Total consumer spending grew 0.7% in July

Insight

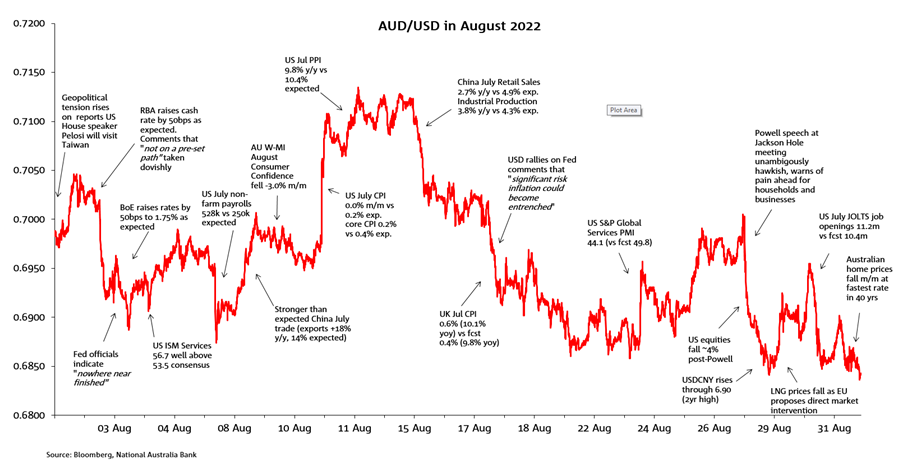

The AUD/USD spent August oscillating around the 70 US cents mark but spent much more time below than above.

The AUD/USD spent August oscillating around the 70 US cents mark but spent much more time below than above. AUD/USD both opened (0.6983) and closed (0.6842) below 0.70. The latter was very close to the intra-month low of 0.6835, recorded on 31 August. The high of 0.7137 came on 11 August. USD strength, in conjunction with a deterioration in risk sentiment/falling stock prices, was the overarching theme in August, which really only came to the fore in the latter half of the month in the context of increasingly hawkish Fed policy rhetoric and heightened recession fears, culminating in Fed chair Powell’s Jackson Hole speech on 26 August.

Before that, the month had begun with rising geopolitical tensions linked to US House speaker Nancy Pelosi’s planned visit to Taiwan, followed by a negative AUD response to the RBA’s widely expected 2 August 0.5% Cash Rate increase. The latter accompanied by a comment that policy was ‘not on a pre-set path’ – interpreted as somewhat ‘dovish’ by markets, at least relative to pre-RBA expectations.

A strong US non-farm payrolls report on 5 August added weight to AUD via support for the USD, before a bounce back to above 0.70 assisted by stronger than expected China trade numbers and then aided even more by a downside surprise in the July US CPI inflation report. Headline and core CPI were both 0.2% less than expected, checking the rise in US Treasury yields and generating a rally in US stock markets on hopes future Fed policy actions might not need to be quite so aggressive.

The fall-back in AUD off its 11 August highs began with a set of much weaker than expected China July activity readings (for retail sales in particular, up just 2.7% on a year ago) followed by a barrage of hawkish commentary from Fed officials in the following days, mostly downplaying the significance of the CPI drop and empathising the need to get Fed policy into restrictive territory. UK CPI inflation hitting double-figures (10.1%) around the same time, didn’t help the ‘risk-off’ mood.

Late in the month, Chinese Yuan volatility became a relevant (negative) force on AUD after USD/CNY rose, first to above its May 2020 highs and later up through 6.90, consistent with the strong historical relationship between CNY and AUD.

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.