Robust growth for online retail sales observed in June

Insight

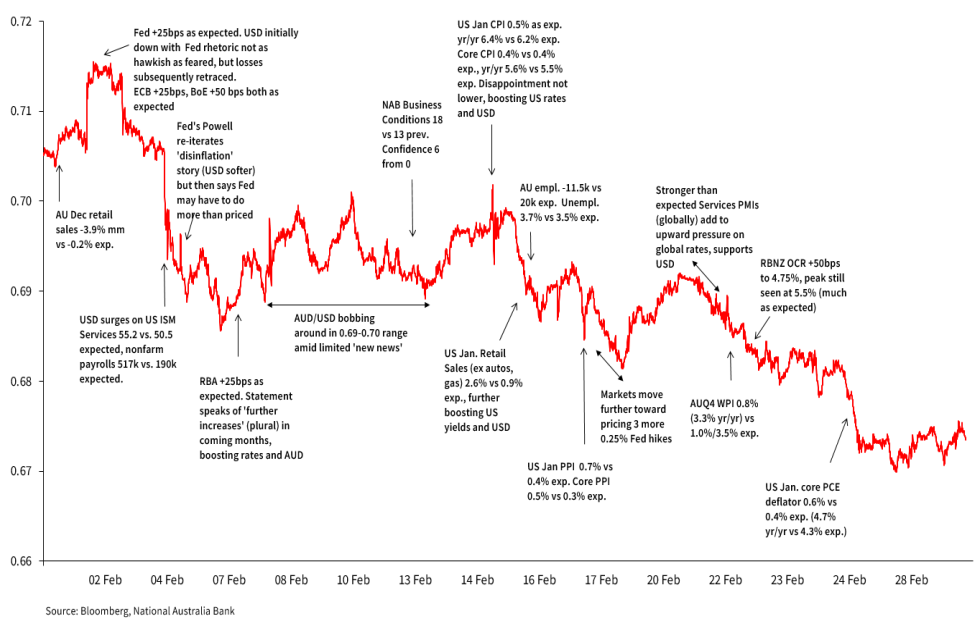

AUD performance in February was an almost exact mirror image of January, AUD/USD trading back down to near 67 cents from above 0.71 cents, having risen from sub-0.67 to above 0.71 in January.

AUD performance in February was an almost exact mirror image of January. Hence after January saw AUD/USD trade from an early-month low of 0.6688 to a late month high of 0.7142, February witnessed a (2 Feb) high of 0.7158 giving way to a (27 Feb) monthly low of 0.6698. This 4.6 cent intra-month range very slightly exceeded the January range (4.5c) marking the second successive month of well above average volatility (3.15c in the post-float era), confirming an ongoing high-volatility environment thus far in 2023.

Australia-specific influence in the AUD last month were small, overwhelmed by a succession of upside US economic data surprises and repricing of Fed policy expectations – both in terms of how high the peak will be, and how long before rates start to come down – and a related USD strength alongside deterioration in risk sentiment indicators. Key US data prints were ISM Services (55.2 from 49.2), nonfarm payrolls (517k) PPI (5.4% for core versus 4.9% expected) retail sales (2.6% ex-auto and gas against 0.9% expected) and the core PCE deflator (up to 4.7% from 4.6% and 4.3% expected).

As for local influences, the RBA’s February meeting yielded the as expected 25bps cash rate rise to (3.35%) but AUD drew some support from the accompanying Statement that further increases (plural) were to be expected in coming months. Weaker than expected headline employment and unemployment data (-11.5k and 3.7% up from 3.5%) were dismissed as not reflective of the (ongoing) underlying health of the labour market, while the Q4 Wage Price Index at 0.8% against 1.0% expected played with the grain of upwards Fed rate repricing outpacing that for the RBA during the month. A negative dynamic for the AUD.

Read our NAB Markets Research disclaimer.

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.