Consumers lead the way

Insight

SRI aims to incorporate environmental, social and governance (ESG) factors into investment decisions and the industry is growing rapidly.

Socially responsible investing (SRI) means integrating nonfinancial factors – such as ethical, social or environmental concerns – into the investment process. The term SRI is often used interchangeably with other terms like ‘ethical investing’ and ‘values-based investing’.

Ethical investing

Ethical investing is the oldest phrase and its use can be traced back to early biblical times when Jewish law set out the first specific rules for ethical investment. In the mid-1700s, the Methodist Church sought to do the same and in the 1900s markets started to focus more on the religious requirements of the Islamic community.

In the early 1970s, socially responsible investors took to task companies involved in war, discrimination and environmental pollution. In the 1980s, they were joined by institutional investors participating in the worldwide South Africa divestment movement. More recently, investors have focused greater attention on the issues of corporate governance and climate change.1

Responsible investing

SRI is closely linked to the broader term responsible investing, which also aims to incorporate environmental, social and governance (ESG) factors into investment decisions.

According to the United Nations, while SRI seeks to combine financial return with a moral or ethical ‘return’, responsible investing can and should be pursued even by an investor whose sole purpose is attaining a financial return. That is, ESG information should be incorporated into decision-making to ensure that all relevant factors are accounted for when assessing risk and return.2

The industry

The global responsible investment industry has grown rapidly. According to the Global Sustainable Investment Alliance (GSIA), the worldwide ‘sustainable investment’ market grew from US$13.3 trillion at the start of 2012 to US$2.9 trillion at the start of 2016, with its share rising to 26.3% of all professionally managed assets in the regions surveyed by the GSIA.3 (Note: the GSIA defines ‘sustainable investment’ to include both responsible investing and SRI,)

Europe

The SRI industry is perhaps most advanced in Europe. A survey of 13 European countries by Eurosif (the European Sustainable Investment Forum) found that the SRI market there grew at double-digit rates between 2011 and 2013, faster than the broader European investment market.4

Some European countries have produced government-sponsored SRI guidelines or information resources for investors; others have offered tax relief for ‘green funds’ or community investment.

Belgium has introduced a law prohibiting any Belgian investor from investing in any company that produces or distributes anti-personnel mines and cluster munitions.5

US

In the United States (US), the total US-domiciled assets under management using responsible investment strategies grew from US$6.57 trillion at the start of 2014 to US$8.72 trillion at the start of 2016, an increase of 33%. These assets now account for more than one in every five dollars under professional management in the US, according to US SIF (the Forum for Sustainable and Responsible Investment).6

Asia

The SRI industry in Asia is relatively small, but growing. A common form in Asia is community investing, which includes micro-credit and revolving loan schemes. Some of the best-known practitioners of community investing, such as Grameen Bank of Bangladesh, originated in Asia.

Another form of SRI common in Asia is Islamic finance and Syariah-compliant financial schemes.7

Australia/New Zealand

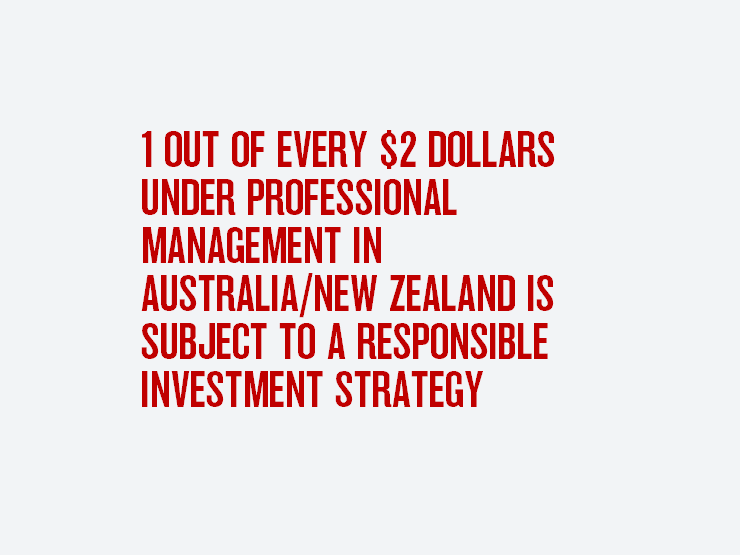

Australia/New Zealand is a standout in the period 2014-2016 growing 247%, with 1 out of every 2 dollars under professional management subject to a responsible investment strategy.

Investors

Investment firms have been eager to participate in the expanding SRI market, and have responded by creating and promoting various products to investors or by assigning analysts to overlay ESG analysis across regular investment products.

Family offices, foundations, nonprofit organisations and university endowments are also increasingly exploring SRI.

SRI fund managers – often in concert with civil society organisations and other groups – have been credited with persuading public companies to improve greenhouse gas reduction goals, implement sustainable forestry practices, address poor labour conditions in global supply chains, and promote gender diversity on boards.8

Proponents of SRI argue that investing is not an inherently ‘neutral’ activity and that through their decisions investment managers can play a role in creating both social and financial value.

Climate change

A major contemporary driver of SRI is concern about climate change. Environmental groups have urged university endowment managers to divest from fossil fuels and investors concerned about climate risk are increasingly seeking to reduce carbon-intensive holdings and to expand renewable energy and energy efficiency investment options.9

This article is from A review of socially responsible investing in Australia (PDF 582KB)– a report on SRI produced by NAB’s long term research partner, the Australian Centre for Financial Studies. The report seeks to explain the seven categories of SRI strategies and undertakes an extensive review of global performance data overall.

1 von Wallis, M. and Klein, C. (2014), ‘Ethical Requirement and Financial Interest: A Literature Review on Socially Responsible Investing’, Business Research, Vol. 8, pp. 61-98. See also: Lydenberg, S. (2014), ‘Ethics, Politics, Sustainability and the 21st Century Trustee’, in: Socially Responsible Investment in the 21st Century: Does it Make a Difference for Society?, Emerald Group Publishing.

2 UN Principles for Responsible Investment (n.d.) https://www.unpri.org/about/what-isresponsible-investment

3 Global Sustainable Investment Alliance (2015), ‘Global Sustainable Investment Review 2014’, February.

4 Eurosif (2014), ‘European SRI Study’.

5 Steurer, R., Margula, S. and Martinuzzi, A. (2008), ‘Socially Responsible Investment in EU Member States: Overview of Government Initiatives and SRI Experts’ Expectations towards Governments’, report for the European Commission, Vienna, April.

6 US SIF (2016), ‘Report on US Sustainable, Responsible and Impact Investing Trends’, Executive Summary.

7 Williams, G. (2010), ‘Socially Responsible Investment in Asia’, Lien Centre for Social Innovation.

8 US SIF Foundation (2016), ‘The Impact of Sustainable and Responsible Investment’, June.

9 US SIF Foundation (2016), ‘Family Offices and Investing for Impact’.

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.