We expect NAB’s Non-rural Commodity Price Index to fall by 4.9% in Q2

Insight

Environmental, social and governance (ESG) considerations are fast becoming incorporated into mainstream practice across all sectors of business.

For Australia’s superannuation funds, this manifests in the governance and practices of the corporate entity itself as well as the policies and practices that govern their investment portfolios, including investments that can be classified as “responsible investing”. Globally, the focus on ESG and responsible investing has moved to the forefront driven by a number of factors including customer expectations, fiduciary obligations as well as regulatory guidance on matters such as climate change risk. More broadly, there is an increasing awareness of the social and environmental impact of a company’s activities, with the weight of investor money behind this shift. We are witnessing this trend in Australia, with the responsible investment market growing by 13% during 2018 to AUD$980 billion, representing 44% of total professionally managed assets which total AUD$2.24 trillion.¹

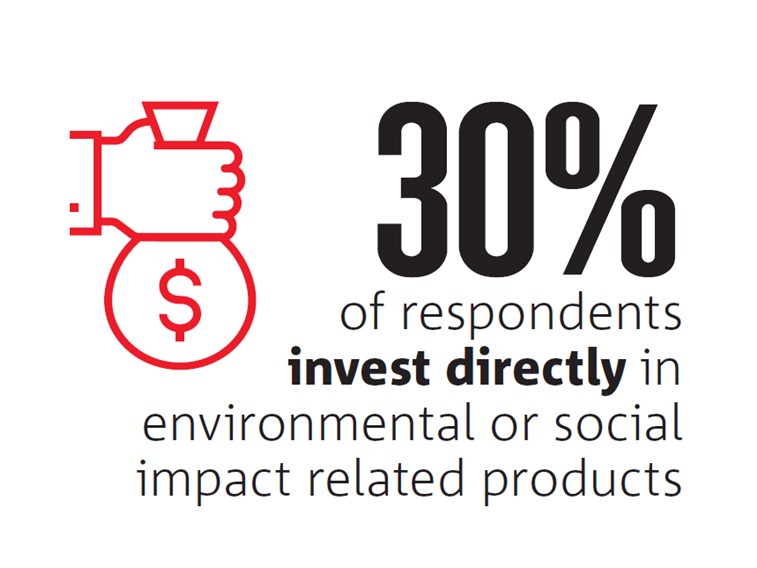

In response to the increased focus on ESG and responsible investing by Australia’s superannuation funds, including in fixed income markets, NAB extended its Biennial Superannuation FX Hedging Survey to include questions on these themes.

We received responses from 30 funds, representing about AUD$820 billion of assets under management, spanning the industry, corporate, government and retail sectors.

Want to know more?

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.