Firmer consumer and steady outlook

Insight

AUD/USD ended Dec 2022 much as it started. For 2022 overall, AUD/USD lost 6.2% which was the the second biggest annual range of the past decade, exceeded only in the 2020 first year of the Covid-19 pandemic.

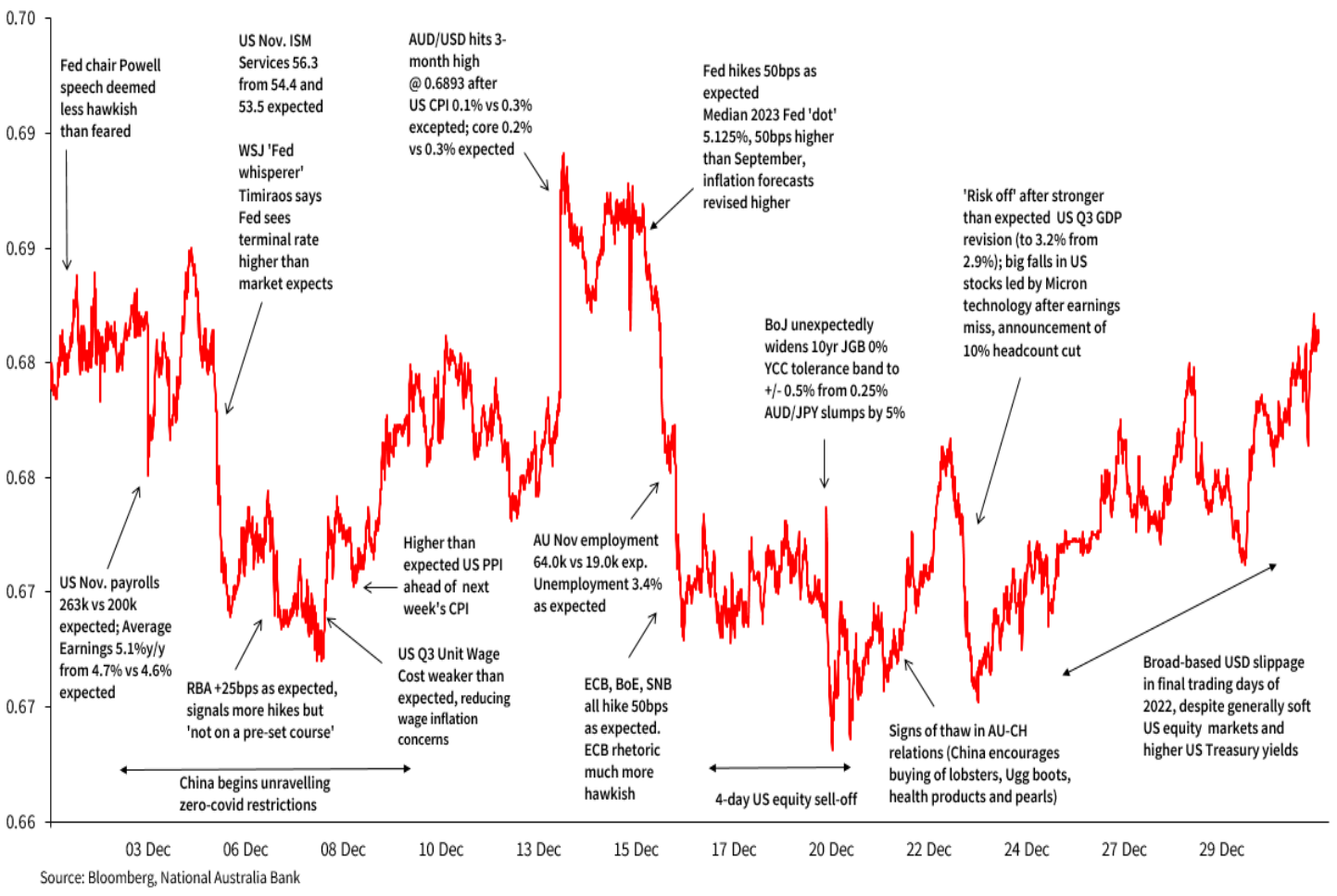

AUD/USD ended Dec 2022 much as it started, close to 0.6800 (0.6813). The high of 0.6893 on 13 Dec came shortly after US Nov CPI data came in below expectations to generate a broad-based US dollar sell-off. The 0.6629 low on 20 Dec was after the BoJ dropped a bombshell by doubling the tolerance band around its 0% JGB YCC target to +/- 0.5%. The resulting surge in all things JPY was most pronounced versus the NZD and AUD, AUD/JPY losing a cool 5% on the day, taking AUD/USD down with it.

The first half of December was characterised by fluctuating fortunes for the USD, driven by a combination of incoming US data – stronger than expected employment and ISM services but then, crucially, weaker than expected CPI – and Fed speak and actions. The Fed’s step down to a 50bps rate rise at mid-month was as expected, but the surrounding update to the Fed’s forecasts (including a raised ‘dot plot’ and 2023 inflation) was seen as hawkish and USD supportive. The RBA’s early-month 25bps rate rise and warning of more to come was a non-event for the AUD.

Following the BoJ-induced low on 20 Dec, AUD/USD ground out a recovery in the last 10 days of the month. Signs of thawing in China-Australia relations and green light for resumption of some trade flows helped, alongside optimism the ending of China’s zero covid strategy would see a significant growth revival in 2023 after the damage caused by reopening and resulting covid infection wave.

For 2022 overall, AUD/USD lost 6.2%, from 0.7263 at the start of the year to 0.6813, encompassing a range from 0.7661 (5 April) to 0.6170 (13 October). This was the second biggest annual range of the past decade, exceeded only in the 2020 first year of the Covid-19 pandemic.

NAB Markets Research Disclaimer

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.