Currency strategy to achieve a better outcome for idle cash that may be awaiting deployment and earning little or no returns

Article

Currency strategy to achieve a better outcome for idle cash that may be awaiting deployment and earning little or no returns

Article

A major global investment fund is using NAB’s financial innovation for derivative portfolios to help incentivise sustainability goals in a new deal for the Australian market.

Article

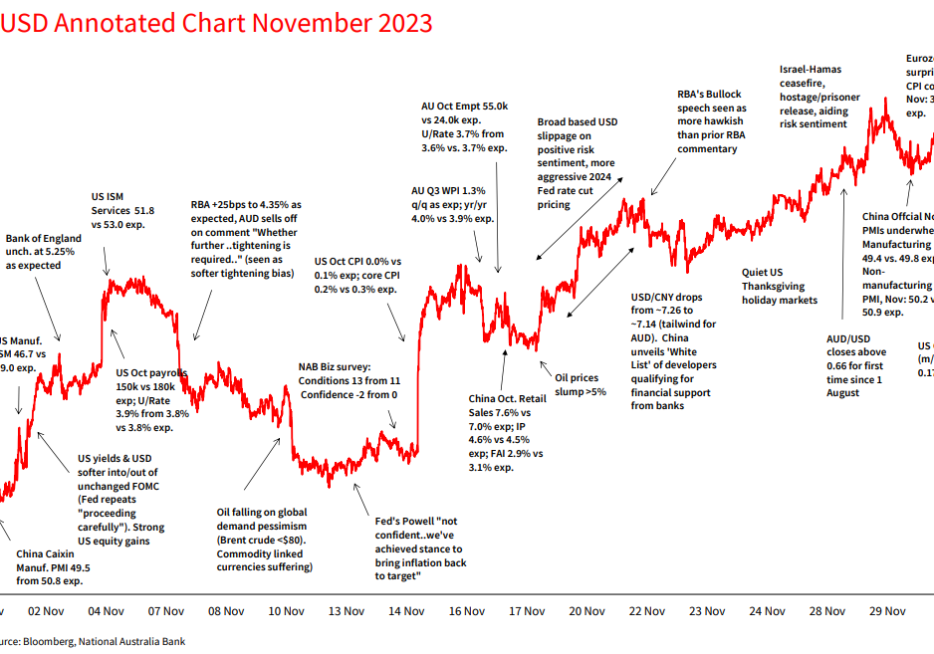

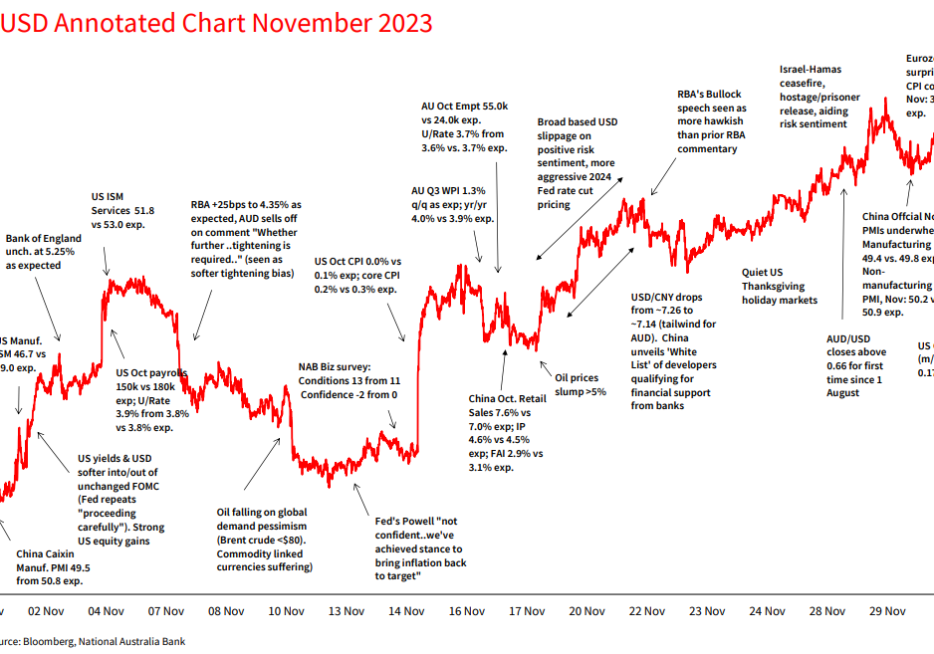

The AUD in November AUD/USD returned to ‘normal’ levels of monthly volatility in November.

After what has been a solid month for equities and bond investors, month end flows have probably play their part in the price action overnight, US equities have lost momentum, UST have led a rise in core global bond yields and the USD is stronger. US and European inflation releases favoured the notion the Fed and ECB are done with their respective tightening cycles.

Bond markets have been supported by some market-friendly data and while Fed speakers were again mixed, it was the more dovish remarks that captured attention.

Fed's Waller inches open the US rate cut door

Podcast

US and European markets have begun the new week a subdued mood. But core global bond yields are showing some life, lower across the board while the USD is a tad softer too

The Aussie dollar came within kissing distance of 66 US cents on Friday

UK best Eurozone on the PMI front in Thanksgiving- thinned markets

Todays podcast US data not supportive of Fed’s inflation quest US Jobless claims fall well below expectations Final U of Michigan inflation expectations revised up UST curve bear flattens. 2y up 6bps to 4.93% US equities ignore data and keep marching higher Oil slips on news OPEC + meeting delayed. Saudis not happy USD […]

The FOMC Minutes out 6am Sydney time didn’t do much to excite markets. The euro is a little weaker over the past 24 hours, while the equity market rally has lost some steam.

US equities start the new week in a positive mood, the USD has remained under pressure and after initially edging higher, longer dated UST yields edge lower supported by a well-received 20y Bond auction.

Another choppy night on bond markets with 10yr yields on net little changed and the curve twist flattening slightly.

A choppy session with softer-than expected second-tier US data seeing yields fall, while the USD gained smalls and commodity currencies underperformed

It was a busy 24 hours for data flow globally. Yields partially retraced yesterday’s post-CPI bond rally, while equities have held onto gains.

US CPI came in a tenth below consensus on both the headline and core rates, leaving yields sharply lower, the USD weaker, and equities higher.

Subdued start to the week ahead of US CPI tonight

US equities recorded a solid end to the week with the S&P 500 closing above the 4400 psychological mark. Equity investors showed little reaction to news of a downbeat consumer

Two events late in the session dominated price action. The first was a poorly received US 30yr Treasury auction. The second was not dovish comments by Powell who sounded still hawkish.

Oil prices down again as demand pessimism deepens

Quiet data wise, but some notable moves in markets.

It was a quiet start to the week for news flow, which was mostly reflected in market movements, though yields are generally higher.

Risk assets had a solid end to the week with softer US economic data releases fuelling the notion that the Fed is done with the current tightening cycle. Front end yields led a rally in UST yields while the USD extended its decline to a third consecutive day.

The FOMC was on hold as expected. Yields are lower, though most of the moves came ahead of the Fed with soft US data.

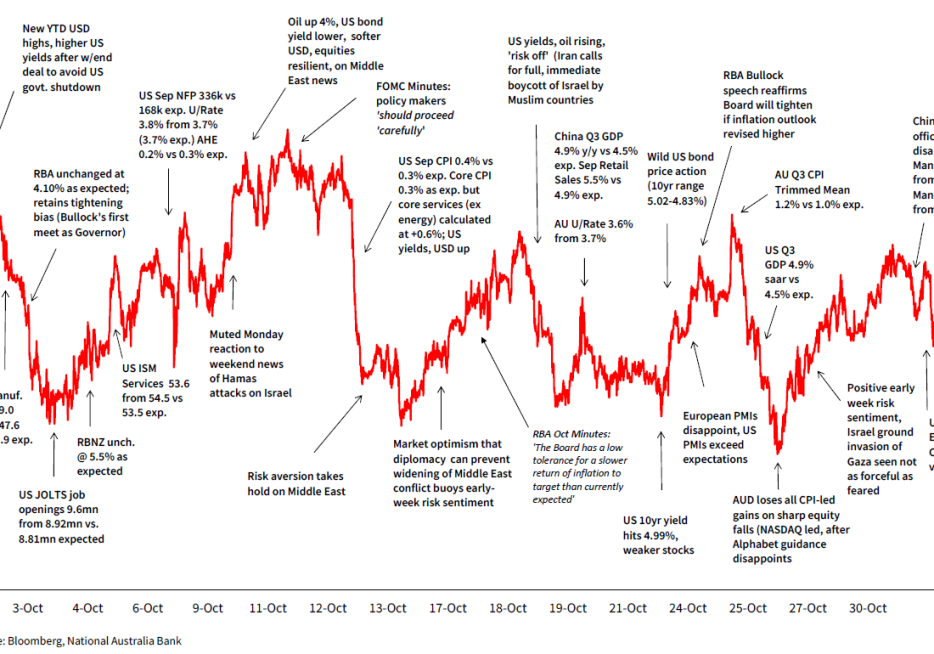

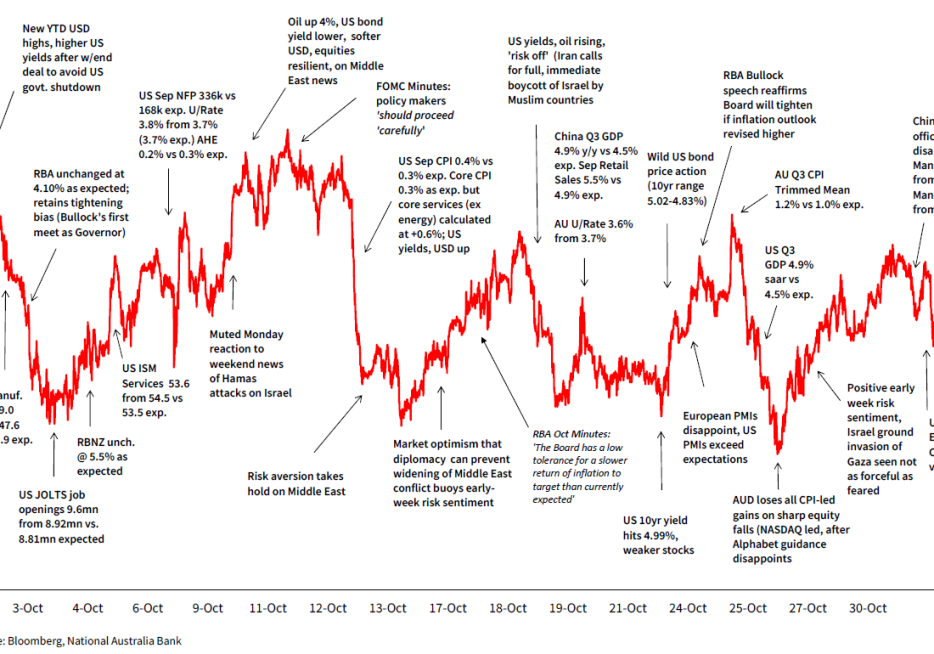

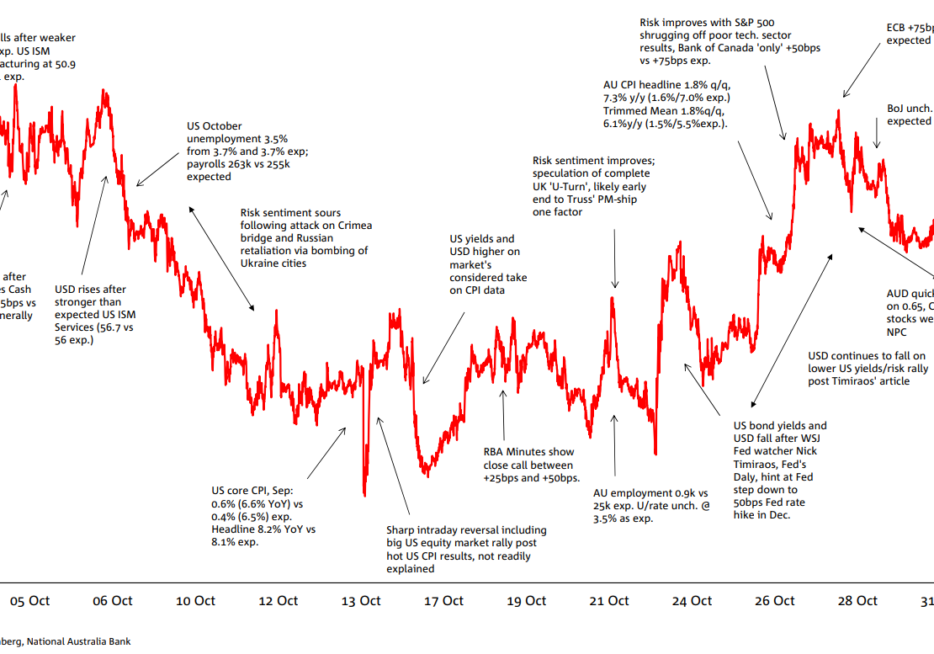

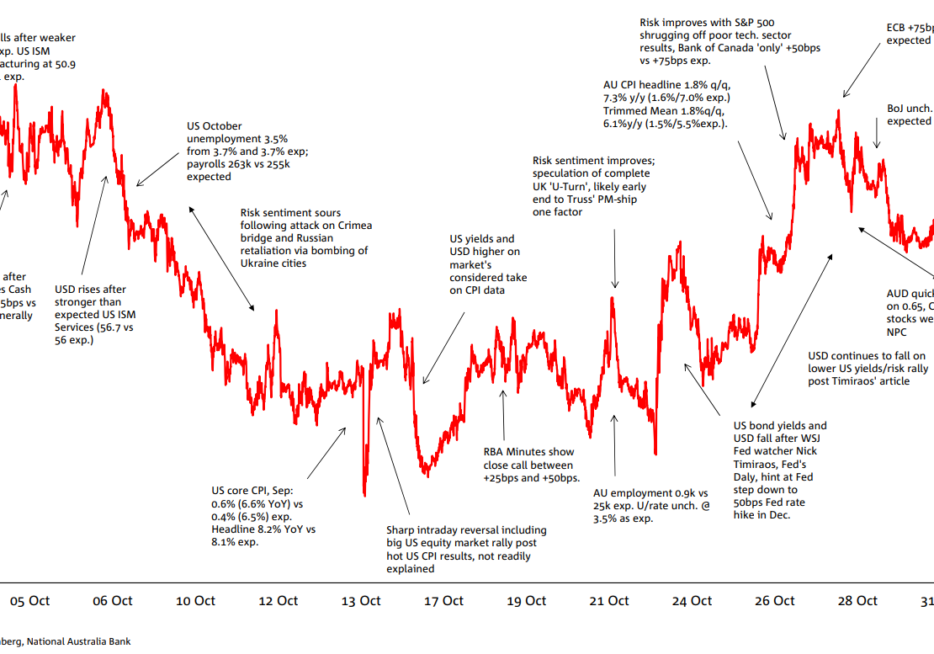

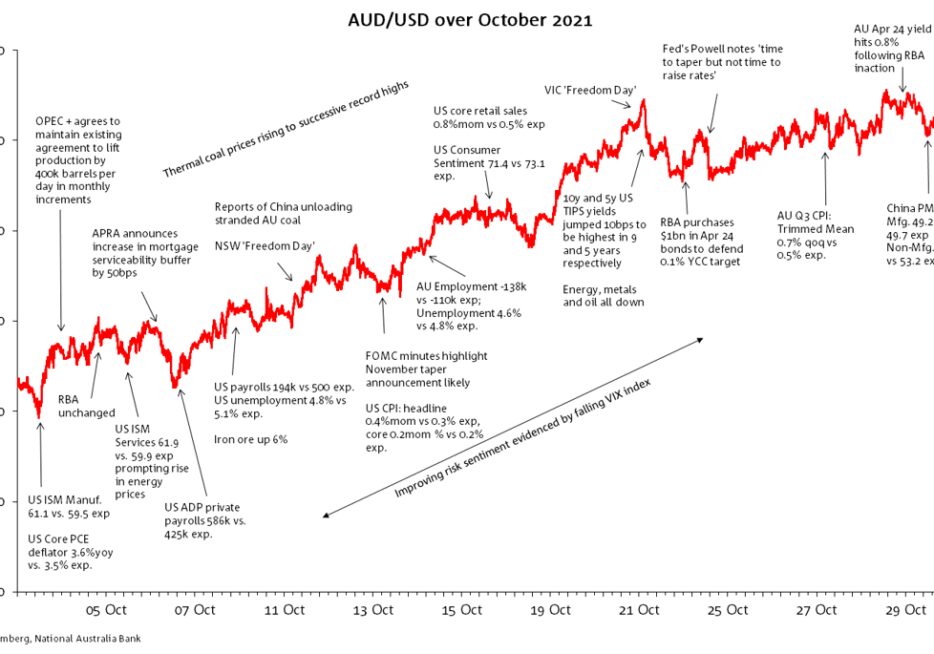

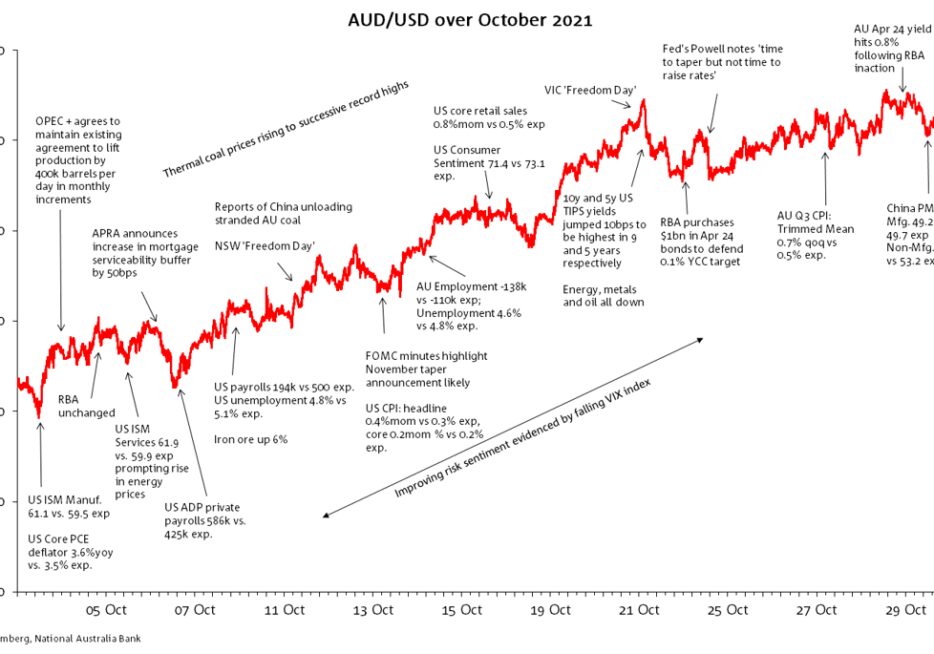

Despite everything happening in the world, the AUD’s October trading range was extraordinarily low.

Japanese Yen slumps after only minor BoJ policy tweaks

Risk sentiment started the week on firmer footing. Equities are higher, the US dollar is lower, and US yields were higher. Brent oil lost 3%, back below $88 a barrel.

European and US equities ended the week with a cautious tone. The S&P 500 extended its weekly decline to 2.53% and entering correction territory in the process. Weekend news that Israel has begun a ground invasion of Gaza suggest markets are likely to retain a cautious tone at the start of the new week.

