Online retail sales growth slowed in May following a fairly strong April

Insight

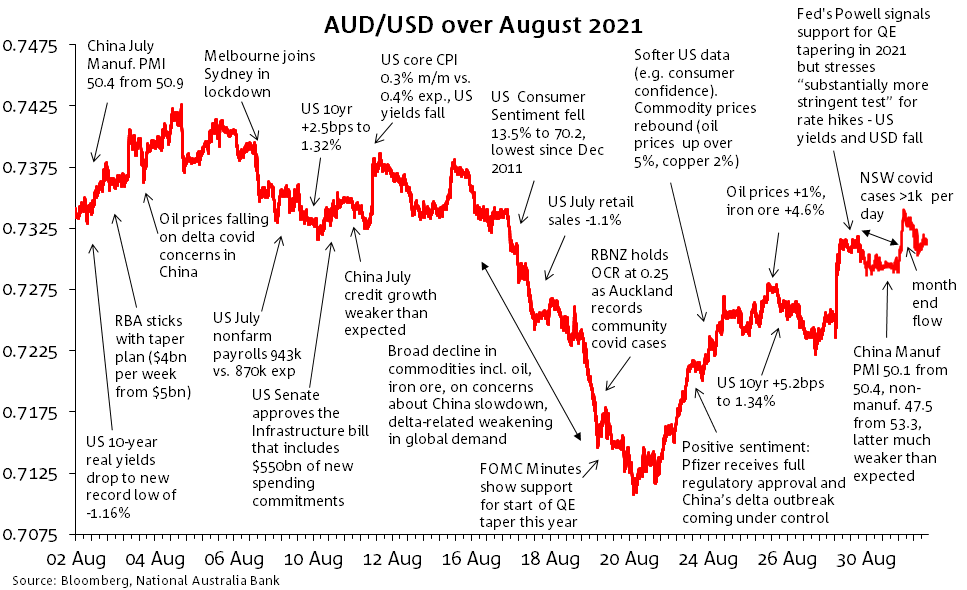

Almost, but not quite, a round-trip for AUD/USD in August.

Almost, but not quite, a round-trip for AUD/USD in August. Having ended July at 0.7344, the pair made a high of 0.7341 on the last day of the month before being pulled down a little late in the day by some apparent across-the-board month-end demand for US dollars. It ended August at 0.7316 after having made a new 2021 year-to-date low of 0.7106 on 20 August.

Relative strength in the AUD at the start of the month was helped by US (real) bond yields making new record lows (-1.16% at 10-years) and the announcement by the RBA out of its 3 August Board meeting that it planned to persist with its July decision to taper weekly QE bond purchases from $5bn per week to $4bn, starting in September (speculation had been they would defer this given the NSW covid outbreak).

This early-month move up was as good as it got though, with news flow in the second week of the month supporting the USD and binging AUD lower. This included Melbourne joining Sydney in lock-down as the virus hit Victoria again, stronger than expected July US non-farm payrolls which saw earlier US interest rate declines reverse, and weaker than expected China credit numbers, playing to concerns about the extent of the evident slowing in China’s economic momentum.

AUD weakness, not just against the USD but on many of the crosses, gathered momentum in the middle part of the month. Sharply falling commodity prices coincided with rising concern about China’s slowdown and its impact on demand, as well as global demand implications from the spread of the Delta Covid-19 variant. FOMC Minutes on 18 August showing majority support for a start to Fed QE tapering before year-end then added a fresh layer of USD support.

The AUD revival of the 20 August lows began with some softer incoming US data (e.g. weak August consumer confidence) and gathered momentum as commodity prices recovered strongly. Fed chair Powell’s Jackson Hole speech at which he distanced ‘tapering’ from ‘tightening’ and articulated his view of transitory inflation, then added fresh weight to the USD.

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.