Total spending grew 0.9% in June.

AUD/USD made its low point for the year on Dec.3 at 0.6993 – the pair’s only foray below 0.7000 in 2021.

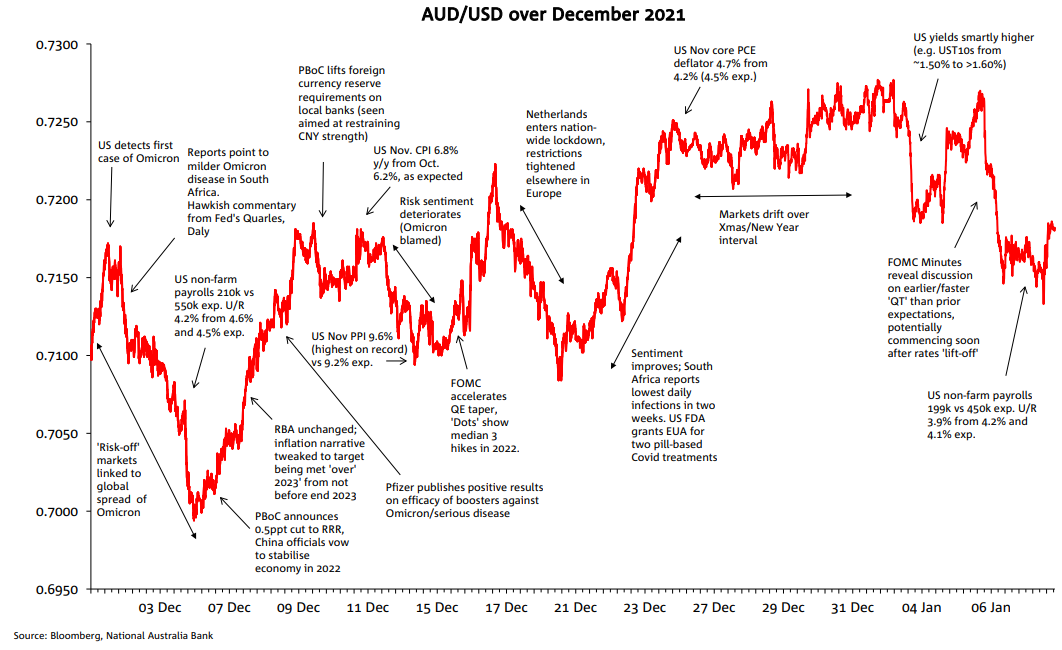

AUD/USD made its low point for the year on Dec.3 at 0.6993 – the pair’s only foray below 0.7000 in 2021 – from where it recovered to a high of 0.7277 on December 31. Over 2021 as a whole, it is remarkable that AUD/USD spent less than two hours above 0.8000 (high of 0.8007 on Feb.25) and less than two hours below 0.7000. Proof, if it were needed, that AUD/USD is at its most comfortable within a 70-80 cent range.

The AUD’s low point early in the month coincided with evidence that the Omicron covid-19 variant, first discovered in South Africa in November and labelled a variant of concern by the WHO on November 26, had spread to many countries and was seemingly much more infectious than its forerunners. The recovery in risk sentiment, and with that AUD, later in December came alongside accumulating evidence than while more infectious, the Omicron variant was a less serious disease than predecessors, necessitating far fewer hospitalisations. Positive news on the efficacy of vaccine booster shots and then later in the month, Emergency Use Authorisation being granted by the US FDA for two covid-19 treatment pills, also played favourably for risk sentiment and with that AUD. It was far from plain sailing though, with set-backs occurring on news of the Netherlands entering full scale lockdown and restrictions tightened elsewhere in Europe.

Also helpful to the AUD’s cause was a subtle shift in language from the RBA, talking about underlying inflation potentially being inside its 2-3% target during 2023 (rather than not before the end of 2023 previously). Tangible signs of China taking measures to stabilise its economy offered additional support, including a 0.5% cut to Reserve Requirement Ratios and then in late December, a 0.05% cut, if largely symbolic, to banks’ 1-year Loan Prime Rate (to 3.80% from 3.85%).

Taking the top off AUD either side of New Year were higher US bond yields, a trend aggravated by December FOMC Minutes revealing support for a faster and more rapid ‘Quantitative Tightening’ than prior expectations/experience.

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.