Risk sentiment remained fragile overnight with equities extending recent losses with disappointing earnings outlooks from major tech companies, despite mostly beating on current quarter earnings.

US equities are lower led by the tech heavy NASDAQ index and not helped by a new surge in UST yields. The USD extended yesterday’s gains with the AUD at the bottom of the G10 board, reversing its post CPI gains.

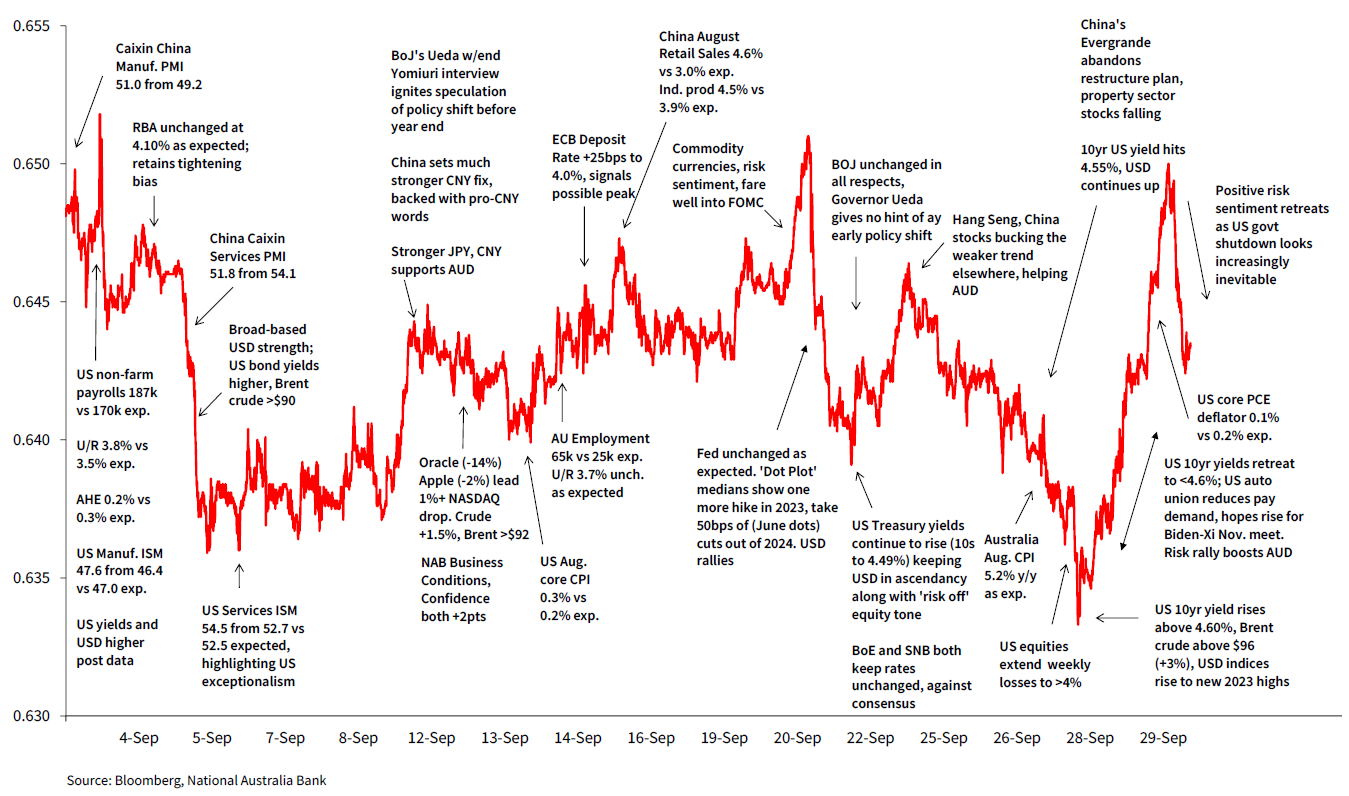

The AUD experienced a volatile month in September spending some time above USD 0.6500 before testing levels below 0.6300 in the early part of October.

Webinar

Weaker European PMIs, and potentially some unwind of yesterday’s move, have seen a stronger US dollar the main mover overnight, up 0.7% on the DXY.

A quiet night for data, but a big night for bonds.

Close but no cigar – US 10 year bonds traded to as high as 4.99% on Friday

Fed Chair Powell’s remarks have seen a choppy market response and a steeper curve, but against a backdrop of weak risk sentiment

Higher US yields and 'risk-off' tone see AUD's hard-fought gains undone

Strong US retail sales sees yields rocket – 10yr yield +14bps to 4.84%

Todays podcast Positive risk appetite to kick off the new week Equities higher, S&P500 +1.1% Yields higher, US 10yr +9bp to 4.70% Dollar loses 0.4% on the DXY with AUD an outperformer, +0.8% to 0.6344 Coming up: NZ CPI, RBA Minutes, US Retail, CA CPI, UK Wages, FED & ECB speakers Events round-up NZ: Performance […]

Podcast

US CPI reverses much of the earlier week market moves

Global markets were relatively stable overnight ahead of tonight’s key risk event of US CPI.

Lower US bond yields and softer US dollar lift AUD back above 0.64

Reaction to the Israel-Hamas conflict triggers a spike in energy prices while German Bunds lead a rally in European bonds with US Treasury futures also pointing to a decline in US Treasury yields. Not all the initial moves have been sustained. The USD is little changed, AUD is up, after being down with Fed speakers favouring holding rather than hiking rates, helping US equities rally while European shares fall.

Markets mark time ahead of payrolls tonight. Core global yields trade in narrow ranges, the USD loses a bit of altitude while US equities end the day little changed.

The bond sell-off that dominated the early part of the week has been put on pause. Why? NAB’s Taylor Nugent says there are a number of factors, but it’s tomorrow’s non-farm payrolls that will really set the direction for early next week.

A better-than-expected US JOLT report provided rattled markets. US Treasuries led a rise in core global bond yields, equities traded lower and the USD was stronger. USD/JPY gapped lower ( official intervention?) and AUD was the notable underperformer.

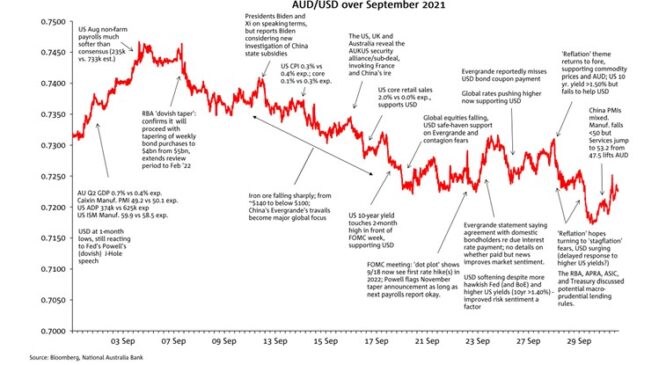

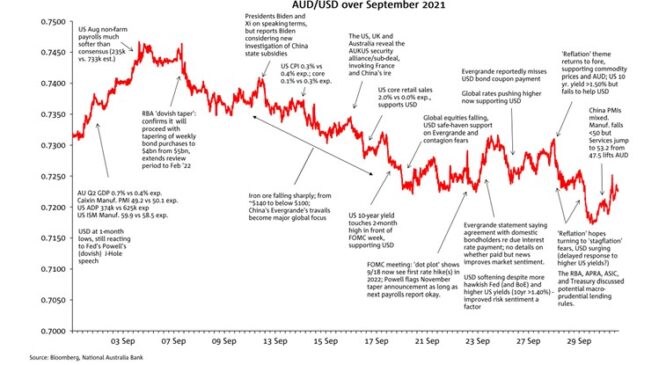

The AUD/USD’s 1.9 cents range in September was the narrowest since the 1.74 cents October 2019 range. Still, the USD was in the driving seat, fuelled by “higher for longer” Fed messaging.

The sell-off in global bonds continued with fresh cycle highs being set for longer-term yields. The

The BoE is the latest to put rates on hold. But are they done? JBWere’s Sally Auld says its not safe to assume it’s over for any central bank.

Todays podcast ECB opts to hike, but taken as dovish with guidance read as a peak in rates Euro -0.8% and European yields are lower US Retail Sales data stronger in August, though offset by revisions AU Employment bounced in August Coming up: China Activity & MLF rate, NZ Manufacturing PMI, US UMich confidence […]

It was a subdued market reaction to the highly anticipated US CPI print.

Ahead of US CPI tonight, oil prices have ratcheted higher as OPEC+ cuts continue to bite

Todays podcast Tesla leads gains within in US equities Core global yields tick higher USD broadly weaker with JPY and CNY the notable movers JPY gains following Ueda’s interview suggesting openness to policy move this year CNY gains on PBoC strong fix, push against speculators and better data AUD and NZD benefit from spill over […]

US equities manage a marginal gain on Friday, but lower over the week and yields edge higher.

Yields are generally lower globally after a boost to US 2-year yields from lower jobless claims proved short-lived while equities declined.

A rise in Services activity last month confirms the US economy still sits firmly on top of the world

In this Weekly, we take stock of progress rebalancing labour markets in the US and Australia, finding significant progress has been made on a range of indicators even without a sizeable lift in unemployment rates

A softer Caixin Services PMI soured the mood yesterday, with the USD broadly stronger and the AUD the worst G10 performer

It has been a quiet start to the week in Europe and the US with the latter out celebrating Labor Day. US equity futures closed little changed while US Treasury futures are pointing to some small upside pressure on yields.

Neither the Fed nor President Biden could have scripted Friday’s US payrolls report any better had they tried

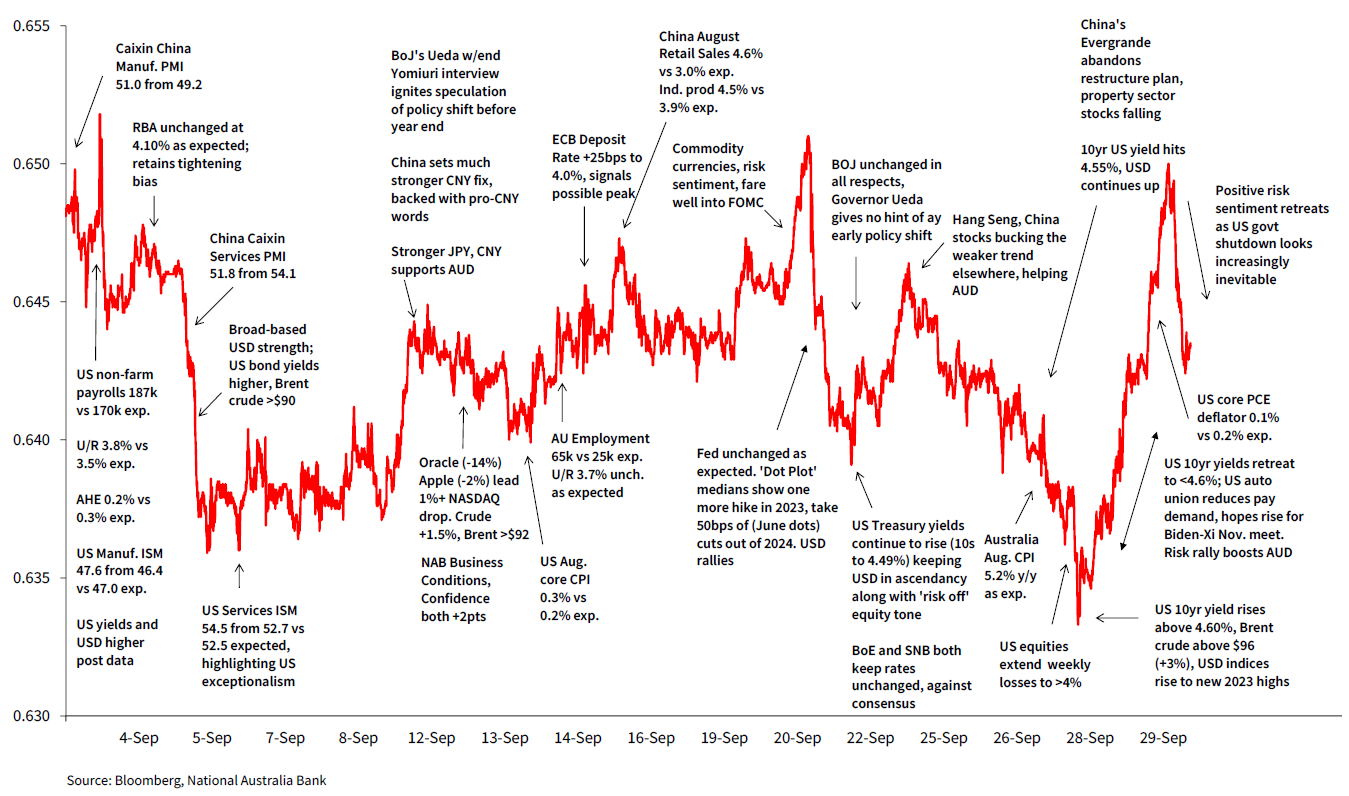

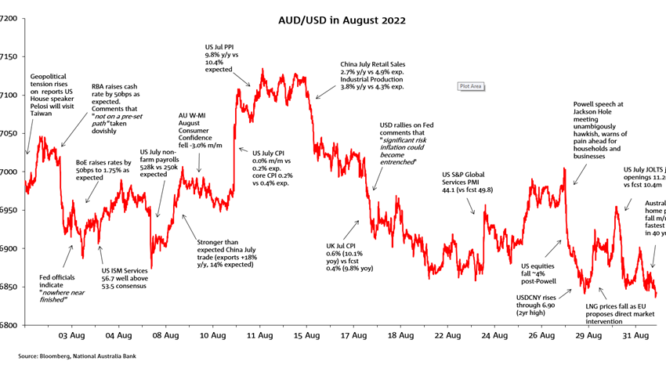

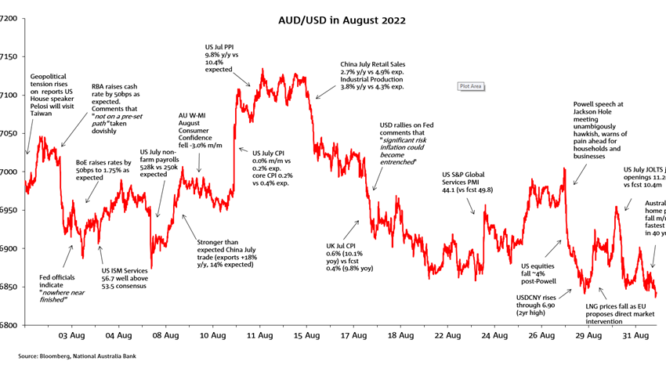

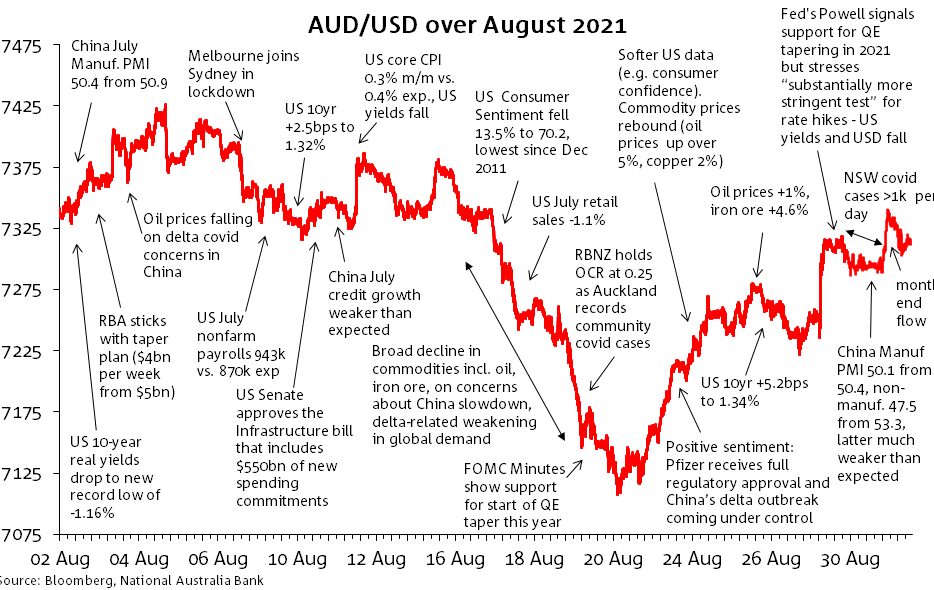

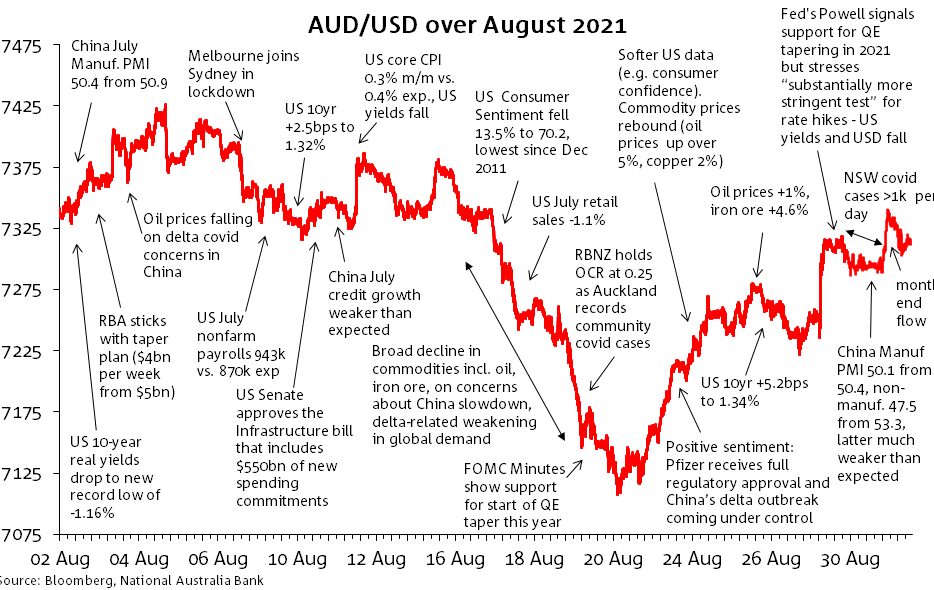

The AUD have an ‘average’ August in terms of its monthly hi-lo range, albeit it fell to a near 10-month beneath 64 cents

Overnight, the BoE’s Pill references ‘Matterhorn’ versus ‘Table Top Mountain’ approaches to monetary policy

US equities extend their positive run to a fourth consecutive day with softer US economic data fuelling expectations of a Fed on hold over coming months. UST yields edged lower while European yields rose following stronger than expected German and Spanish inflation data releases. The USD lost ground against EU pairs while the AUD is little changed.

Softer US consumer confidence and a JOLTs report suggesting ongoing rebalancing in the labour market saw the US dollar and US yields lower, while equities were higher.

Aussie retail sales were stronger than expected in July, but World Cup fever was a factor says NAB’s Ray Attrill

Fed Chair Powell’s speech at Jackson Hole did not break new ground. US equities closed the day in positive territory with both the S&P 500 and the NASDAQ recording their first positive week since July. The UST curve flatten with front end yields ticking higher while the USD closed a tad stronger.

