Consumer spending is up 5.6% over the past 12 months.

Insight

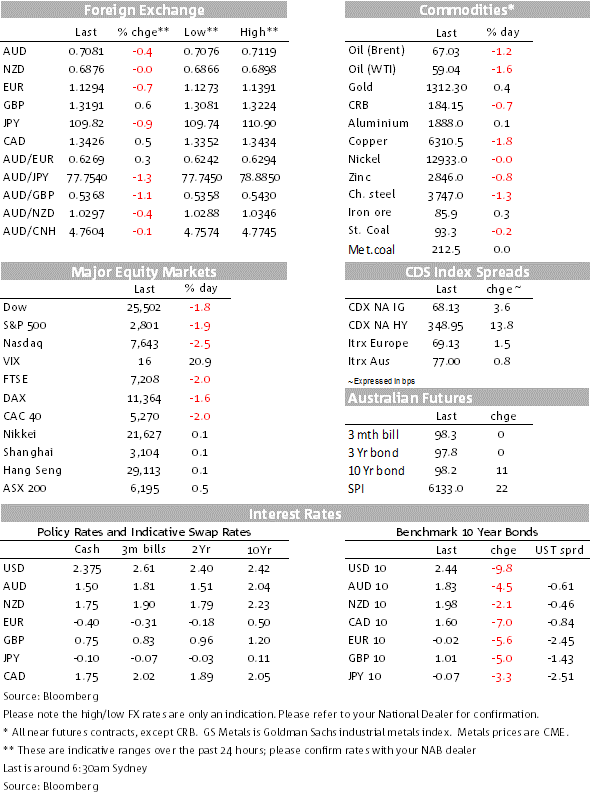

The markets seem a little spooked with big falls in equities in the US on Friday.

https://soundcloud.com/user-291029717/us-recession-talk-and-eu-helps-kick-the-can

Coming up:

Don’t look so frightened, This is just a passing phase, One of my bad days…..Why are you running away? – Pink Floyd “The Wall”

When pausing is not enough…Very soft European activity indicators on Friday, particularly from Germany, sparked concerns that the current global growth slowdown could be more than just a passing phase. 10y Bunds trade sub zero for the first time since 2016 and the 3m 10y UST yield curve, a reliable recession indicator, inverts for the first time since 2007. European and US equity markets sold off sharply with banks amongst the biggest underperformers. The USD ends the week a big stronger, mostly reflecting European currencies weakness while risk aversion weighs on the AUD but NZD is unperturbed. Most commodities also had a bad Friday with copper leading the declines.

It all began in Europe with the Flash PMI releases for March. The German Manufacturing PMI fell to 44.7, its lowest level in six years, while the Euro-wide index fell by more than expected to 47.6 (a reading below 50 indicates contraction in activity). Disappointingly as well both the French services and manufacturing PMI’s contracted in the month (49.8 from 51.5 and 48.7 from 50.2). Details in the reports also fell to provide much hope that an upturn could be in the offing with leading subindices such as new export orders showing further declines. Respondents cited mainly external factors for the slowdown, including softer global demand and uncertainty around US-China trade and Brexit. On a more encouraging note, the EU Services PMI was only slightly lower, and close to market expectations. The composite European PMI fell to 51.3, its lowest level since 2013, but still above the key 50 level for now.

Although the Eurozone reading suggest countries such as Spain and Italy are potentially doing better, there is no way of sugar coating the dismal data with markets reacting accordingly. ECB base case has been for a temporary slowdown in activity, but the lack of bounce in the data is now raising questions about whether a the current soft patch could be signalling the start of a more persistent downturn. ECB President Draghi reportedly told EU leaders on Friday that there was “protracted weakness and pervasive uncertainty” in the Euro area economy but that probability of a recession was still “quite low”.

