% from 0.7% (consensus 0.3%) on softer food and energy prices. The softer PPI is supportive of the prospect for further global goods disinflation, but such subdued price pressures also point to subdued downstream demand. Chinese credit data was also weaker than expected. Aggregate financing was 1220bn in April (2000bn expected) and New Yuan Loans were just 718bn against 1400bn expected. Faltering credit demand dampens hopes domestic demand as the year progresses. An update on the forward momentum of China’s economy after a reopening bounce comes in April month activity reading on Tuesday.

In FX, the USD was stronger. The dollar was up 0.6% on the DXY to 102.08, and managed gains against all G10 currencies. The yen lost 0.2%, while the euro was 0.6% lower at 1.0916. The AUD was down 1.1% to $0.6702, while the NZD also underperformed, losing 1.1% to 0.6297. Commodity prices were generally softer, with copper losing 3.6% and irone ore 4.5% lower.

US equities are a little lower, with the S&P500 down 0.2%. The S&P500 was down as much as 0.7% earlier in the session, weighed by the softer US data, before paring losses. Losses were led by Energy and Utilities, with Communication Services and Consumer Discretionary gaining. In Europe, the Euro Stoxx 50 was 0.1% higher. As a reminder that the banking sector turmoil isn’t over yet, PacWest Bancorp said it saw a fall of 9.5% in total deposits last week and its share price is currently down over 20% as a result, spilling over into weakness for other regional banks.

The Bank of England increased rates by 25bp to 4.5% as expected. The vote was 7-2, with the more dovish Tenreyro and Dhingra voting for no change. A tightening bias was retained, “if there were to be evidence of more persistent pressure, then further tightening in monetary policy would be required. ” Governor Bailey said that this guidance was conditional and not a directional steer, and told Bloomberg that “We are approaching a point when we should be able to in a sense rest in terms of the level.” Markets continue to price around a 75% chance if another 25bp increase in June and a peak around 4.82%.

The BoE’s inflation forecasts were revised higher on concerns of more persistence, especially in food prices, with inflation expected to fall from 10.1% to 5.1% in Q4 2023 (previously 3.9%), and not fall below its 2% target until the start of 2025. The activity outlook has also been revised higher and the forecast recession removed. By mid-2026, GDP is now expected to grow by 0.25% over 2023 (from -0.5%) and to be a cumulative 2.25% higher than the Bank forecast in February.

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets. Read our NAB Markets Research disclaimer.

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.