Caution prevails in front of Jackson Hole; stocks down, bond yields back up, AUD back lower

Yields were generally lower globally as PMI data came in softer than expectations, with deterioration most pronounced in German Services. The AUD was stronger, as were US equities, with tech leading once again ahead of much anticipated earnings from Nvidia.

US equities traded in and out of positive territory, essentially marking time ahead of NVIDIA’s reporting tomorrow and Fed Chair Powell’s speech on Friday. It was also a quiet FX session while in rates 10y UST yields printed a fresh 16-year high before consolidating.

US yields resumed their grind higher to start the new week, though there was little news to speak of, while US equities where higher.

Yields lower on Friday, but still close to recent cycle highs

It’s been onwards and upwards for global bond yields overnight, and AUD has spent time below 64 cents

Todays podcast FOMC Minutes show concern about upside risks to inflation US yields higher led by 5bp rise in 10yr Equities were lower, S&P500 -0.8% with declines late in the session Asia equities weighed by China concerns AUD -0.5% against a broadly stronger dollar at 0.6421 Coming up: AU Employment, NZ PPI, JN Machinery Orders, […]

A stark contrast Tuesday between strong US retail sales and very weak China data

US equities started the new week on a positive note, notwithstanding a negative lead from Asia. Core global yields have continued their ascendancy while the USD is broadly stronger with negative China sentiment weighing on the AUD and NZD

A higher-than-expected US PPI print contributed to higher yields, while equities ended the week on a muted note.

US Core CPI just 0.160% m/m and 3m annualised rate now 3.1%

Ahead of the July US CPI release tonight US equities closed on the back foot. Oil prices extend recent gains while LNG prices surge following news Australian workers vote to strike. Quiet night in FX land.

Risk appetite has been weighed over the past 24 hours by a trio of soft China data, a surprise ‘windfall’ tax on bank profits in Italy, and a downgrade of a number of small and mid-sized banks by Moody’s.

Northern hemisphere summer holidays and a lack of data has seen markets treading water ahead of US CPI figures on Thursday.

Bond sell-off reverses on softer US payrolls

BoE lifts Bank Rate by 25bps to 5.25% as expected, to limited market reaction. US payrolls tonight

Yields rise, US 10yr hits 4.12% before easing back to 4.08%, highest since Nov 2022

The US Treasury curve bear steepened following news the US government will increase its bond issuance by more than previously thought. US equities recorded small declines and the USD is stronger across the board with the AUD the notable underperformer, RBA on hold and underwhelming China data not helpful.

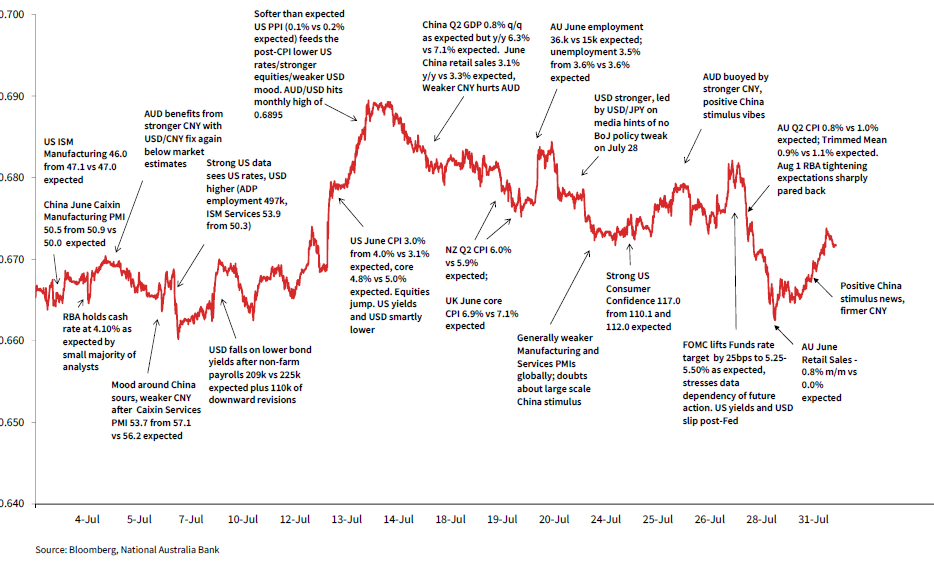

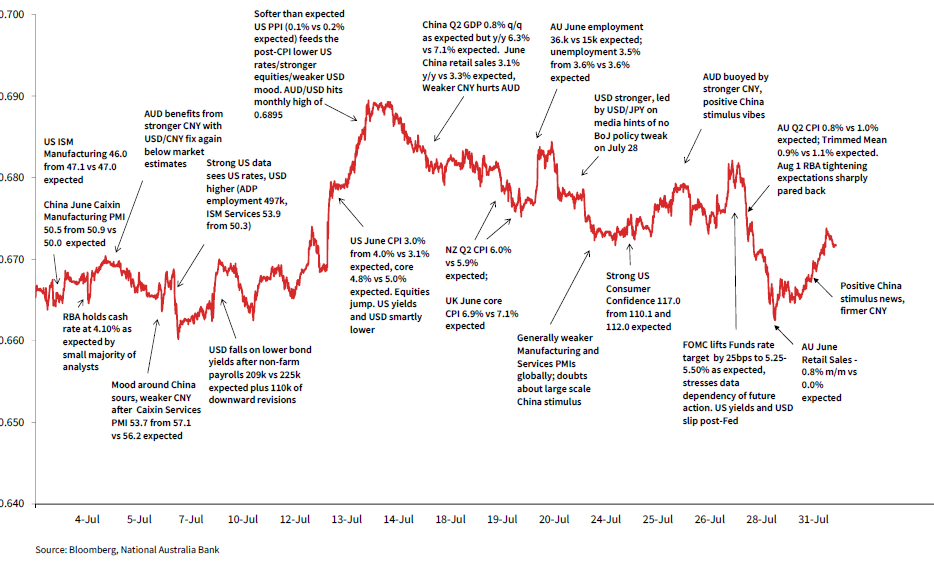

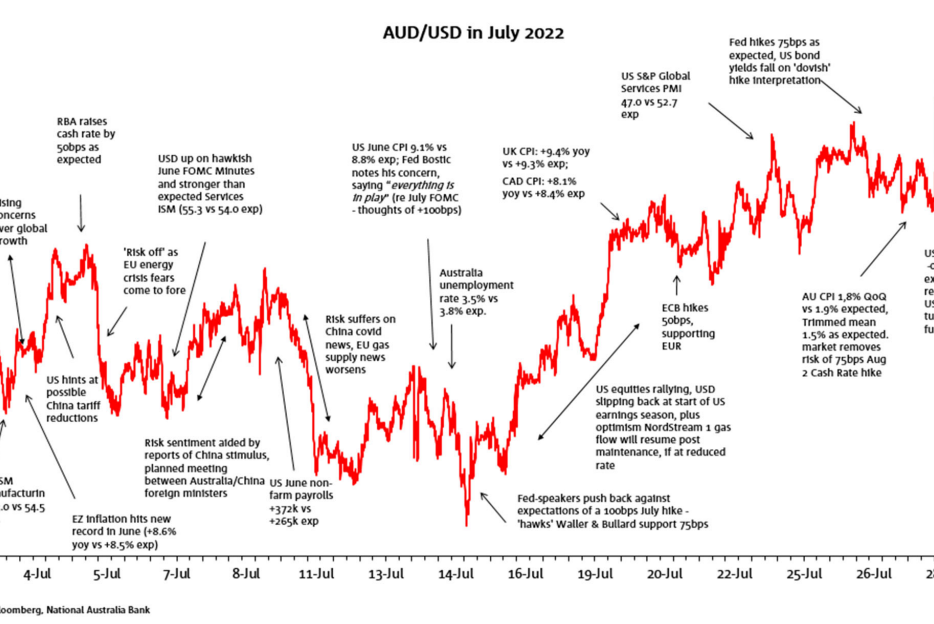

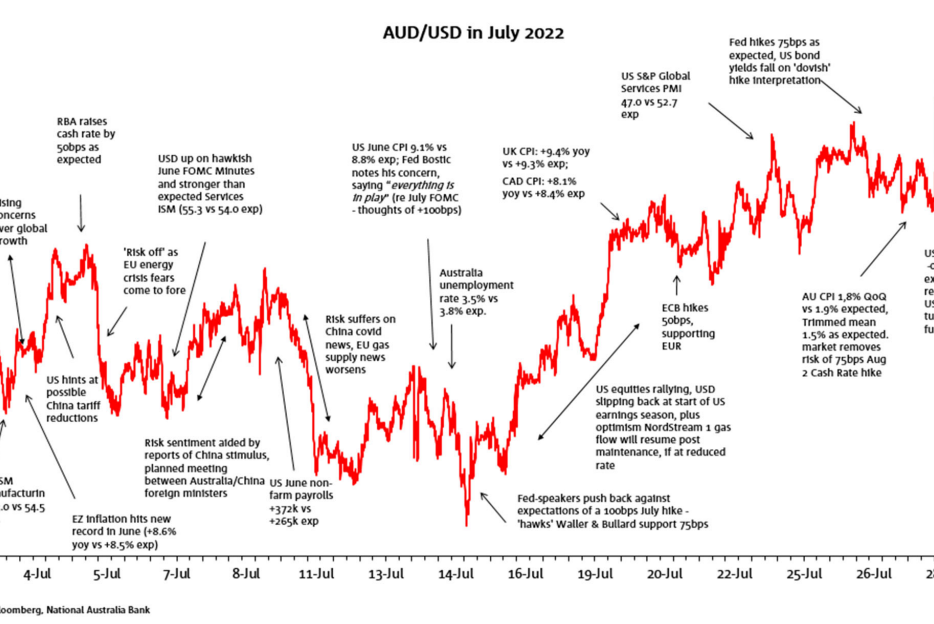

US, China and local inflation news drove much of the AUD volatility in July

Markets were generally quiet to start to week ahead of key risk events later in the week (BoE Thursday, US ISM Services Thursday, US Payrolls Friday).

Friday’s BoJ announcements made a bigger initial impression on global bond markets than FX

Not much reaction to the ECB, says NAB’s David de Garis, but a big reaction in currencies and Treasurys to the latest US GDP numbers. With a lot of European data today and early next week, things could stay quite ‘whippy’.

The US FOMC hiked rates by 25bps to 5.25-5.50% as universally expected.

AUD approaches 0.68, buoyed by China stimulus news and RMB gains

Weak European PMIs have seen yields fall, though moves in US Treasuries retraced latter in the day.

US yields higher with Jobless Claims lower than expected

Another bond rally, this time in the UK with inflation coming in softer than expected.

Central bankers globally seem to have switched to a more measured tone recently. Overnight tapas

Underwhelming China economic data has weighed on sentiment, mostly in Asia and Europe with a decline in CNY also spilling over to NZD and AUD. Core global yields are a tad lower while US equities have resumed their upward trajectory.

A bear flattening of the UST curve post a better than expected University of Michigan survey so the S&P 500 closed marginal lower while the USD found some support.

After the softer US CPI print on Wednesday the cooling US economy narrative was further supported overnight by a softer than expected US PPI print. Megacaps have led gains in US equities while front end bonds have led a decline in UST yields. The USD is broadly weaker with several FX pairs breaking through key support/resistant levels.

Yields tumbled and risk assets soared as US CPI came in much softer than expected

Ahead of the all-important US CPI release tonight, US equities edged higher again overnight while the UST curve flattened driven by an uptick in front end yields. The USD is broadly weaker, but the AUD has been unable to perform.

Payrolls failed to deliver the upside surprise feared following strong data earlier in the week, seeing some pullback in the USD and short-end yields on Friday.

The RBA met yesterday and held rates steady. Other than that, it was a very quiet 24 hours characterised by thin trading alongside the US 4 July holiday.

A quiet night overnight given shortened pre-holiday trade in the US ahead of Independence Day today.