Reaction to the data saw 10y Bunds trade collapse by 6bps to subzero to -0.015% (the first time it has traded in negative territory since 2016) while 10y UST yields fell 10bps to 2.44%. The flattening of the UST curve also caused an inversion of the 3m 10y UST yield curve, an event not seen since 2007. The 3m 10y UST curve has been a reliable predictor of US recessions, correctly predicting every US recession since 1975. That said, is probably worth pointing out that an inversion typically needs to persist for at least a quarter for a recession to eventuate, also historical comparisons are somewhat difficult given current unconventional policies (QE and forward guidance supressing term premium) as well as the fact that the current slowdown is driven by external forces ( EU and China slowdown). Worth pointing out too that although US recessions have followed curve inversions, they have occurred between 6 month to 24 month after and unlike other central banks, the Fed still has fair bit of conventional ammunition to stimulate the economy. The market now prices an 80% chance of a Fed rate cut by the end of this year and two full rate cuts by the end of 2020.

All that being said, equity markets were rattled by the underwhelming data on Friday. The three main US equity indices (S&P 500, Dow and NASDAQ) recorded the sharpest decline since the 3rd of January with the flattening of the curve hurting bank shares while pro cyclical materials and energy sectors also underperformed. The VIX index closed at 16.48, 20% higher but still comfortably below its long term average of around 20.

Looking at currencies the USD closed Friday stronger in index terms, largely reflecting European currencies weakness. Early in the overnight session the soft European PMI’s saw the euro collapsed from 1.1391 to 112.89 with the union currency retaining its losses into the NY session close. The Japanese yen outperformed on the back of the risk-off sentiment and sharp decline in 10y UST yields, USD/JPY fell0.82% to ¥109.92 where it currently trades.

A combination of risk aversion and soft commodity backdrop (Copper -1.94% while metals and Brent fell close to 1%) weighed on the AUD/USD with the pair ending the week at 0.7083. Our AUD short term model suggest fair value for the currency is currently at 0.7186, so in spite of Friday’s risk aversion, the AUD/USD still looks a little bit undervalued. Sharper declines in commodity prices and a VIX at least above 25 are probably needed for the AUD/USD fair value to sink below 0.70. Meanwhile, NZD traded in a narrow 0.6865-0.6900 range on Friday, despite the marked increase in risk aversion, and ended the week unchanged at 0.6875.

GBP managed to retain its early Friday gains (+0.8% to 1.3210) after the EU agreed to an unconditional extension of Brexit to the 12th of April. Theresa May wrote to Conservative MPs on Friday and said she would only put her deal to a vote this week if there is sufficient support for it (which looks unlikely at this stage). An amendment will be put forward by several backbench MPs, including Tory MP Oliver Letwin, on Monday proposing that parliament holds so-called ‘indicative votes’ this week on possible options, which might include: revoking Article 50 and cancelling Brexit; another referendum; a customs union solution; EEA membership (a la Norway); a Canada-style free-trade agreement, and a no-deal exit. With a large majority of MPs against a no-deal outcome, and parliament likely to take steps to take control of the process this week, there is scope for the GBP to build on its gains from Friday. But with Theresa May coming under heavy political pressure to resign (UK media are reporting on a possible coup by cabinet ministers) and the tail risk of new elections, it’s still likely to be a bumpy ride.

In US economic data, the US services and manufacturing PMIs were weaker than expected (albeit both comfortably above 50) while existing home sales bounced back strongly. Market sentiment wasn’t helped by Trump’s announcement that he had nominated former campaign advisor, and vocal critic of the Fed, Stephen Moore to a vacant Fed Governor position. Moore has previously labelled the Fed as “the swamp” and blamed it for “economic mismanagement”. Commentary over the weekend suggest that Moore acceptance to the Board is not a certainty as his selection subject to Senate approval. Two previous Trump nominees, Nellie Liang and Marvin Goodfriend, failed to advance in the Senate in 2018 and initial impression from both Republican and Democrat Senators suggest his nomination is likely to be blocked.

In other news, Special counsel Muller handed down his findings to the US Attorney General on Friday and this morning a summary of his findings have been made public. Bloomberg notes that Muller found no evidence of collusion with Russia but failed to exonerate President Donald Trump on obstruction of justice even though Attorney General William Barr said he didn’t find enough evidence to pursue an obstruction charge. The fact that the full report has not been made public is likely to be cause of Congress angst and expectations are of months of fighting and potential court rulings.

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.