We expect NAB’s Non-rural Commodity Price Index to fall by 4.9% in Q2

Insight

Big moves overnight with the BoE and ECB feeding the market narrative that the end of the tightening phase may be nearing.

“So if you like to party; Get on and move your body; The Vengabus is coming; And everybody’s jumping; New York to San Francisco; An intercity disco”, We Like to Party, Vengaboys 1998

Big moves overnight with the BoE and ECB feeding the market narrative that the end of the tightening phase may be nearing. While both central banks hiked by 50bps, Governor Bailey and President Lagarde said they may need to evaluate/re-evaluate policy in the near-term (Bailey “if the economy evolves in line with central forecast, we will need to re-evaluate”; Lagarde “we intend to raise interest rates by another 50 basis points at our next monetary policy meeting in March and we will then evaluate the subsequent path of our monetary policy ”). That was all markets needed to hear with market pricing for both the BoE and ECB pared. Global yields have fallen sharply: UK 2yr -24.0bps to 3.20%; German 2yr -17.2bps to 2.50%, and European peripheral yields by even more with Italian 10yr -39.0bps to 3.90%. US yields have also edged lower with the 10yr Treasury -2.6bps to 3.39%, after its circa 10bps move post-FOMC yesterday. Equities have rallied hard with the Eurostoxx 50 up 1.7%. Into the close the S&P500 is up 0.9%, boosted by Meta’s earnings after the close yesterday with Apple, Amazon and Alphabet also reporting post close.

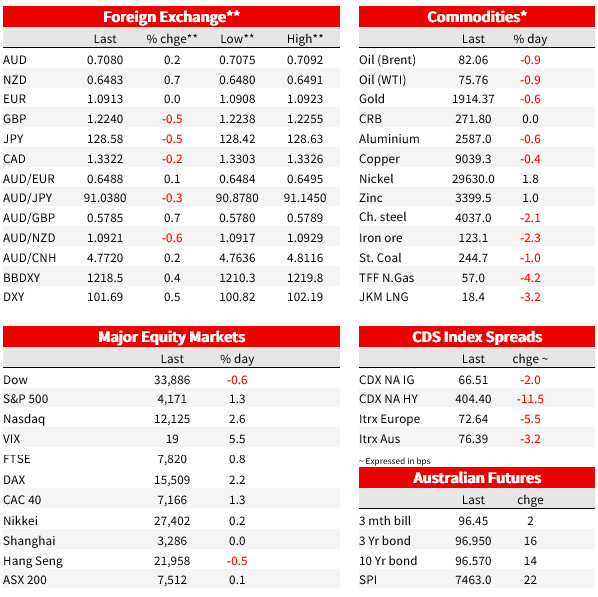

In FX, the USD recovered its post-FOMC fall with the DXY +0.5% overnight. Some of that move attributable to GBP which fell -1.3% to 1.2237 post its FOMC moves to be lower than it was pre-FOMC, while EUR gave up all its post-FOMC moves to be at 1.0915. The exception was USD/JPY with Yen strength given the lower rate backdrop: USD/Yen -0.5% to 128.58. Of note in Japan, former Deputy Governor Nakaso – one of the leading contenders to replace Kuroda as Governor – has taken on an expanded advisory role for APEC. This raises a question mark over his likelihood of being appointed the new Governor and adds to the chance of current Deputy Governor Amamiya winning the role – seen to be more dovish than Nakaso. With USD strength, both the AUD and NZD have been dragged lower with AUD currently trading at 0.7080, almost back to where it was prior to the FOMC.

The BoE hiked by 50bps to 4.0% (in a 7-2 decision with two voting for no change) along with a decidedly less hawkish messaging. While a tightening bias was maintained, Governor Bailley did note the “Change in language reflects a turning in the corner but very early days”, but a tightening bias overall was maintained given “the Committee continues to judge that the risks to inflation are skewed significantly to the upside ”. The less hawkish messaging was supported by the forecasts in which inflation declines below the 2% target in the medium term (CPI falls to 3.9% by Q4 2023 and then is at 1.0% y/y in Q2 2024), which assumes a market-path of the Bank Rate of around 4½% in mid-2023 and easing back to 3¼% in three years’ time. In Governor Bailley’s words “If risks emerge and we continue to get overshoots in wage data and services inflation, we will have to respond” and alternatively “If economy evolves in line with central forecast, we will need to re-evaluate”. (see BoE MPC Monetary Policy Summary, February 2023 and BoE Monetary Policy Report for details)

Markets have pared back BoE hike expectations with a 79% chance of a 25bp hike in March, and a peak BoE rate of 4.28%, along with 31bps worth of cuts in H2 2023. That is different to the day before which had a peak BoE rate of 4.36% and 21bps worth of cuts in H2 2023. The biggest moves have been in yields with the 2yr yield down -24.2bps to 3.21%, and the 10yr yield -30.3bps to 3.01%. No surprises then to see GBP -1.3% post the FOMC moves early yesterday to 1.2240.

Across the channel, the ECB met and also raised by 50bps to 2.5%, with an intent to raise by another 50bps in March and “we will then evaluate the subsequent path of our monetary policy”. ECB President Lagarde said that risks to the growth outlook have become more balanced (previously saw negative risks), while risks to the inflation outlook were also balanced (previously saw upside risks). (see ECB Press Conference for details). The market saw this as a less hawkish outlook than expected and pared back expected further tightening, slicing about 15bps off the peak policy rate to 3.29% by July 2023. The market is prepared to run with the further 50bp hike in March, and another 25bps hike priced after that. This spilled over in the bond market, with Germany’s 2-year yield down 19bps and 10-year rate down 21bps on the day. Peripheral market bonds have outperformed, with Italy’s 10-year rate down a massive 40bps.

As for data it was mostly ignored. US Jobless Claims were lower than expected at 183k vs. 195k consensus, and 186k prior. Difficulty in seasonally adjusting weekly data at this time of year suggests we should be cautious, but supports the view of a still tight labour market given the JOLTS figures earlier in the week and bucks the anecdotal layoff trend. US productivity figures were better than expected, but as always on a quarterly basis hard to read, with non-farm productivity 3.0% annualised vs. 2.4% consensus and 1.4% previously. Unit Labour Costs decelerated to 1.1% from 2.0% previously. Meanwhile final core durable goods orders were revised a touch weaker to -0.2% m/m from -0.1%.

Coming up:

For further FX, Interest rate and Commodities information visit com.au/nabfinancialmarkets. Read our NAB Markets Research disclaimer

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.