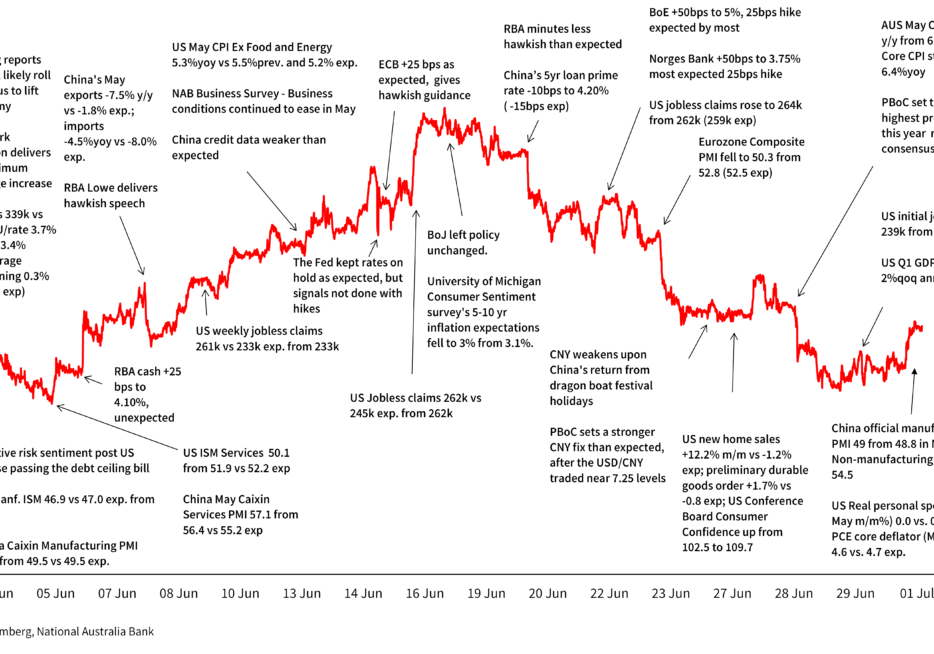

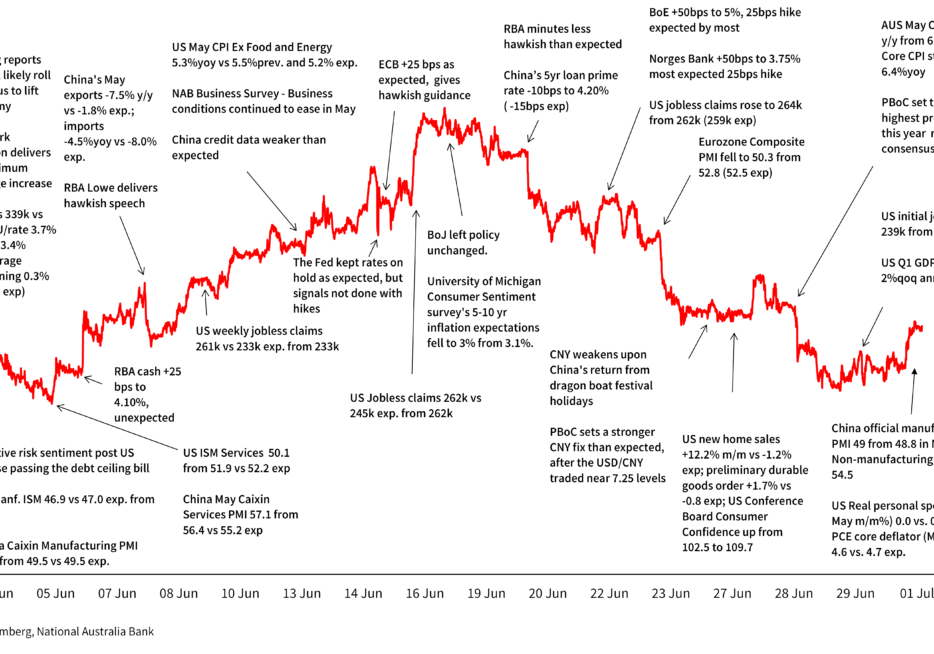

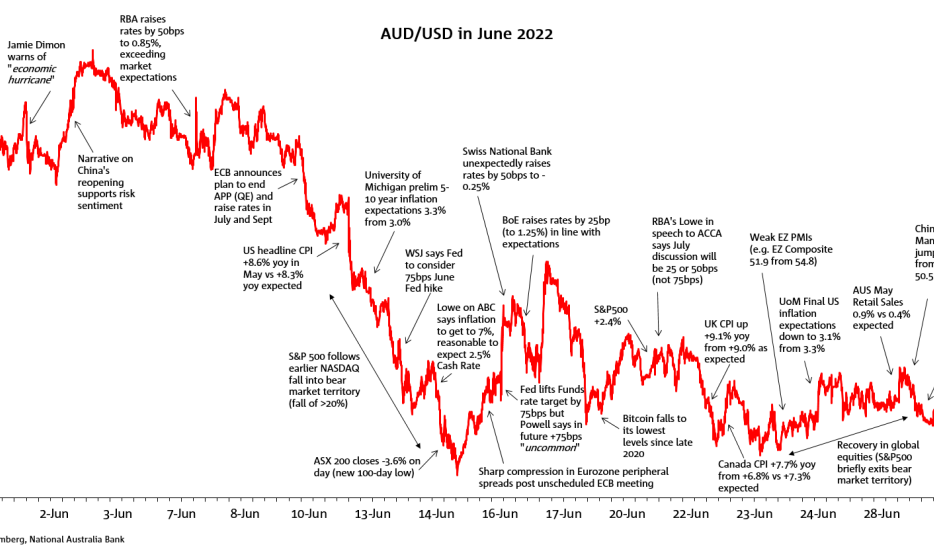

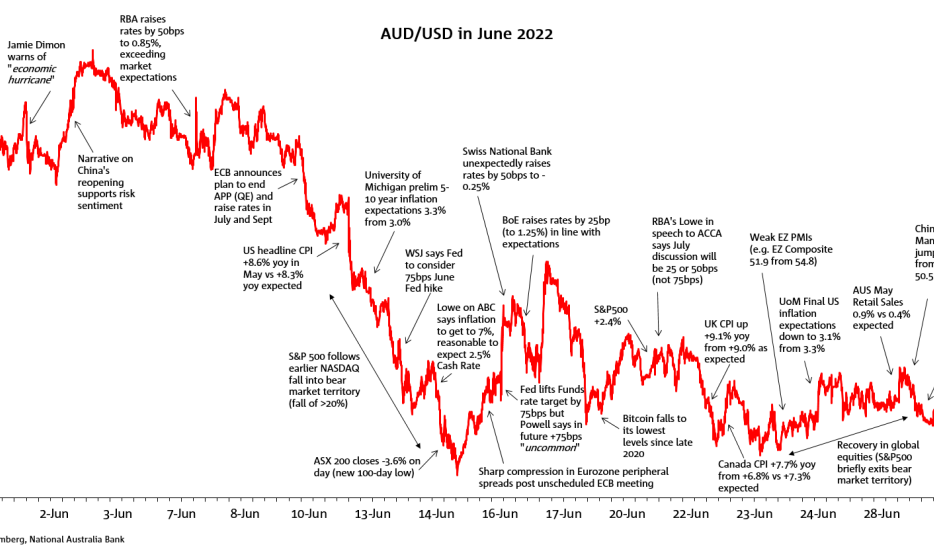

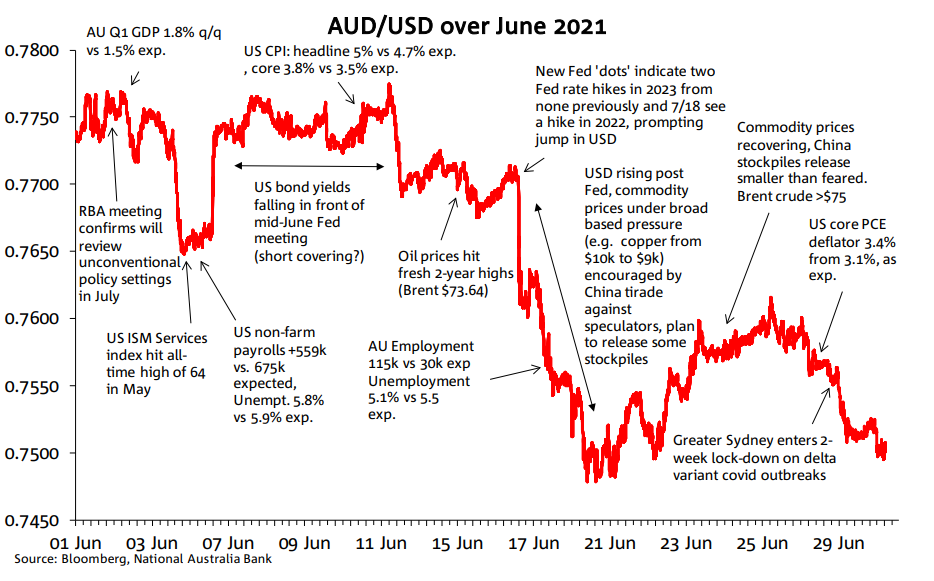

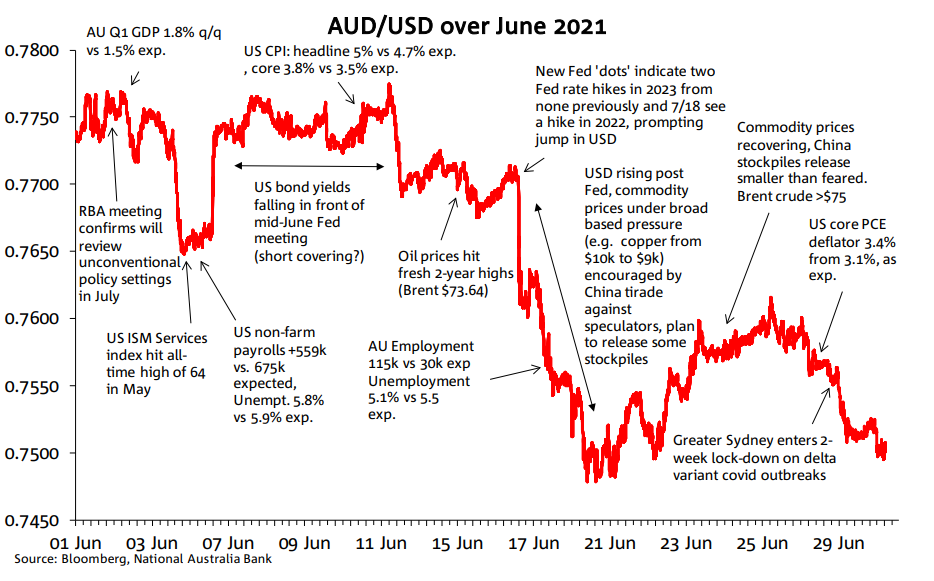

The AUD/USD price action in June was a story of two halves. Soft US data and a cash rate hike by the RBA helped propel the currency to an intra-month high of 69c, but then concerns over China’s growth outlook and better than expected US data releases weighed in the second half of the month.

Friday capped a risk positive end to the week and the month of June with softer US economic data releases treated as good news. Weaker US consumer spending and inflation boosted US equities with gains over 1%, US Treasury yields traded lower after the data release and the USD closed the week broadly weaker.

The string of positive US data surprises continued overnight with a big drop in Jobless claims and a decent upward revision to Q1 GDP. US Treasuries led a jump in core global bond yields and US equities closed in the green, unperturbed by the move up in yields. Positive US data surprises help the USD reverse earlier losses, but the AUD/USD held its ground aided by yesterday’s stronger than expected retail sales figures.

Fed, ECB, BoE heads reiterate hawkish views; BoJ reiterates dovish stance

Better than expected US data releases and hawkish ECB talk are two main macro themes from the price actions overnight. US equities embraced the positive vibes from Asia and then better than expected US data releases provided an additional tail wind. In contrast, European equities were little changed with hawkish ECB talk dampening the mood. The belly of the curve led a rise in UST yields while the USD lost a bit of ground.

This week we examine some possible budget assumptions for Australian growth, inflation, wages, interest rates and the $A for 2023-24 as well as the context, thinking behind and risks to the forecasts

Quiet start to week with no market fall-out from weekend Russia news. Weaker Yuan a focus.

PMIs on Friday showed Eurozone output growth close to stalling, seeing Europe lead yields lower and the euro fall.

The BoE surprises market with 50bps, Norges Bank less so with its 50bps. SNB opts for a ‘hawkish' 25bps

Powell added little new information in House testimony, but the US dollar was weaker and equities were lower. UK CPI data surprised higher ahead of the BoE later today

Soft risk sentiment overall last night which was mostly China driven.

European equity markets have started the new week on the back foot following a negative lead from Asia. Investors are seemingly disappointed by the lack of new news on China’s stimulus, US equities are closed for a holiday with futures contracts pointing to small dips for the S&P 500 and NASDAQ 100.

AUD ends a big if short local week at the top of the G10 currency pile, AUD/USD +2% w/w

US equities have pushed on yet again, shrugging off a string of soft US data releases. The ECB hiked its deposit rate as expected, lifted its inflation forecast and delivered a hawkish guidance. Core European yields climb on the back ECB news with the euro gaining over 1% while soft US data triggers a decline in UST yields with the USD weaker across the board.

Jamie Bonic, Head of FX Investor Sales APAC, and Ray Attrill, Head of FX Research, joined ASFA to discuss the launch of NAB’s Super FX hedging survey.

Fed pauses as expected but ‘dot plot’ adds two, not one, more rate rises to 2023

US CPI was in line with expectations, adding to confidence the FOMC will skip at tomorrow’s meeting even as yields pushed higher. Strong UK labour market saw UK yields surge.

After closing modestly higher on Friday, US equities have started the new week with modest gains, led by big tech. 10y UK Gilts, up 10bps to 4.33%, are the notable movers within core global bond yields on the back of hawkish BoE talk. The USD is a tad higher with AUD retaining its upward trend that has been in place since the start of the month. Oil prices tumble on supply-demand dynamics and another downgrade by GS.

Jump in US jobless claims supports lowers US yields and US$; S&P500 back in bull market

![Markets Today – My [Hikes] Will Go On](https://business.nab.com.au/wp-content/uploads/2023/08/todays-market-update-chart-934x654.png)

The BoC shocked markets overnight, hiking by 25bps to 4.75%.

![Markets Today – My [Hikes] Will Go On](https://business.nab.com.au/wp-content/uploads/2023/08/todays-market-update-chart-934x654.png)

It has been a quiet 24 hours in markets with generally small market movements, while the Australian dollar held onto its gains following yesterday RBA rate hike, 0.8% higher against the US dollar.

Markets go into today’s RBA decision ascribing a roughly 65% chance to a pause

A combination of a US debt ceiling resolution alongside a mixed US jobs report, still favouring a June Fed pause, and news that China may be considering further support to its beleaguered property sector boosted risk sentiment (VIX sub-15), major equity indices closed the week with solid gain.

A positive night for risk sentiment with equities up (S&P500 +1.0%; Eurostoxx50 +0.9%), USD down (DXY -0.7%), and yields lower (US 10yr -3.8bps to 3.60% and 2yr -6.4bps to 4.34%).

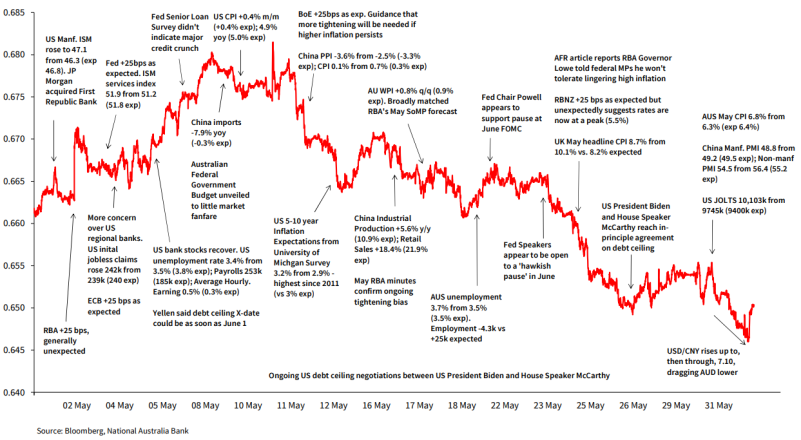

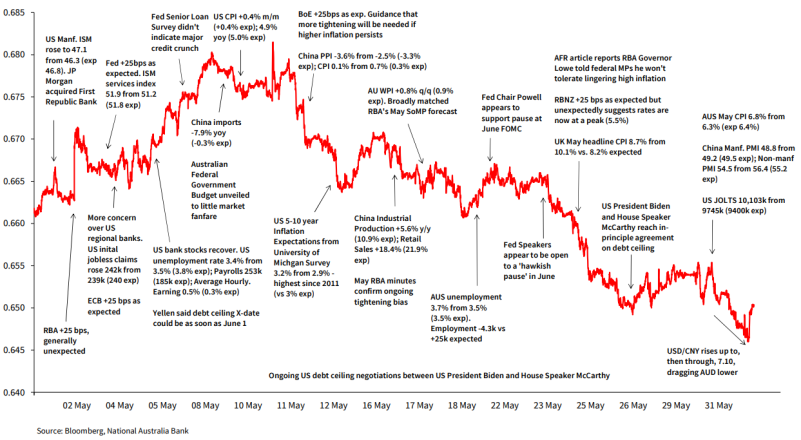

The AUD fell below 65 cents in May, in doing so re-establishing a more ‘normal’ monthly trading range after two months of highly compressed volatility.

The AUD had fallen to a new post November 2022 following more disappointing China data

NAB presents detailed insights into superannuation investment behaviours and trends in our comprehensive survey of Australian Superannuation Funds undertaken every two years and opening again for 2023.

After enjoying a long weekend, the US is back with mixed signals coming from equities and bond markets. US Treasuries have led a move lower in core global bond yields while the S&P 500 is unchanged. Oil prices fall over 4% with OPEC + meeting looming large, the USD is little changed, but AUD and NZD struggle, not helped by Yuan weakness.

Public Holidays in the US, UK and Germany made for a very quiet night as far as market moves are concerned.

US equities were higher on Friday as hopes grew of a debt ceiling deal, ahead of news on the weekend that an agreement in principle had indeed been found. US data was strong and Fed tightening expectations firmed.

The US dollar extended its positive streak and yields globally were higher despite mixed economic data as AI-related tech saw US equites higher

Still no sign of breakthrough on US debt ceiling talks, souring risk sentiment.

The absence of a debt ceiling deal weighs on risk sentiment even as Biden calls talks ‘productive,’ while global PMIs reaffirm the stark divergence between services and goods.

A quiet start to the week with little in the way of significant market moves.

US equities struggled for direction on Friday, ending the day marginally lower. After a choppy session, UST yields closed higher across the curve with the USD broadly weaker, ending a three-day winning streak. Debt impasse did not helping sentiment while Fed Chair Powell expressed a bias for pausing rate hikes in June.

Hopes for a deal on the debt ceiling improved.

A quiet start to the week with little in the way of new news or top-tier data.

Markets were spoked on Friday by an unexpected rise in US consumer inafltion expectations

Latest US yield curve movements are giving an even stronger signal of imminent US recession

US yields were lower and the dollar stronger with the FOMC increasing rates by 25bp as expected and dropping the expectation for further hikes.

Big moves in markets overnight as US regional bank worries reignited, signs of catering in European loan demand, and a sharp fall in US job openings.

US yields are higher and the dollar stronger with little fallout from the failure of First Republic, being acquired by JP Morgan in an FDIC-supported deal.

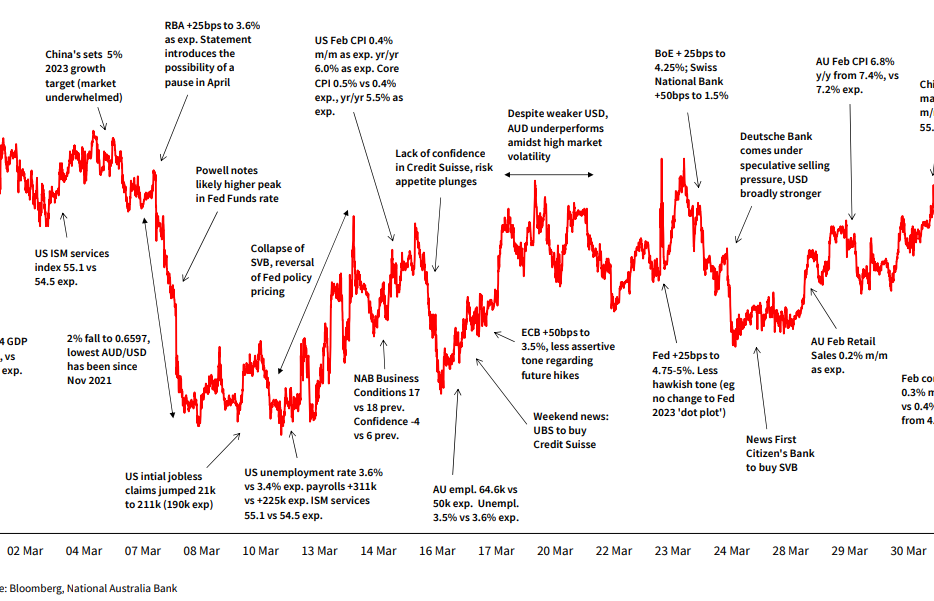

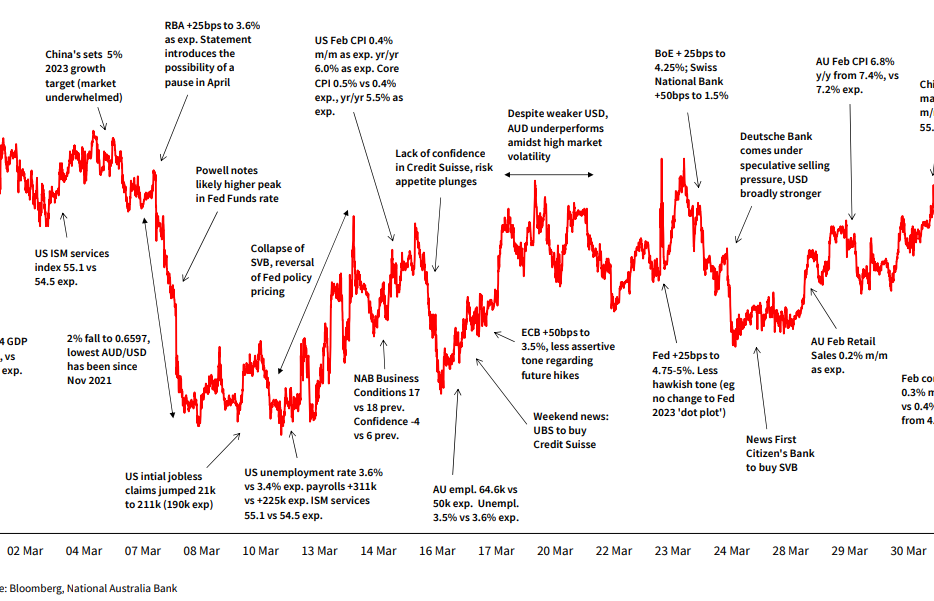

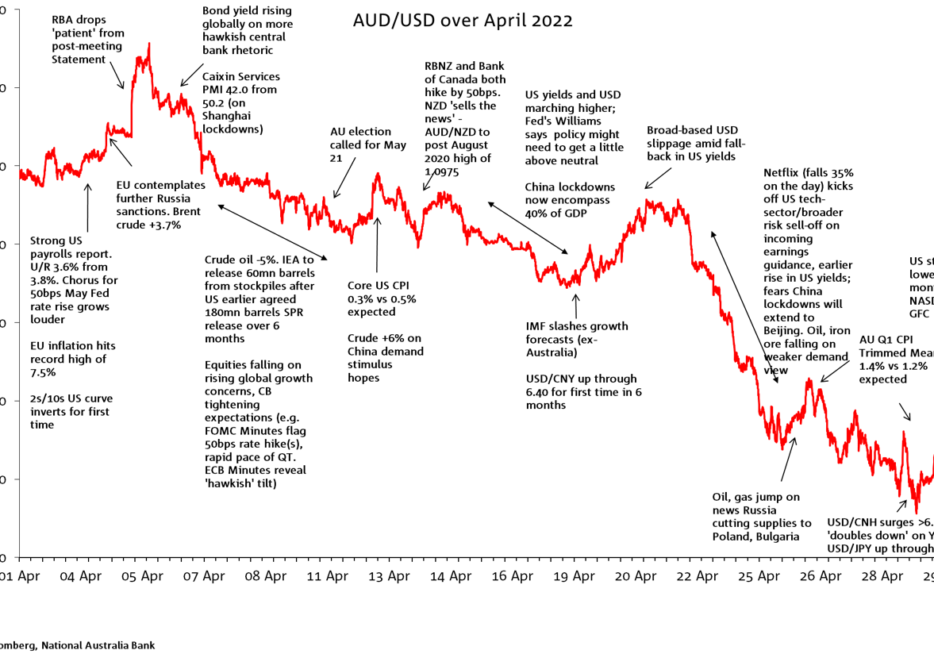

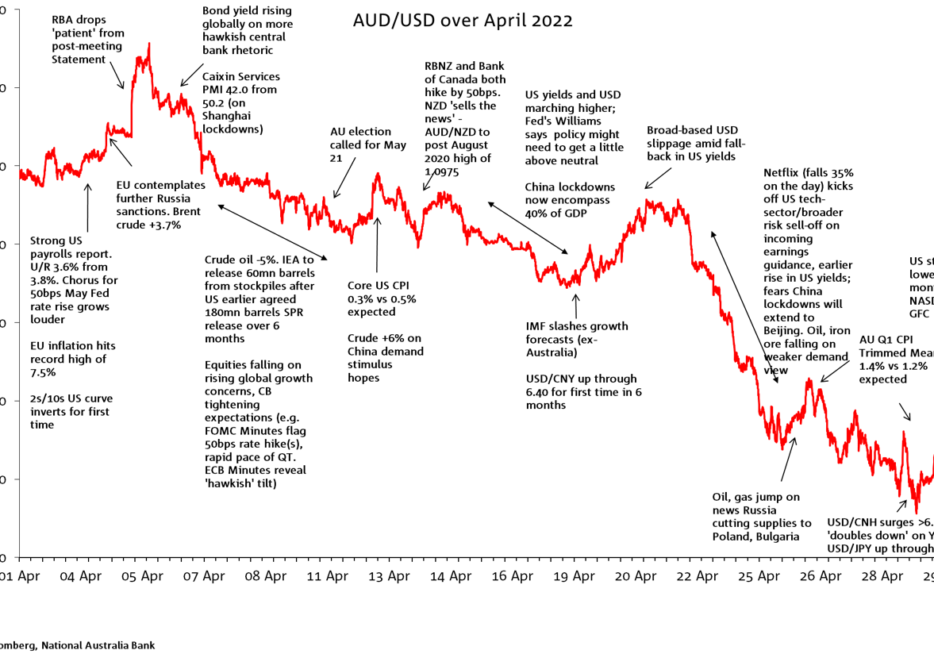

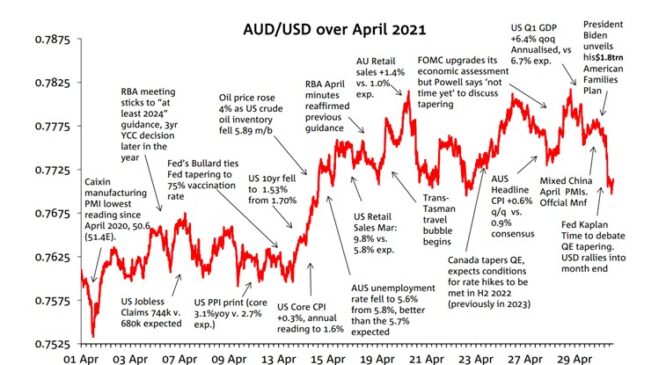

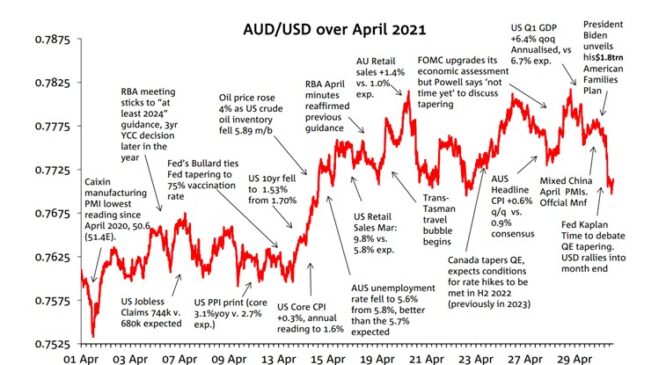

After reducing to just a 2.2 cents range in March, April’s AUD/USD range was little different – 2.3 cents

The last trading day of April had a lot to digest with BoJ policy decision alongside market moving data both in Europe and the US. Equities ended the month on a positive move, core yields drifted lower amid growth concerns while the USD was little changed. JPY was the big underperformer and AUD starts the new week at 0.6601.

