A private sector improvement to support growth

Insight

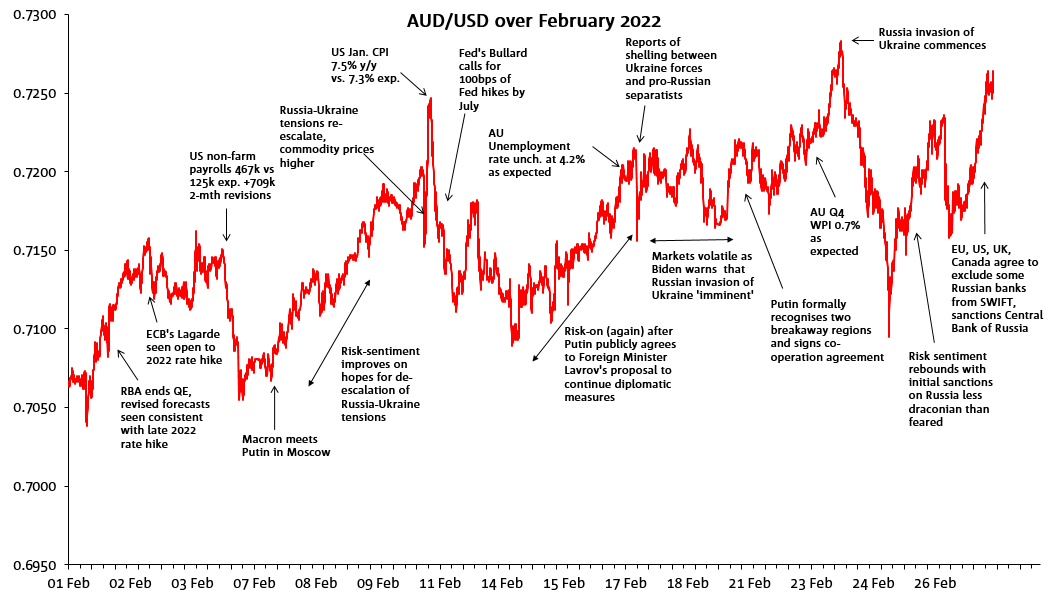

Despite being the month when Russia invaded Ukraine, the high-low range in AUD/USD was less than in January.

Source: Bloomberg, National Australia Bank

Despite being the month when Russia invaded Ukraine, the high-low range in AUD/USD was less than in January. The latter’s 0.6965 – 0.7314 range was reduced to 0.7034 – 0.7284 (low on February 1, high on February 23). This smaller range disguised what were choppier markets, not just in AUD but markets generally, be it FX, bonds or equities. Indeed, intra-day ranges in AUD/USD were generally wider than in January.

Markets were buffeted throughout the month by Russia-Ukraine headlines, with an ebb and flow of optimism over whether or not a crisis could be averted by diplomacy. That, tragically, proved not be the case of course, with Russia invading Ukraine soon after mid-night AEDT on February 23. The AUD’s high point for the month was literally seconds before news of the invasion came through, and the fall from 0.7284 to 0.7099 later the same day (-1.7%) represented the biggest one-day range in the currency since in almost exactly a year (the last bigger one-day drop, in late February 2021, coming in conjunction with a sharp rise in US bond yields, a big sell-off in risk assets, and surge in the USD).

A reminder then, that the AUD remains at heart a highly risk-sensitive currency. The surprise therefore was that AUD was not weaker given the geological stress that dominated markets in the latter half of the month. One factor to note here was the support that commodity prices were drawing from the heighted speculation over the free-flow of oil and gas supplies from Russia, lending the AUD some terms-of-trade support.

Another was the fact that Emerging Markets (EM) in general held up remarkably well – with the exception of the outsized impact the sharp falls in the Rouble and Russian bond credit spread spreads were having on various EM-related risk metrics.

Also relevant to AUD’s relative resilience was that, unlike H2 2021, in February the USD no longer drew support from the further lift to market pricing for Fed rate hikes in 2022, which ratcheted up after another higher-than-expected CPI inflation print for January (to 7.5%) released on February 10.

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.