Protecting your business online is simpler than you think. NAB Executive Business Direct and Small Business, Krissie Jones, shares practical advice on how you can get started.

Newsletter

Protecting your business online is simpler than you think. NAB Executive Business Direct and Small Business, Krissie Jones, shares practical advice on how you can get started.

Newsletter

Cyber crime, scams and fraud are key issues facing broker businesses in Australia, but fortunately there are steps businesses can take to help mitigate the risks.

Article

NAB brings together a group of treasurers from authorised deposit-taking institutions (ADIs) to discuss recent developments and experiences in the securitisation market.

Article

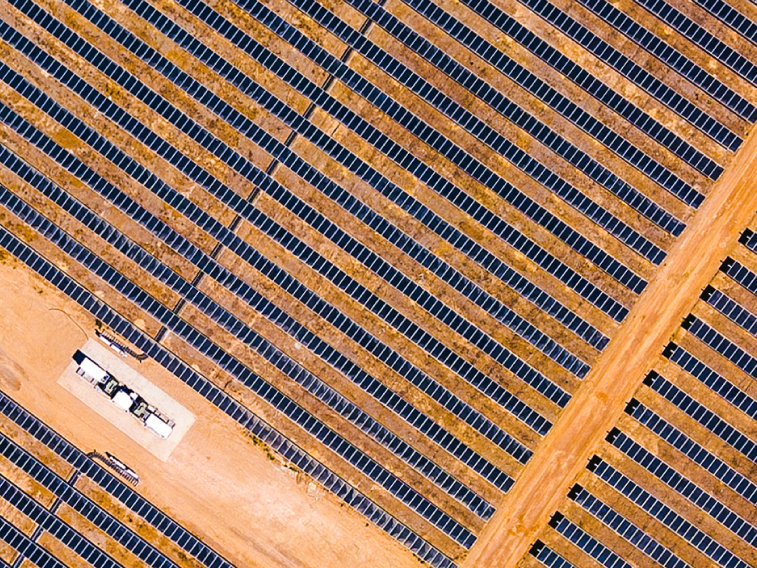

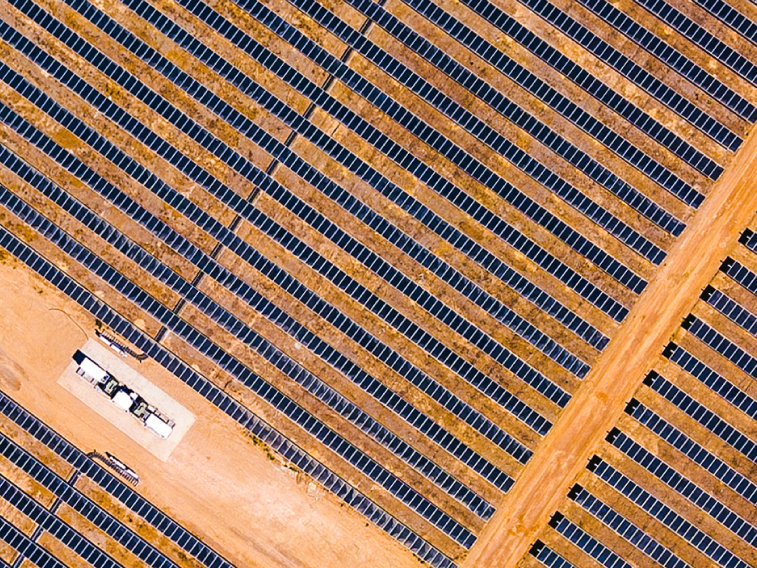

Australia needs a vast amount of capital to build out the utility-scale wind and solar projects to power a net-zero future by 2050. NAB’s Executive, Specialised Finance, Andrew Smith and Executive, Capital Markets, Sarah Samson explore potential debt funding options in market.

Article

A strong start to the new year after a volatile 2022 is offering attractive conditions for capital markets participants ready to act while stability holds.

Article

Strong performance in the emerging technology sector shows how NAB is helping to create a robust industry ecosystem and deliver on what it takes to make it as a new digital business.

In October 2019, National Australia Bank hosted a Round Table with emerging lenders to share their experiences on the journey to bank securitisation funding and beyond.

We invited Treasury representatives from four non-bank financial institutions and one UK-based asset manager – Liberty Financial, La Trobe Financial and Resimac Group in Australia and Kensington Group and TwentyFour Asset Management in the UK - to an International Round Table to discuss the opportunities and challenges in their respective mortgage and securitisation sectors.

NAB has debuted several innovative green and social bonds in recent years. In this article we go behind the scenes to find out how a new, green investment product reaches the market.

NAB’s Securitisation team goes from strength to strength, being the clear house of choice for customers and thought leader in the market.

Securitisation has been one of the compelling stories in the Australian market in 2017. Issuers are keen, investors are willing and there’s abundant appetite for new and exciting assets and structures.

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.