Softer US growth but stubbornly sticky prices has seen US yields higher, while US equities recorded their biggest gain since January.

The US share market is split between tech majors, doing well on the back of strong earnings versus Financials (and the rest) which are buffeted by banking uncertainty and recession fears. Core global yields are higher and the USD is weaker largely reflecting EU FX outperformance while the AUD has led a commodity linked FX decline.

Us equities haven fallen sharply, bond yields are lower and AUD/USD is back near 0.66, ahead of CPI this morning.

A quiet end to a choppy week, with some intra-day volatility following stronger than expected PMIs.

Weaker second-tier US data has helped push global yields lower, while disappointing earnings by Tesla (-9.7%) and talk of margin compression dragged down equities.

The RBA ‘Fit for the future’ review out this morning, with media saying Treasurer Chalmers accepts all 51 recommendations

A quiet overnight session despite the plethora of earnings reports.

The uplift in US bond yields continued overnight, supporting the US dollar but not hurting equities

Stronger than expected US data pushed US yields higher and supported a broadly stronger US dollar on Friday.

Todays podcast Soft US PPI helps drive a risk-on rally Adds to views the US Fed is almost done USD falls, and AUD and NZD outperform Yields mixed, equities up ahead of earnings Coming up: US Retail Sales, US Bank Earnings “Love is in the air, everywhere I look around; Love is in the air, […]

US treasuries retraced most of their post-CPI rally overnight with core CPI coming in as expected.

It was a quiet session overnight ahead of key risk events later in the week (US CPI is on Wednesday and bank earnings are on Friday, including Wells Fargo, Citigroup and JP Morgan).

A softer than expected JOLT report shook the market overnight, triggering a bull steeping in the UST. The USD fell with JPY along with European currencies outperforming. Commodity linked currencies lagged the move with AUD the notable underperformer, following yesterday’s RBA decision to pause it tightening cycle. US equities ended a four day rally with pro-cyclical sectors underperforming.

Weak US Manufacturing survey data overnight reversed the impact of higher oil prices, leaving bond yields lower and the AUD higher. It’s all about the RBA today

A NAB panel explores the practical implications involved for superannuation funds in their net zero investment ambitions.

Report

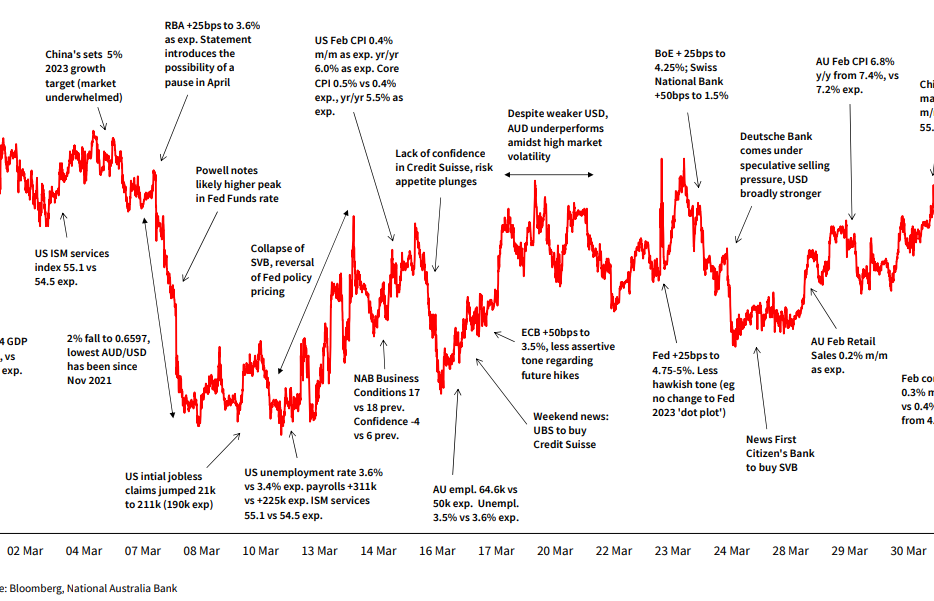

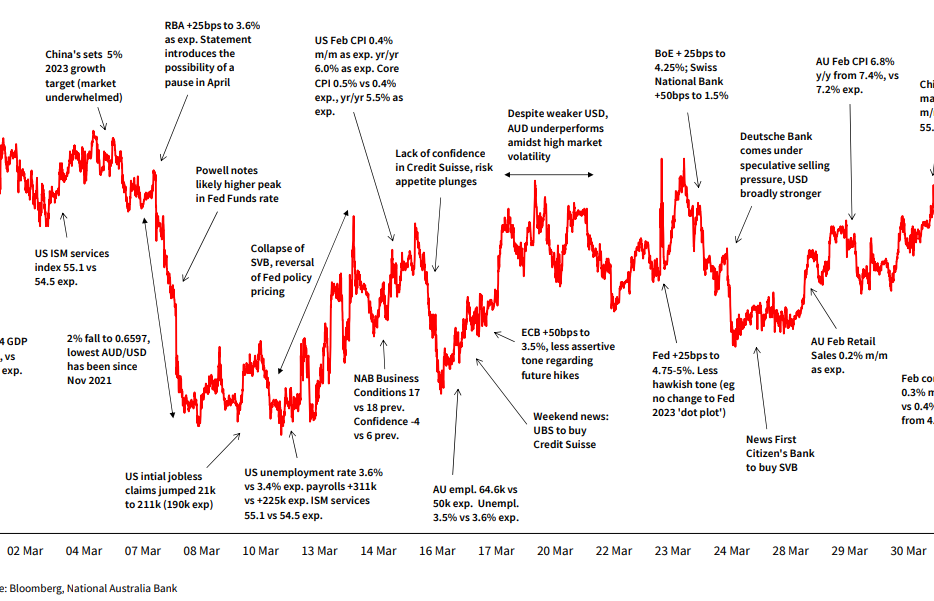

Following two months of well above-average ranges, the AUD/USD range reduced to just 2.2 cents in March, though the currency did hit a 4-month low of 0.6565.

A softer than expected US Core PCE Deflator (0.3% m/m vs. 0.4% expected) helped push yields lower on Friday (US 10yr -8.1bps to 3.47%).

It’s a third successive day of relative calm across markets, though an upside surprise to German CPI has seen European yields push higher.

The positive vibes evident during our trading session yesterday have extended overnight with European and US equity indices higher on the day. Movements in rates and FX markets have been more subdued. The USD is a tad stronger in index terms with JPY the notable underperformer. AUD and NZD are also lower with the former not helped by a yesterday’s softer than expected monthly CPI print.

There has been little top-level news flow over the past 24 hours, which has seen markets relatively calm by the standards of recent weeks.

Bond yields are sharply higher overnight, improved sentiment towards the banking sector one key driver

Deutsche Bank woes weighted on European equities and on US equities at the open, but the latter enjoyed a decent rebound before the close. Core global yields ended Friday lower across the board , the USD was broadly stronger , but still fell for a third consecutive week, AUD and NZD were the week’s underperformers.

After a positive start, US equities struggled for direction amid lingering banking stability concerns. Front end tenors have led a decline in UST yields with similar price action seen in European curves. BoE, SNB and Norges Bank deliver on expected rate hikes. AUD gives back earlier gains as equities struggle.

The FOMC hiked rates by 25bps to 4.75-5.00%, continued QT, and kept the existing dot plot which pencils in one further hike to 5.00-5.25%. Market reaction was dovish, but was not risk on.

Todays podcast VIX tumbles as investors see the glass half full ahead of FOMC early tomorrow morning Banks lead gains in Equities with HG bond issuance also signalling improvement in risk appetite UST and Bund curves bear flatten as market increases Fed and ECB rate hikes expectations 2y UST jump 20bps, 10y UST gain […]

It was another fairly volatile day following the weekend deal for UBS to buy Credit Suisse, though overall the deal seems to have found some cautious acceptance.

A deal was struck over the weekend that sees UBS buying Credit Suisse for CHF3.0bn, a fraction of its value at Friday’s close. Iitial market response, in FX at least, has been (cautiously) favourable.

The ECB delivered on its 50bps rate promise but scraps forward guidance. Meanwhile the US’ First Republic Bank gets a $30bn deposit injection from other banks

Banking sector turmoil is back to the fore driving all markets, today centred on Credit Suisse.

Bond yields rose sharply on the developing assessment of turmoil in US banking, helped by but largely overshadowing a stubbornly strong US CPI.

Reassurances from US authorities not enough yet to appease markets. Bank stocks remain under pressure with bond yields diving as the path of future Fed hikes comes into question. The USD is also weaker across the board.

The collapse of SVB, the 16th largest bank in the US with $209bn in assets (as at 31 Dec 2022), shook markets on Thursday and Friday. That

Jump in US jobless claims provides hope US labour market may be cooling while Challenger layoff data suggests there is more weakness ahead Softer US data triggers rally in UST and weakens the USD. AUD struggles to perform as US equities tumble with bank stocks leading the decline.

Markets broadly held onto Tuesday’s wild moves, which were driven by US Fed Chair Powell’s Senate Testimony. Overnight Powell spoke again to the House.

The market was not prepared for Powell’s hawkish remarks, sending short rates and the USD higher and equities lower.

Hawkish comments from ECB’s Holzmann send European yields higher in an otherwise quiet night for news flow

The US dollar and Treasury yields both fell back on Friday in what was a good day for equities everywhere – except Australia.

The run of worse than expected (global) inflation-related news continues to ripple through markets, the latest culprits being core Eurozone CPI and revised US Q4 unit labour costs.

The US 10yr finally breached 4.00% for the first time since November, following five days of resistance. A hot German CPI and renewed price pressure in the Manufacturing ISM drove, while risk assets were mixed given the strong China PMIs yesterday

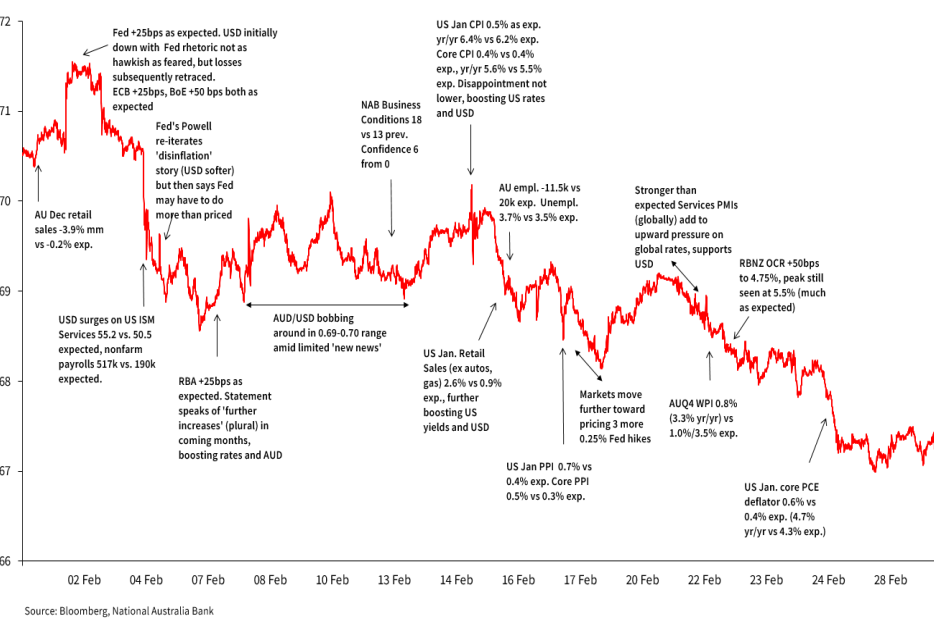

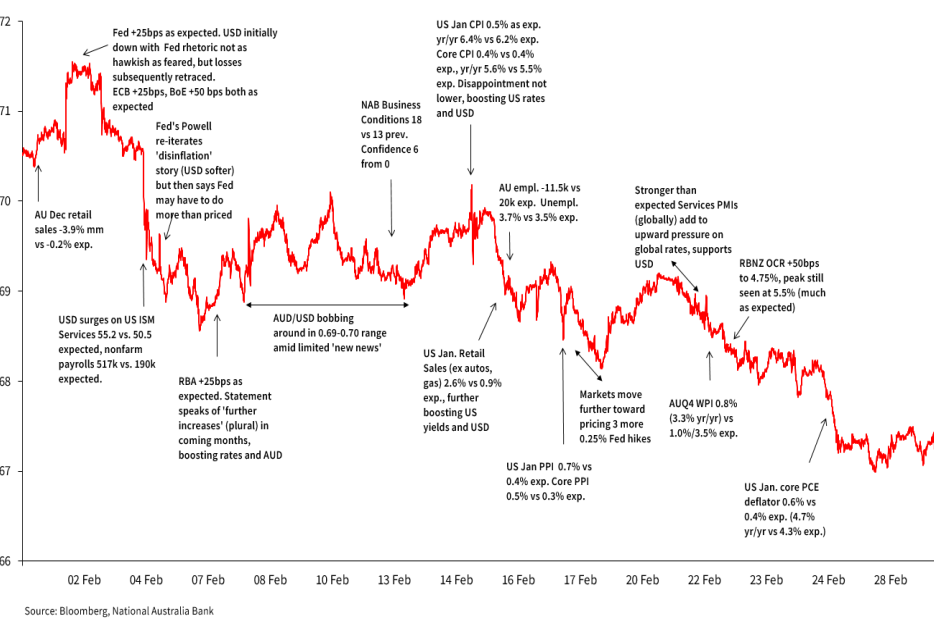

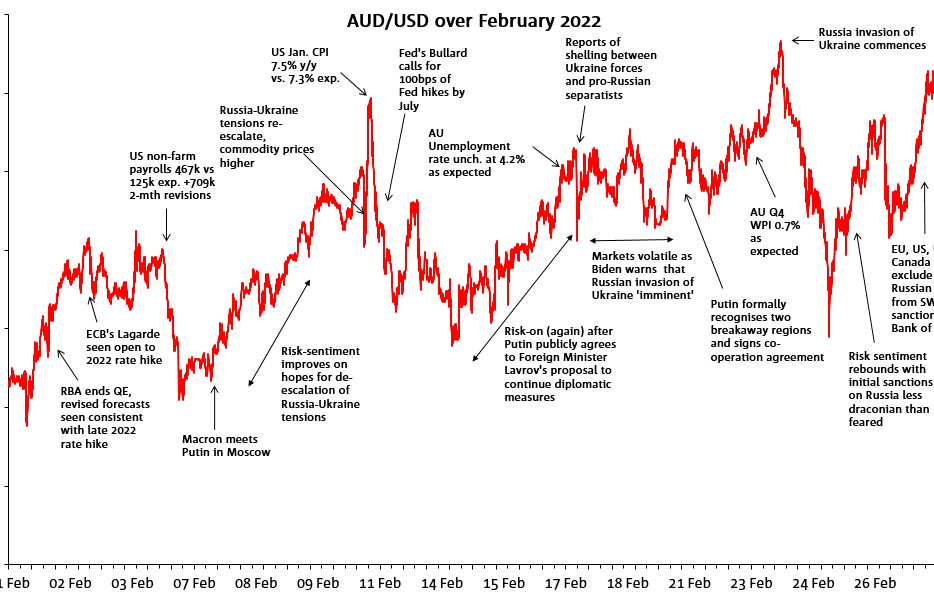

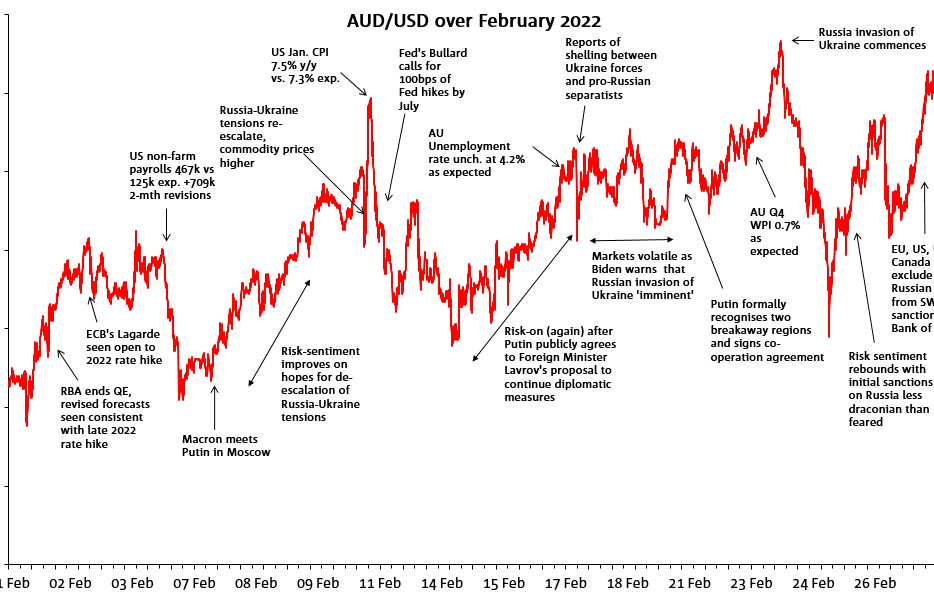

AUD performance in February was an almost exact mirror image of January, AUD/USD trading back down to near 67 cents from above 0.71 cents, having risen from sub-0.67 to above 0.71 in January.

Upside surprises to European inflation out of Spain and France have seen ECB pricing and European yields push higher, with some bleed through into the US. Elsewhere, US equities are little changed, shrugging off soft consumer confidence data, but are and on track for a monthly decline of more than 2%.

A quiet start to the week with no top-tier data. The biggest piece of news was the EU and UK agreeing to a new Northern Ireland trade agreement, now termed the Windsor Agreement.

The US economy has started 2023 from a stronger position that many of us had expected and when looking at the Fed’s new preferred inflation reading that tries to exclude much of the noise in the data, the story doesn’t change.

US equities stage a late recovery, but remain edgy

The flow of economic data surprises has continued overnight and this time it was a uniformly stronger than expected performance of the services sector across major Developed Market economies.

NAB researchers have undertaken a detailed review of a large sample of the portfolio holdings disclosure (PHD) data made available in 2022 under regulatory changes for the industry.

Report

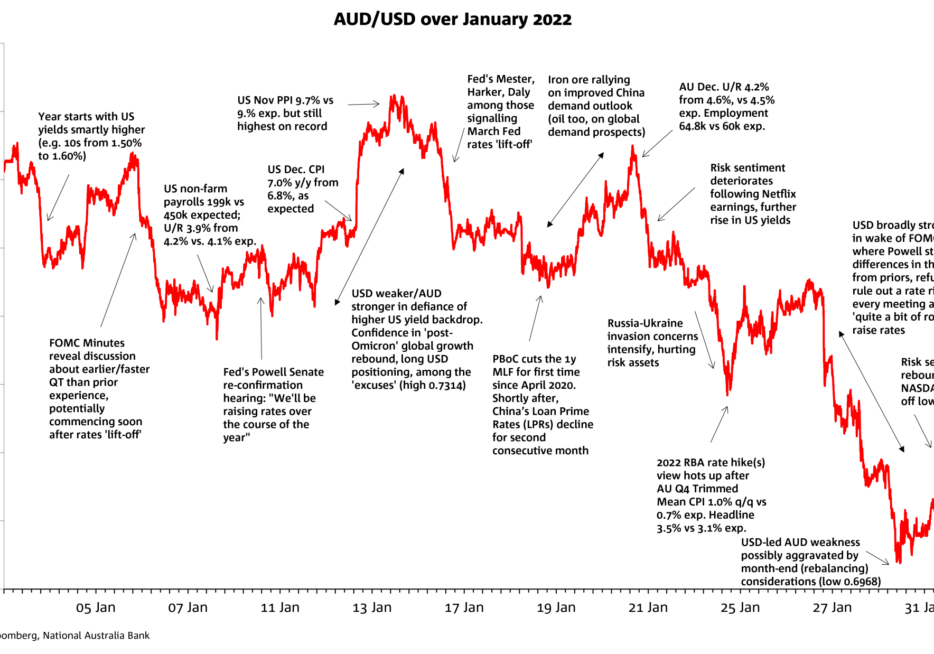

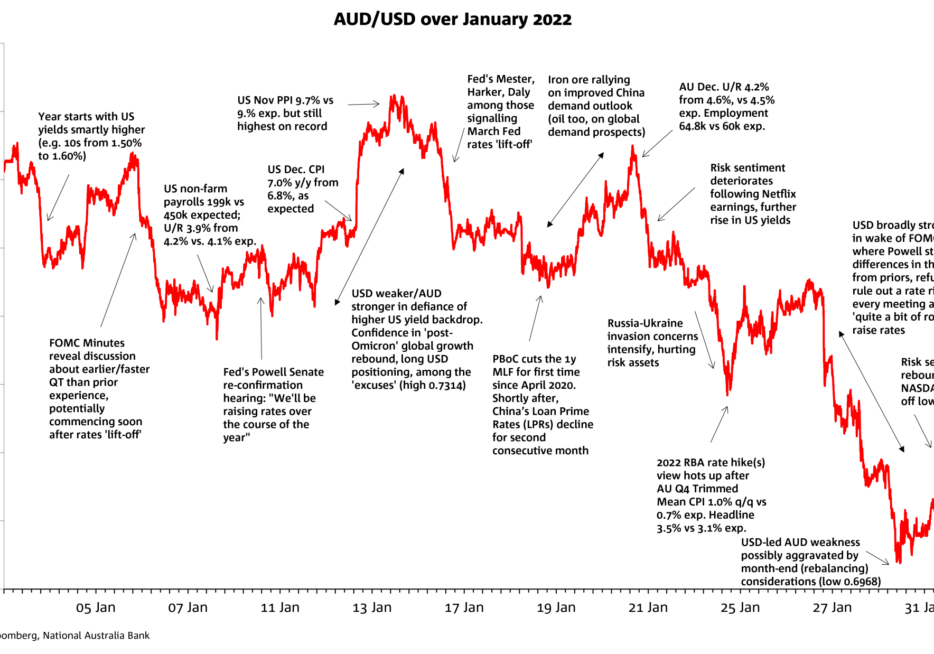

AUD/USD began the year at 0.6802 and ended January at 0.7056, a 2.5 cents or 3.7% gain.

Since Australia Day the two biggest pieces of news were the BoC explicitly signalling a pause to the hiking cycle on Wednesday after hiking by 25bps, and US Q4 GDP which although beating expectations had a soft underbelly (2.9% annualised vs. 2.6% expected; but private domestic just 0.2%).

European and US PMIs were the main data flow overnight.

Tech stocks lead gains in US equities. NASDAQ up just under 2%.

5% Netflix post-earnings pop helps drive best day for S&P500 in two weeks

USD softer despite ‘risk-off’ market tone.

Very weak US retail and industrial production adds to the tumble in yields

As the market waits for the BoJ policy decision today, the ECB has been the market mover overnight following a Bloomberg source story suggesting the Bank may be turning less hawkish.

US out for MLK day holiday. S&P futures little changed

US equities managed to claw back into the green on Friday to extend the strong start to the year.

US CPI cools as expected, but with even more encouraging details.

Ahead of CPI tonight US Treasuries (and bonds globally) have rallied, 10-year US notes off 5bps (3bps of that seen in the Tokyo session) and 2s down just under 2bps.

Economic news flow overnight has been relatively light, though playing with the grain of the suggestion from last week’s US data (ISM Services) that the US is in process of losing its global growth leadership position.

BoJ stuns markets with a 0% YCC tolerance band widening…

AUD/USD ended Dec 2022 much as it started. For 2022 overall, AUD/USD lost 6.2% which was the the second biggest annual range of the past decade, exceeded only in the 2020 first year of the Covid-19 pandemic.

The BoJ thus takes out our award for the most unpredictable central bank of 2022.

Equity sentiment has not been helped by a decent sell-off in core global bonds.

Recession risks were highlighted on Friday with the US S&P Global Services PMI again in contractionary territory.

Hawkish ECB rhetoric post 50bps rate rise spooks risk markets

Early this morning and in line with market expectations the Fed lifted the funds rate by 0.5% to a range between 4.25% and 4.5%, a rates level not seen since 2007. The 50bps increase was a downshift following four consecutive hikes of 75bps.

CPI comes in cool at 0.1% m/m and 7.1% y/y, two tenths below consensus

A distinctly cautious air prevails in front of tonight’s all-important US CPI release and tomorrow’s FOMC.

Solid US PPI cements apprehension ahead of the US CPI & FOMC

It was a quiet night for markets devoid of any top-tier data or news flow ahead of key risk events next week (of US CPI, FOMC, ECB).

The Bank of Canada rose 50bps, the sixth consecutive increase, and took the target rate to 4.25%.

The RBA increased interest rates by 25bp to 3.1% and continues to guide that “the Board expects to increase interest rates further over the period ahead".

WSJ’s Fed Whisperer Nick Timiraos wrote overnight if CPI on Tuesday comes in hot then the Fed could consider another 50bp increase in February.

The dollar was softer and US yields lower over the past week as markets both pared terminal rate pricing and priced in more cuts from mid 2023.

Markets hold, and more importantly extend yesterday’s post-Powell moves.

The AUD ended the month in the ascendency, boosted by a less hawkish than feared Fed Chair Powell speech, forcing a broad USD retreat.

Markets were relatively muted ahead of Powell’s remarks with US yields and the Dollar were tracking a little higher and equities a little weaker.

China vaccination push sees Hang Seng gains extended to 5%+ by the close

In a quitter session, relative to recent times, the risk positive vibes have extended into a third consecutive day with higher global equity markets, lower global rates and a weaker USD.

The single biggest piece of market-moving economic news overnight has come via the US S&P Global PMIs, which slumped to 47.6 from 50.4, well below the 50.0 consensus.

US equity investors are certainly looking at the glass half full ahead of Thanksgiving tomorrow with all major equity indices showing decent gains on the day.

Oil market volatility is showing no signs of let-up , Brent crude down to a low of $83 overnight on a Wall Street Journal report suggesting Saudi Arabia was contemplating a 500,000 barrels per day production increase from December.

Latest Fed speak from Boston Fed President Collins, suggests 75bps is still in play for December, noting markets price around 52bps for the December meeting.

US yields are higher and the dollar stronger in a modest and reversal of some of last week’s post CPI moves as Fed speakers remain stubborn that rates will continue to go higher to get to a level that is sufficiently restrictive.

Fed speakers were clear that a pause is not imminent and there is more to do, even as they may move at a slower pace, while stronger US retail sales numbers showed resilience in spending, providing some small counter to the burst of optimism after softer-than-expected US inflation data last week.

It has been a wild night in markets. After initially enjoying a broad and solid risk on move with equity markets rising and core global bond yields falling alongside a broadly weaker USD

The new week has begun with a small reversal in the some of the risk positive moves recorded last week, particularly in FX markets and US Treasuries while equity market are showing resilience.

US CPI, US political gridlock (maybe) and China covid policy tweaks...

It has been a super risk positive night courtesy of a big downward surprise in the US CPI release.

Republican ‘red wave’ failed to materialise, but still expect slim House majority

The NAB Business Survey showed Conditions falling just one point to +22 to remain at very elevated levels, above the pre-pandemic highs for the series.

Speculation about China reopening continues to add some market volatility with WSJ reporting Chinese leaders were considering reopening steps getting some notice.

Risk appetite soared on Friday as Chinese whispers swept markets last week that China had put together a ‘conditional re-opening plan’, reportedly mapping out a material re-opening by March 2023.

Wednesday’s FOMC meeting continues to reverberate through markets.

FOMC Statement hints at reduced pace of tightening ahead…

It has been a volatile session in markets with risk assets initially lifted by rumours China was looking at phasing out its zero-covid policy, only for Beijing to later deny the speculation.

Australia specific influences on AUD once again played second fiddle to broader USD volatility and swings in risk sentiment.

NAB has pencilled in a 25bp hike, we also think there is a real risk that the RBA hikes by 50bps, and that this risk is higher than the 22% chance that markets are currently pricing.

Big gains in US equities on Friday help extend rally for a second week

The ECB meeting was the big event for markets last night and as expected the Bank delivered a 75bps hike, but it sounded less committal on future rate hikes.

Yields are generally lower globally as the earlier run up in expectations for central bank tightening are pared a little further. A hike of ‘only’ 50bp from the BoC helping that sentiment.

Last night’s first Federal Budget under Labor Treasurer Jim Chalmers contained no fireworks, falling fully in line with pre-Budget media briefings.

The UK has a new PM in Rishi Sunak, and gilts have rallied in response. UK 10yr gilt yields were 31bp lower at 3.75%. That’s 90bp off their peak of 4.64%, but still about 60bp above their level before the Truss Premiership.

Friday’s offshore markets produced as many fireworks as we have seen on just about any day this year with the mere suggestion of the Fed stepping down from 75bps to a 50bps incremental rate hike in December producing a fierce rally in US equities.

Terminal Fed Funds pricing have lifted to 5.00% by March 2023 from 4.92% last week and continue to price a 75bp hike at the upcoming November FOMC meeting and a 75% chance of a follow up 75bp at the December meeting.

Yields rose to fresh cycle highs and risk appetite soured. US equities were lower, halting a 2-day rally despite relatively upbeat earnings from the likes of Netflix and United Airlines.

The selloff in bonds has seen a ‘reversal of the reversal’.

Another big UK fiscal U-turn and positive earnings from BofA boosted global risk appetite last night.

Rise in 1y ahead US inflation expectations spooks markets

Volatile overnight session sees risk on, risk off then risk on again

UK markets remain at the epicentre of global market volatility

Bailey in Washington says bond purchases will end as scheduled on Friday

Risk aversion has dominated the start of the new week amid heighted geopolitical tensions and a market disillusioned by credible BoE support for the Gilts market.

It was ‘good news is bad news’ for US Payrolls which were a touch better than expected and seen as too solid to support a pivot narrative.

In Australia there are two macro developments worth watching, Seek new job ads and Consumption imports in the August trade balance.

Another volatile session in markets; US equities opened lower, not helped by anticipated news of a bigger oil cut supply agreement by OPEC +.

Yesterday 25bps RBA cash rate rise, defied the broad consensus among economists and investors (~45bps was priced in for the meeting) but which was justified by the Board in part on the premise that “the cash rate has been increased substantially in a short period of time”.

The AUD/USD high of 0.6916 came on the 13th and the low of 0.6363 on the 29th (last day of the month).

A surprise U-turn by the UK government on the fiscal package and a weaker than expected US ISM Manufacturing (50.9 vs. 52.0 expected) have driven a large fall in global yields.

US equites fall on Friday to close out a 3rd consecutive negative quarter

In a positive development the OBR will provide preliminary costings of the UK’s fiscal package on 7 October, instead of the previously signalled deadline of November 23 (the same day as the Budget).

Bank of England has pledged to buy up to £5bn of longer dated gilts each day for up to 13 days (£65bn total) with a motive of protecting the UK pension industry.

UK rates continue to push higher

Fallout from UK mini-budget continues.

Epicentre of current market turmoil shifts across the Atlantic to UK on Friday

BoE, SNB and Norges Bank follow the Fed’s +75bps with 50bps, 75bps, 50bps respectively

Fed hikes 75bps as expected, looks for 125bps in ’22 then 25bps more in ‘23

A sourer tone took hold over the past 24 hours, with equities lower and haven currencies, including the dollar, stronger.

US yields continued to push higher ahead of the FOMC

Last week will be marked out as one of the more tumultuous for financial markets since the early days of the pandemic, says NAB's Ray Attrill.

Volatility has come roaring back in Thursday’s offshore session.

After recording hefty losses post the US CPI release on Tuesday, US equity markets closed with modest gains.

Today’s podcast Overview Rumours of inflation’s demise much exaggerated US CPI shocks to the upside: stocks, bonds take fright USD bounces back, AUD and NZD both down by more than 2% Next week’s Fed debate now seen to be between 75 and 100bps (83bps priced) German ZEW survey readings slumps while US NFIB Business Optimism […]

Positive risk sentiment ahead of US CPI tonight.

Risk appetite improves despite hawkish Fed talk

It has been all about the ECB and Fed overnight with the former delivering a jumbo hike and hinting at more to come while Fed Chair Powell reiterates commitment to act forcefully against inflation

A volatile night where earlier price action in Asia was largely reversed.

A broad rise in core global yields has been the big news overnight, fuelled by a better-than-expected US ISM report and news UK PM Truss is planning a huge debt-funded fiscal stimulus.

Eurozone bonds yields and stocks falling on the latest jump in energy prices – both oil and gas – following confirmation the NordSteeam1 gas pipeline will remain shut while Russian sanctions are in place.

A goldilocks payrolls report failed to support risk assets on Friday, with equities and the USD quickly reversing on news that Russia was not restarting gas flows through the Nord Stream pipeline

The AUD/USD spent August oscillating around the 70 US cents mark but spent much more time below than above.

The bond sell-off shows no signs of abating with a stronger than expected US ISM Manufacturing helping to drive the US 10yr yield up.

We'll help you find the right foreign exchange risk management strategy by understanding your core business and the challenges you face every day.

August has been a terrible month for balance fund investors with no diversification gains from holding a portfolio of equities and bonds.

Goldman’s noted inflation could hit 22.4% y/y in the UK in early 2023 if gas prices don’t moderate and if there is little in the way of cost of living relief.

Following a negative lead from Asia, US and EU equities have begun the new week on the back foot.

After clocking 5.5 million podcast plays and 15,000 daily listeners, NAB’s Morning Call is celebrating six years of market highlights, with even more expert analysis to come.

Podcast

Fed chair Jay Powell’s address to the Kansas Fed’s Jackson Hole Symposium on Friday was short and as far as equity market investors were concerned, bitter not sweet.

Another day spent in anticipation of Powell’s speech tonight

Another night devoid of top-tier data or news flow. The past week has been a bit like Waiting for Godot with markets apprehensive ahead of US Fed Chair Powell’s Jackson Hole speech on Friday.

Composite PMI sub-50 everywhere in the world bar UK; US worst of all.

Markets are apprehensive ahead of US Fed Chair Powell’s Jackson Hole speech on Friday

NAB's Rodrigo Catril says the Canadians are out shopping; we also saw a big increase in purchase prices in Germany, in fact the largest monthly rise since 1949.

Following yesterday’s FOMC Minutes overnight we’ve heard from FOMC members wanting the Funds Rate up to 3.75-4.0% this year and questioning why you’d want to drag rate rises out into next year.

In Australia, wages data for the 3 months to May disappointed most forecasters, though the result was in line with the RBA August SoMP (and NAB) forecast.

This week we expand on the hot inflation reads seen in the NAB Business Survey and what this may mean for CPI pressures in Australia, particularly for Q3.

After a negative start, US equities managed to end the day in positive territory supported by better than expected earnings reports from retailers.

Oil prices have fallen to their lowest since early February 2022 with falls of around 4% in part due to weaker China demand.

Equities continued their relentless rise, brushing off the inflation expectations data and hawkish Fed rhetoric

The San Francisco Fed’s Mary Daly warned it is too early to ‘declare victory’ over inflation.

It was all about US CPI overnight with markets reacting sharply to a lower than expected print with Equity and FX markets taking the CPI miss as a positive signal, taking some pressure off the Fed and a sign that inflation has peaked.

There was no let-up in elevated price pressures in the July NAB Business Survey published yesterday, with price indicators accelerating further from the already record highs of recent months.

China is continuing its military drills around Taiwan, but that hasn’t impacted markets apart from gold (+0.7% to 1,787.61) retaining some slight geopolitical risk premium.

An all-round stronger than expected US employment report Friday dominated the end-of-week market price action; whether they extend or at least partially reverse this week hinges in large part on Wednesday’s US July CPI data.

As widely expected, the BoE lifted the cash rate by 50bps and retained the option to act forcefully in the future, the Bank now officially sees a recession in the horizon.

A few hours on from Nancy Pelosi leaving Taiwan and markets have almost forgotten she ever came. Equity market have recovered their poise, a tech sector rally seeing the NASDAQ close at its highest level since 4 May.

In Australia, the RBA met yesterday and raised the official cash rate by 50bps to 1.85% as expected, the third consecutive 50bps increase to be at its highest level since April 2016.

The AUD/USD opened the month at 0.6903, fell to its monthly low of 0.6682 on July 14 and made a high of 0.7032 on July 29 before closing the month at 0.6985.

Data releases over the past 24 hours have provided further evidence the global economy is slowing. China’s Caixin Manufacturing PMI confirmed that China’s reopening rebound is over.

US economic data on Friday underscored the inflation challenge facing the Fed

ECB’s Visco says “there is a risk of a recession” and that ECB policy can’t drive down gas prices.

The Fed delivered a unanimous 75bp hike as widely anticipated.

More price increases are likely for food and grocery. If they continue to rise in Q3 and Q4, it is hard to see US core inflation numbers moderate sufficiently for the Fed to pivot.

Kremlin confirms 20% cut of gas to Europe from Wednesday. Gas up 9%

A round of softer than expected PMIs on Friday added further fuel to ongoing concerns over a global economic slowdown with the move into contractionary mode for both the EuroZone composite and US Services PMIs the main culprits.

The ECB hiked rates by a more-than-expected 50bps, taking the deposit rate back to 0% and ending its negative interest rate policy that has been in place since 2014

Draghi’s government looks set to fall after three key parties failed to support him in a confidence vote which could complicate the ECB plans to deliver details on its new anti-fragmentation tool.

ECB now seen hiking by 50bps tomorrow and then again in September

Oil is the standout mover, Brent +$4.50 and WTI crude +$4.60 on reports Saudi Arabia won’t be pumping any more oil

Risk sentiment rallied on Friday with a better than expected US retail sales print and positive earnings from Citigroup lifting equities

Australian employment data yesterday was showed a tighter labour market than the RBA had been expecting with the unemployment rate plummeting four tenths to 3.5% , a new 48-year low.

Bank of Canada surprises with ‘front-loaded’ 100bps rate rise

Risk off again overnight as recession fears intensify

Risk off ahead of a big week for data, partly driven mainly by China virus news

US June non-farm payroll employment 372k vs. 265k expected.

Risk sentiment improved over the past 24 hours.

Higher US yields together with a further drop in the EUR sees the USD in DXY terms now at its highest since September 2002.

Brent oil prices are down 17% since 14 June and have the potential to drive some welcome relief on headline inflation prints.

Europe remains stuck in the middle between the Russia/Ukraine crisis and a weakening global economy

After a dismal first half, US equities start H2-22 with a positive tone

The AUD/USD opened the month at 0.7170, made a high of 0.7283 on June 3 and fell to its monthly low of 0.6851 on June 15.

Core global yields have been the big market movers overnight with European bonds leading the decline in yields.

Weaker US consumer confidence dents equities

US equity markets have begun the new week on the back foot with a clear lack of conviction.

It was a great day for US stocks on Friday, with two-thirds of the mid-month sell-off now retraced.

Despite softer PMIs and still-hawkish messaging from the Fed, US equities managed to turn around intraday.

Recession or hard landing fears have taken a firmer hold on most markets in the past 24 hours.

Some relief in equities with a strong bounce back from last week’s decline

The RBA is front and centre in local markets this morning.

US and European equities showed signs of stabilisation on Friday, but still ended with sharp declines on the week which was not helped by Fed Chair Powell's words that the Fed has unconditional commitment to restoring price stability.

The Bank of England rose rate by 25bps and left its options wide open on future moves

Fed delivers 75bps rate rise, sees 50 or 75 most likely at next meeting

Ahead of tomorrow's FOMC meeting we have seen an increase in market volatility across Equity, Rates and FX.

A hot US CPI report and signs of inflation expectations de-anchoring on Friday has seen yields surge, risk assets sell off, and recession talk rise.

Announcing the end of the Asset Purchase Programme (APP) as of July 1, the ECB also pre-announced a 25bps rise in interest rates out of its July meeting with a further rise planned out of the Sept meeting.

Rise in oil prices fuels inflationary concerns and the need for central banks to increase their hawkishness.

RBA surprises (most) for second month running with 50bps Cash Rate rise to 0.85%

Yields rose notably in what was a quiet night for data and events.

Markets took the strong US payroll gains on Friday as affirming the near-term path for continued Fed tightening.

A positive day for risk sentiment ahead of US Payrolls tonight on no new news

Reaction to a strong set of US data releases has been the main story overnight

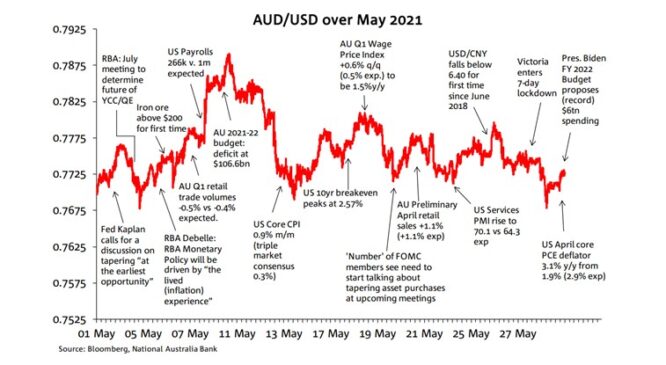

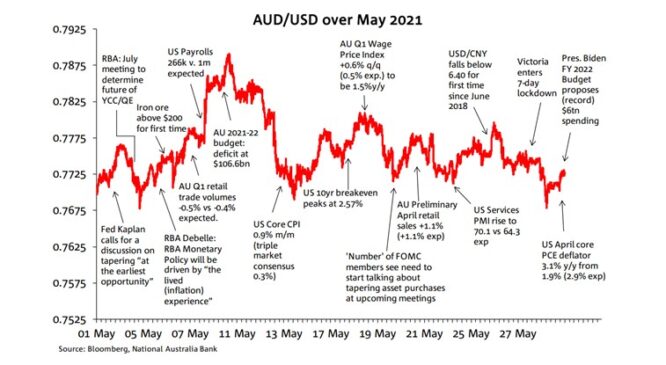

AUD/USD hit a near two-year low of 0.6829 on May 13 after hitting its highest May prints earlier in the month (0.7266, seen on both May 4 and 5).

Inflation is back in focus with European inflation at its highest ever level of 8.1% y/y helping rates extend yesterday’s selloff.

Brent oil recorded its 8-consecutive day of price increases, supported by expectations of a China reopening in addition to the expected EU Russian oil ban.

After having moved briefly into bear market territory the previous Friday, last Friday saw the S&P500 up by its largest weekly gain so far this year.

US equities had a strong night with the S&P500 +2.0% and NASDAQ 2.7%.

The market found some relief on the notion that the FOMC Minutes revealed a broad consensus for 50bps hikes in June and July and the possibility for a pause later in the year.

Monday’s upbeat sentiment was short-lived with falls in equities and yields overnight.

A more positive risk backdrop begins the new week. US equities are higher, the S&P500 up 1.9%, extending a turnaround after dipping into bear market territory intraday on Friday.

The S&P500 falls into bear market terrain Friday before late day pull-up

Although employment growth disappointed yesterday, and along with wages data from earlier in the week, remains consistent with a rate rise of 25bp by the RBA in June.

The S&P500 high to low fall since the early January high puts it down 19% year to date and although not officially in bear market territory yet, looks to be only a matter of time.

The UK's unemployment rate fell to it's lowest level since 1974 and along with a further pickup in average earnings growth, now see money markets pricing 125bps of BOE rate hikes by December.

The biggest news overnight is commodities, oil prices are up, which threatens to prolong the inflation narrative.

US Consumer Sentiment fell further than expected to be at its lowest level since August 2011 and with consumer confidence so low, the risk of recession is rising.

Risk assets remained out of favour as concerns over inflation and recession risk continued to dominate.

Another volatile session in markets with an upward surprise in the April US inflation data release adding an extra layer of uncertainty

Decline in inflation expectations drive core global bond yields lower with further fall in oil prices helping the move.

The ongoing theme of mounting growth concerns against a backdrop of central bank tightening is continuing to drive market movements.

The current debate in Markets is whether the Fed would be willing to let the economy slip into recession to tame inflation.

Inflation is now forecast to peak at over 10% this year in the UK

Powell comments that 75bps isn’t something the FOMC is actively considering and that 50bps is on the table for the next couple of meetings

The RBA yesterday increased the cash rate target by 25bp to 0.35% and said it will do what is necessary to return inflation to the band

US 10-year Treasuries have just breached the psychological 3% barrier for the first time since late November 2018 in what has been a further bear steepening of the US curve

Sentiment toward the AUD went from hero to zero in April.

The NASDAQ recorded its worst monthly performance in more than a decade.

A wild ride in FX markets over the past 24 hours

News of Russia’s decision to cut gas supply to Poland and Bulgaria triggered a 30% jump in EU gas prices at the open before eventually settling 10% higher.

The World Bank has warned the war in Ukraine is set to cause the "largest commodity shock" since the 1970s (referencing the 1973 oil embargo).

There’s been a strong risk-off sentiment to the start of the week.

Markets are a little easier to understand today. Bond yields are back on the rise, given inflation expectations and more hawkish rhetoric from central banks.

Bond yields have fallen sharply overnight, but that doesn’t mean inflation expectations are going away, or does it?

It’s not something that will continue for long, but US bond yields have risen sharply today, and so have equities. Which one will give in first?

Global yields continued their March higher over the Easter period with the US 10yr yield hitting a fresh cycle of 2.88%, its highest since 2018.

Despite 50 basis point hikes by the Bank of Canada and the RBNZ over the last 24 hours, bond yields haven’t moved a great deal.

US inflation rose as expected, but there’s still been a reaction in the bond markets.

Bond yields continue to climb with risk assets now coming under pressures.

No respite from rising Treasury yields – 10s up another 4bps to 2.70% +32bps on week further hurting tech. stocks/NASDAQ vs other indices and boosting USD DXY index to 100.

The reaction to the Fed minutes early yesterday morning continued to dominate markets overnight.

FOMC Minutes reveal plans for much faster and more aggressive balance sheet reduction than 2017-2019

RBA’s April meeting yesterday left policy on hold at 0.1% but underwent a substantial rewrite to the post meeting statement.

Talk of Europe restricting Russian oil and gas has re-surfaced, driving oil prices higher

Eurozone inflation printed a new record high with ECB hawks calling for policy action.

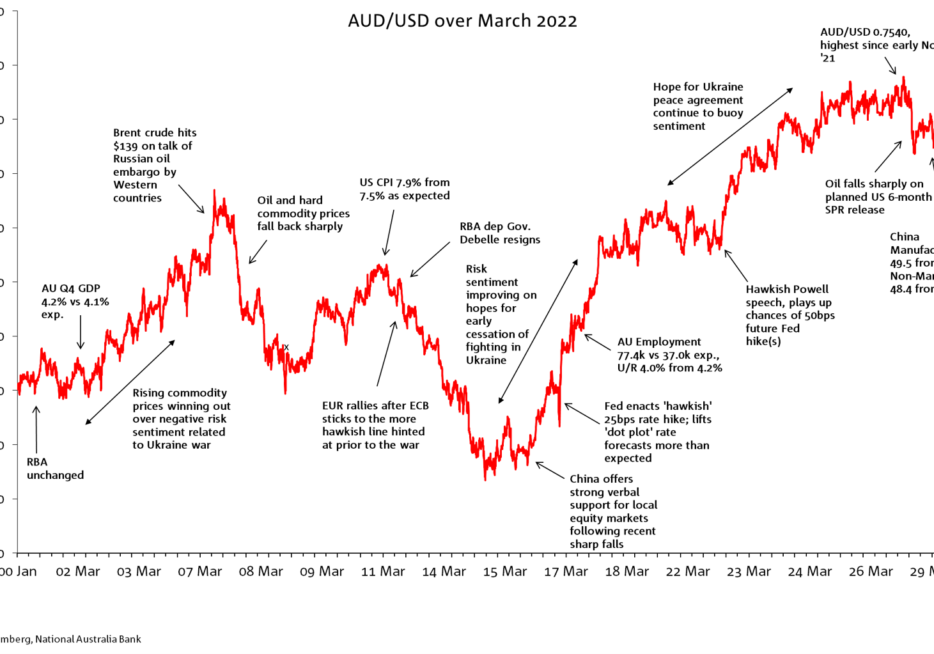

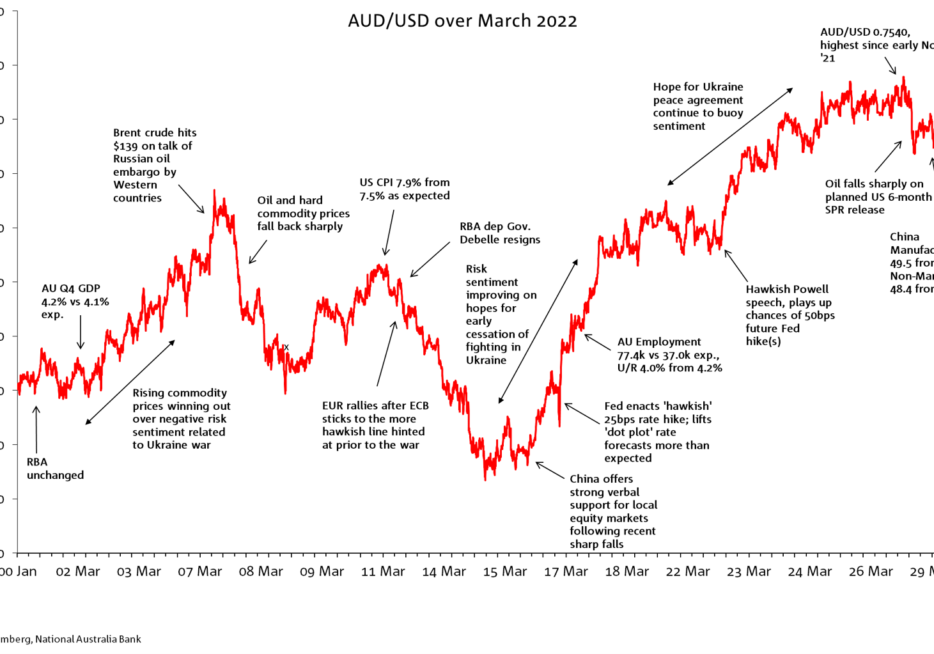

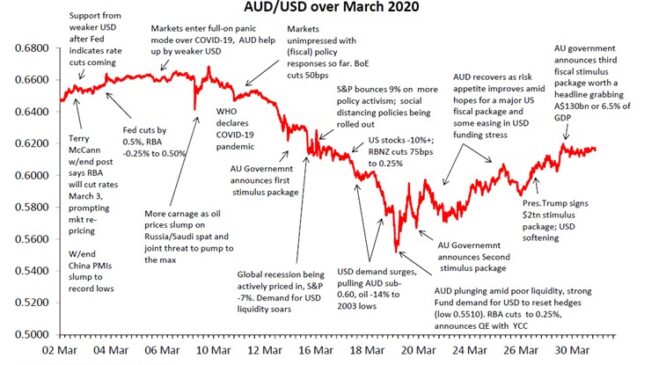

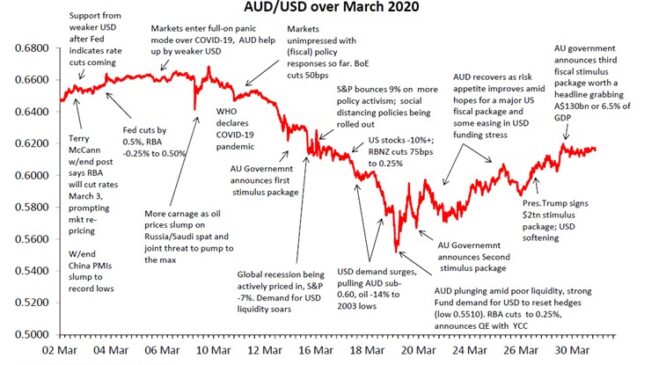

AUD volatility picked up in March, almost all accounted for by Global factors.

The main news overnight is the US decision to release 1m barrels a day for 6 months from their strategic petroleum reserve

ECB Lagarde warning of supply and uncertainty shocks from the Ukraine war.

Last night’s Federal Budget contained few surprises and won’t be a big influence on markets this morning.

It has been a nervous start to the new week with big moves seen in rates, oil and FX markets.

Economists outdo each other for Fed hikes with Citi calling four 50 basis point hikes back to back

Investors are showing a preference for US equities with all three major indices enjoying a decent rebound after yesterday’s decline.

Yields continue to rise with US 10yr now +9.6bps to 2.39%.

US bond yields march higher pre and post Powell speech

AUD/USD closed above 0.74 for the first time this year, cementing its position as the world’s strongest G10 currency year to date.

Russia makes USD bond payments, adding to a sense of hope on Russia/Ukraine

US Fed lifts cash rate 25bps, as expected

In this Weekly we explore how central banks might balance the two conflicting forces – inflation expectations key according to Fed speak.

A switch of market focus from Ukraine to China (and Hong Kong)

Yields have soared even as commodity prices have fallen.

Friday was a day of contrasting fortunes for US and EU equity markets.

The ECB has surprised markets with an accelerated QE unwinding plan

War still rages, but Eurozone stocks and EUR roar back to life

Markets remain volatile unable to confidently price implications from the news flow given the complex state of the global economy

Brent oil is up 30% on the week to US$130 a barrel and wheat, thermal coal and gas prices have also surged.

Germany rejects proposed US, EU embargo on Russian oil imports

Risk sentiment was hammered on Friday with sharp falls in stocks and a large rally in bonds

EU considering further measures against Russia overnight which would allow them to impose tariffs and quotas to Russian exports, further disrupting global trade.

Russia’s Ukraine invasion and sanctions continue to roil commodity markets which were already tight given the increase in demand from a reopening global economy and low inventories

Head of FX Strategy, Ray Attrill and Director, Currency Overlay Solutions, Mike Symonds discuss the results of our 10th Biennial Superannuation FX Hedging survey with ASFA.

Despite being the month when Russia invaded Ukraine, the high-low range in AUD/USD was less than in January.

History suggests Russia’s actions in the Ukraine may result in only a short-lived episode of risk aversion with contemporary macro themes eventually reasserting themselves.

Risk sentiment craters (S&P500 -1.3%) as the Russia/Ukraine situation has no sign of ending

News from Ukraine remain bleak with Russia Ukraine talks yielding no resolution while fighting rages on.

Markets are opening up to headlines that ‘Putin puts Russian nuclear forces on ‘special alert’.

Biden announces range of sanctions on Russia, but not including SWIFT.

Ukraine/Russia tensions continue, no further military escalation apart from cyberattacks

Restrained market reactions so far (bar oil) to Russia-Ukraine developments…

Geopolitical tension lifted overnight with President Putin formally recognising the two Ukrainian breakaway regions of Donetsk and Luhansk and signing aid and cooperation agreements.

US President Biden is convinced Russia has decided to attack Ukraine

Yesterday’s glimpses of risk off vibes have intensified over the past 24 hours with Russia Ukraine tensions the main culprit.

The standout data point overnight was US Retail Sales, which came in well above consensus expectations.

President Putin spoke to the media saying that "of course" Russia does not want war in Europe, but then added that his security concerns must be addressed and taken seriously .

The S&P is back in the red (-0.5%) following reports of satellite images being circulated purportedly showing Russian troops leaving assembly points and moving to attack positions.

Russia/Ukraine headlines weighed heavily on risk sentiment late Friday with the US again warning Russia could invade at any time.

US inflation comes in hot again with core measures showing wides-spread inflation pressures

Lots of central bank speak from Fed, BoC, ECB and BoE today

The key question as yields march higher is how high can they go in this cycle?

Inflation and related central bank thinking remains by far the bigger influence on market sentiment

US economy brushes Omicron aside with a strong January Labour market report

European yields soar as ECB pivots more hawkish – Lagarde fails to rule out hiking in 2022

Equities recovery continued overnight with both European and US markets extending recent gains.

It was an eventful start to the year, AUD/USD tracing out a range from a high of 0.7314 (Jan 13) to a low of 0.6965 (Jan 30)

The US economy is travelling with some momentum along side a tight labour market and still elevated inflationary pressures

Bostic retracts his 50bps comment, states “is not my preferred policy action” for March

AUD below 0.70 to lowest since mid-July 2020 – month end could be a factor

Shares attempts a recovery but US equities back in negative territory in afternoon trade

Hawkish hold by the FOMC/Powell sees yields rip higher and equities reverse earlier gains

Geopolitics has had an influence on markets today, but the influence of the Fed should still not be underestimated.

Bond yields retreated at the end of last week even though the assumption remains that the Fed will signal a March hike.

Latest flurry ahead of January 25-26 FOMC suggests March rates lift off expected.

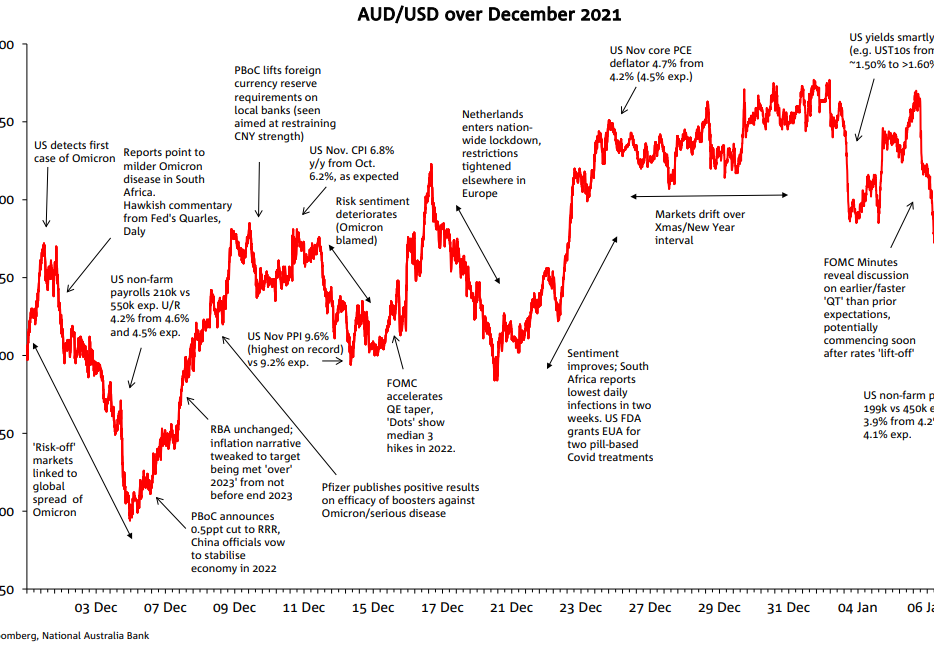

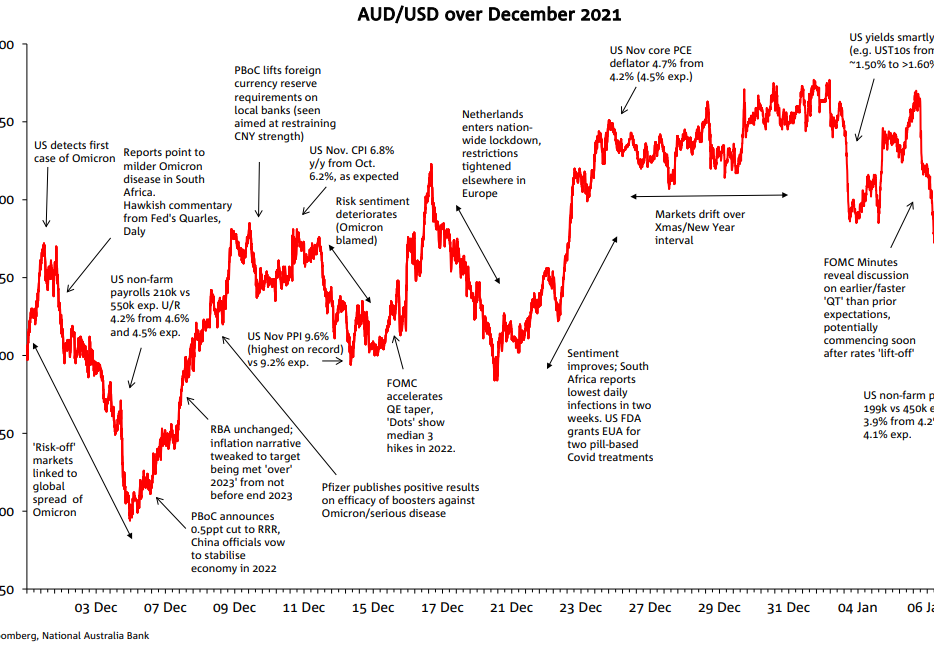

AUD/USD made its low point for the year on Dec.3 at 0.6993 – the pair’s only foray below 0.7000 in 2021.

US and EU equities rebound overnight with mostly positive Omicron news lifting sentiment while company specific news have also helped the cause.

Commodity market news overnight is a fresh surge in European gas prices

Expect a cautious start to the week with the Netherlands going into lockdown on Sunday

Against the consensus view for an unchanged outcome, the BoE unexpectedly also raised rates by 15bps to 0.25%.

The FOMC delivered a hawkish tilt for Christmas with the Fed dot plot showing three rate hikes in 2022 while also accelerating the taper profile.

US PPI beat expectations fuelling hawkish FOMC expectations

Slight risk aversion to start the week with equities down, yields down and US dollar up

Limited market reactions to ‘as expected’ US CPI – 6.8% headline highest since June 1982

Risk tone deteriorates in front of US CPI tonight, lack of positive new news on Omicron

After a solid run in the previous two days, equities are taking a breather with European shares closing lower amid concerns over the need for a new round of covid restrictions.

Markets continue to travel with optimism that Omicron will not have the severity of prior variants in terms of health outcomes, even if it is more transmissible.

Markets might be right on the interest rate outlook.

Positive Omicron reports coming from South Africa alongside an encouraging preliminary assessment from Dr Fauci over the weekend boosted sentiment with overnight news of policy easing in China, an additional bonus.

As we start a new week, Omicron headlines were positive on Saturday which may add to some stabilisation in risk sentiment.

NAB's 2021 biennial Super Fund FX Survey highlighted that on average, close to 47% of funds’ assets are allocated offshore.

Risk sentiment recovered overnight with virus/vaccine news flow being net positive

The US CDC has just identified the first case of Omicron in the United States – joining the UK, Switzerland and Brazil overnight – at a time when US infection rates of the delta variant had already started creeping back up.

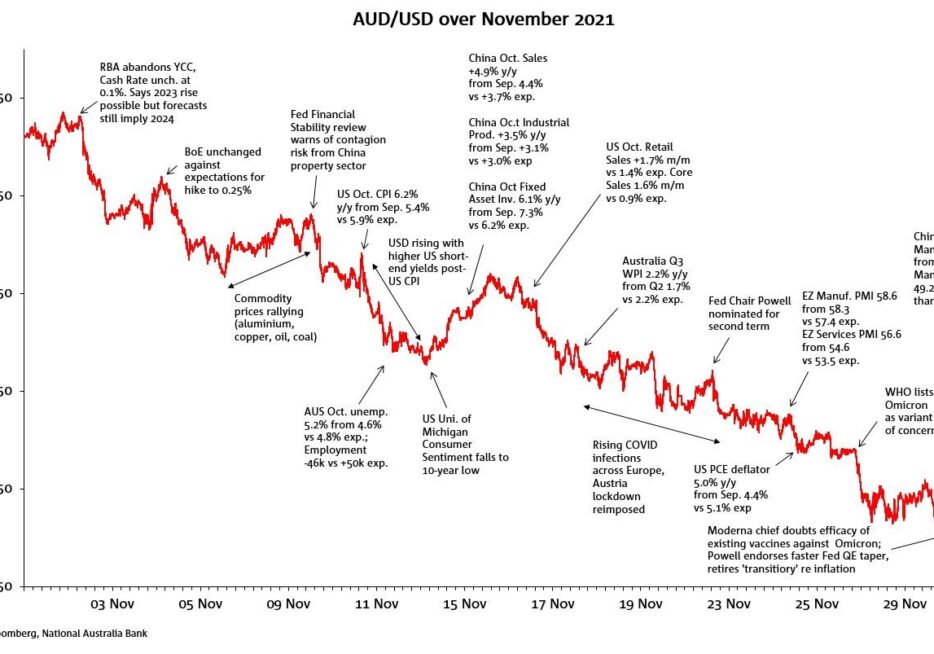

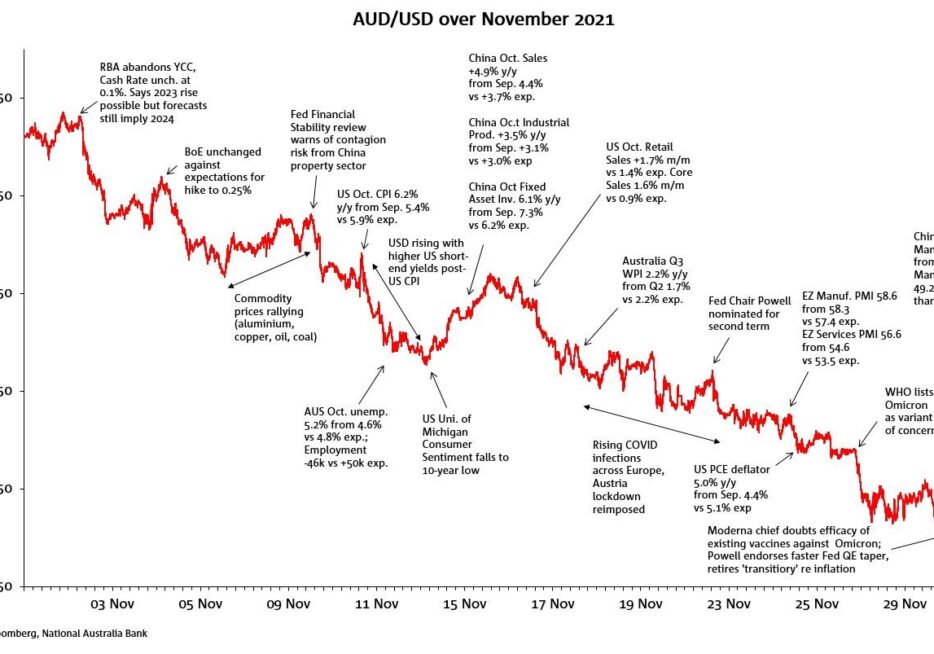

The overwhelming negative influence late in the month was the emergence of the Omicron covid-19 variant and doubts over the efficacy of existing vaccines against this strain and all that might imply for the global economic re-opening process.

It has been a volatile session overnight driven by differing headlines around vaccine efficacy, capped off by very significant hawkish tilt by US Fed Chair Powell in Senate Testimony.

Global markets have seen a modest retracement of many of last Friday’s violent ‘risk-off’ moves, with equities higher in Europe, so too US government yields up, as too is oil, but in all cases to nowhere near Friday’s closing levels.

New NAB research shows how asset managers are working towards a more sustainable future through their investing activities and how companies can best embrace the change.

Omicron uncertainty triggers a rethink on the global economic outlook

BoE’s Bailey still guiding that rates will need to be higher ahead of the Dec MPC meet.

Dovish Fed Official (Daly) flips to looking at accelerating tapering and to hikes in 2022

Eurozone PMIs spring upside surprise, supporting EUR and holding USD in check

Ahead of a speech by President Biden later today on the economy and inflation, we got news that Jay Powell is to be re-appointed to a second term as Fed chair.

Rising COVID infections around Europe and news that Austria will go into lockdown rattled markets on Friday with 10y Bunds leading a decline in core global bond yields.

Fed speak was not market moving, but it is worth noting it is mostly turning slightly hawkish.

Some in the market were positioned for an upside surprise in Australian wages data, but that wasn’t forthcoming, with the data bang in line with expectations at 2.2% y/y, back to pre-pandemic levels.

Trio of strong data with US Retail, US Industrial Production, and UK Jobs all beating

Our 10th biennial survey – the only survey of its kind to examine hedging techniques of Australian Super Funds – captures their shifting priorities in this rapidly changing landscape.

Data, supply and hawkish CB talk push core yields higher

US stocks had a positive day on Friday, so further recouping some of last Tuesday and Wednesday’s pre and post CPI weakness

The US has been out for Veterans Day, though stock markets have been open and have recouped a little of their pre and post US CPI losses

US CPI jumped in October with annual readings printing at new multi-decade highs, the broad base acceleration in prices challenges the transitory narrative and increases the pressure on a patient Fed.

Risk sentiment takes a turn for the worse with the first S&P down day in nine.

US equities close slightly higher while Europe starts the new week on the back foot.

There was a mixed market reaction to the better than expected US Payrolls print on Friday with equities up, yields down and the USD lower.

The BoE shocked markets overnight with its thunderous silence.

A new NAB report offers insights into how asset managers are incorporating sustainability metrics into their investing activities and what companies can do to develop best-in-class strategies.

No surprises from the FOMC in its formal policy pronouncement, the Fed announcing a November start to the QE tapering process at the as-expected pace of $15bn per month.

Global yields fall at the short end in the wake of the RBA’s dovishness yesterday.

Stock mostly firmer at start of new month, Europe faring better than US where S&P 500 ends +0.2%

The RBA’s failure to buy the bond in the days following the Q3 CPI report convinced the market the YCC target at least in current form, was set to be formally abandoned out of the 2 November Board meeting.

US equities have remained resilient and oblivious to the volatility seen in rates markets amid increasing concerns over higher inflation and the prospect of Fed funds rate hikes coming sooner than expected.

US equity continue to march to their own beat, oblivious to softer data releases and volatility in rates markets driven by Central Bank policy uncertainty.

A volatile night for rates markets with short-end rates shooting up driven by hawkish signals from yesterday’s Aussie Q3 CPI and Bank of Canada meeting, but longer-end rates tumbling after the UK budget showed a sharply lower debt profile.

US and European equities have ended the day in positive territory, supported by solid earnings reports and better than expected US data releases.

Inflation fears continued to build amid the backdrop of a strong Q3 earnings season which is showing firms have some pricing power to pass on higher transitory inflation

Friday’s main economic events, namely the ‘flash’ PMIs, tell us that there is little reason to fear stagnation, for the time being at least, given still elevated levels for all readings across Europe and the US.

The biggest moves across Global Markets have been seen in the US rates market, where break-even inflation rates have jumped by a full 10 basis points at both 5 and 10 years.

The S&P 500 has extended its winning streak to a sixth day with mixed earnings and a subdued Fed Beige report not enough to derail the positive vibes

If the market is rethinking how soon the Fed might lift rates, there was nothing from incoming Fed speakers overnight to support this view.

Although the US is less exposed to the energy crunch, supply bottle necks are still affecting its economy, particularly in sectors there is a shortage of workers, raw materials, and chips.

Inflation fears are clearly lifting, with the latest driven by the rise in energy prices.

The sun has been shining on risk sentiment, commodity prices and commodity currencies overnight

With markets having aggressively pushed Fed pricing into 2022, it is likely there is some thought that such a tightening will weigh on demand earlier.

The ‘Quit Rate’ is the highest on record, reflective of the ease which workers are switching jobs, in part at least for better pay or conditions elsewhere.

The rise in energy prices is fuelling concerns that the transitory lift in inflation seen in the wake of the pandemic may prove to be longer lasting.

US September payrolls were a big miss, but strong revisions to prior months alongside a decline in the unemployment rate and lift in hourly earnings resulted in a relative subdued reaction by markets, suggesting the figures were strong enough to keep the Fed on track to begin its QE tapering programme in November.

Risk asset have enjoyed a solid rebound overnight following news that the US Senate had reached an agreement to extend the debt ceiling through early December.

Words from politicians of various stripes have gone a little way to alleviating two of the major concerns currently plaguing global markets, namely the ongoing energy crisis centred on Europe and the looming deadline for lifting or scrapping the US debt ceiling

European and US equities rebounded overnight with a stronger than expected US Services ISM supporting the view that it’s all good, notwithstanding the ongoing rise in energy prices and supply bottlenecks.

NSW meeting the 70% full vaccination target may be announced as early today (more likely tomorrow) in which case it may well attract more local media headlines than the RBA meeting.

US equities finish last week strongly with positive trial results from Merck's Covid treatment drug helping sentiment.

Forces acting on the AUD (and other commodity linked currencies) independent of USD strength in September were largely China related.

US equity losses accelerate into Thursday’s close; worse month for S&P500 since March 2020

Equities made an unconvincing “buy the dip” bounce as yields consolidated their recent moves.

Fed talk overnight tilted hawkish with the Fed’s Bullard advocating for two hikes in 2022 and also flagging the case for balance sheet unwind after tapering ends.

10yr Treasuries spend time above 1.50%. Neither equities nor USD seem to care….

Week ends quietly after Evergrande/FOMC related volatility earlier in the week

BoE meeting more hawkish than expected, seen opening door to hikes by year’s end.

Fed tees up November taper announcement, subject to reasonably good Sep. employment report

US equities fail to bounce after Monday, with the S&P500 down -0.1 ahead of the FOMC.

A torrid day for Hong Kong’s hang Seng index yesterday, driven by sharp fall in property sector stocks and led by a 16% fall in Evergrande ahead of Thursday’s bond coupon payment day, spilled over to the global arena on Monday with equities down sharply, bond yields lower and safe haven currencies in the ascendancy.

Caution is in the air ahead of the FOMC this week where market moves on Friday tiled towards a mildly hawkish outcome.

Responding to changing asset manager behaviours and expectations.

There have been quite a lot of moving parts to the price action overnight.

The market was looking for an ease in US CPI readings and in the end the figures delivered a bit more than expected

It has been a slow start to the week with little in the way of market moves outside of commodities. Markets overall appear to be in a holding pattern ahead of US CPI figures tonight and the FOMC next week . The S&P500 swung between small gains and losses to finish up 0.2% after five consecutive days of losses, helped along by energy stocks.

After a positive APAC lead, equities came under pressure again on Friday night following news the Biden administration was considering a new investigation into Chinese subsidies and their damage to the US economy

As expected, the ECB will moderate its Pandemic Emergency Purchase Program (PEPP) bond buying pace in Q4 with its December meeting now a key event. China makes historic sale of oil reserves weighing on oil prices.

US equity markets slip for second day, bigger falls in Europe amid more cautious mood. NY Fed’s Williams re-enforces markets views post-Jackson Hole, August payrolls.

US investors have returned from the long weekend in a cautious mood. US and EU equities are broadly weaker with big tech outperforming, helping the NASDAQ stay on the green. Core yields are also higher with supply and ECB meeting on Thursday factors at play.