Firmer consumer and steady outlook

Insight

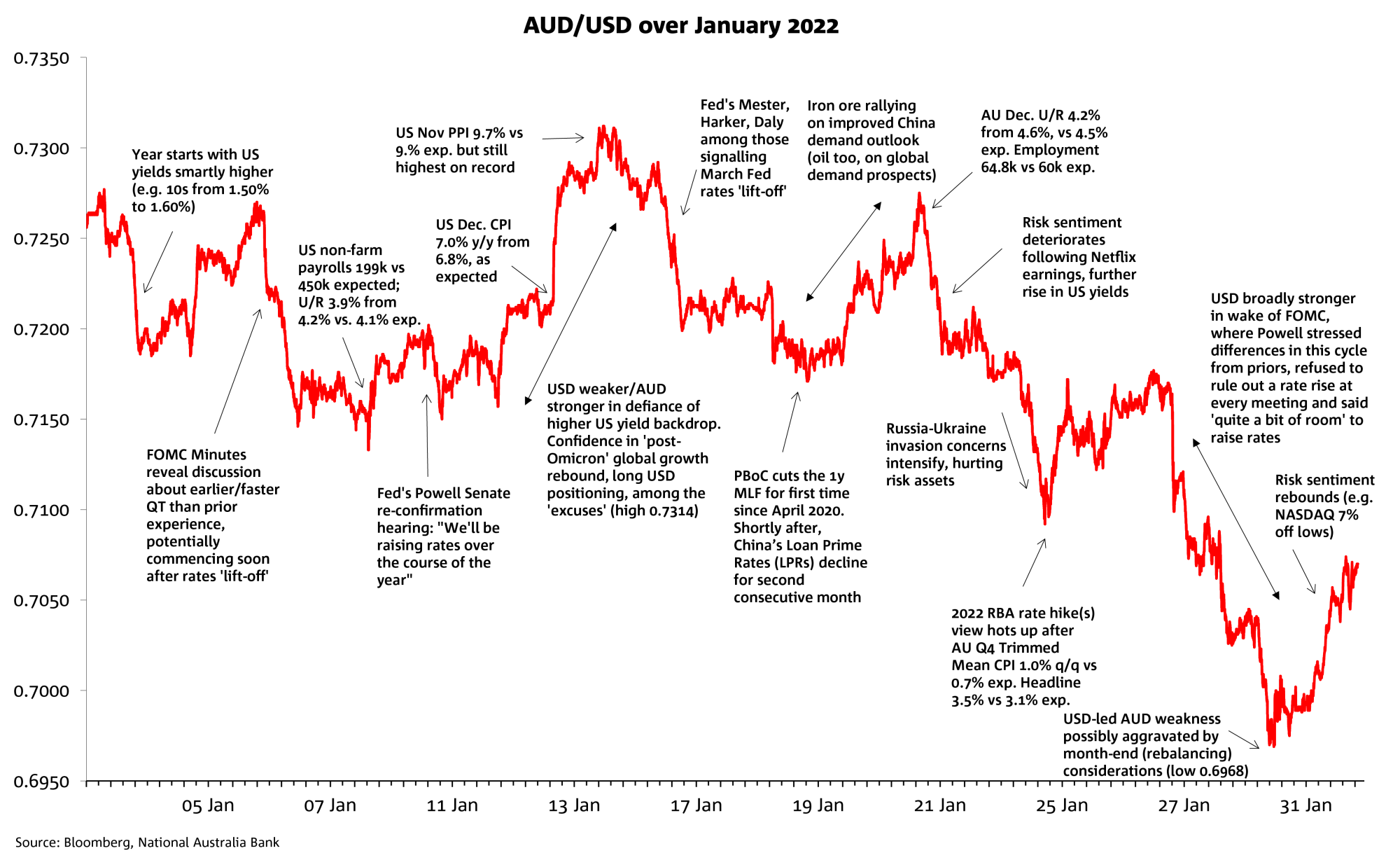

It was an eventful start to the year, AUD/USD tracing out a range from a high of 0.7314 (Jan 13) to a low of 0.6965 (Jan 30)

The AUD in January 2022

The AUD in January 2022It was an eventful start to the year, AUD/USD tracing out a range from a high of 0.7314 (Jan 13) to a low of 0.6965 (Jan 30) – a slightly wider range than the one witnessed in December.

AUD relative strength in the first half of the month was largely a ‘USD thing’ and where the surprise was the failure of the big dollar to embrace the rise in US Treasury bond yields. These came on the back of increasingly hawkish rhetoric from various FOMC officials, as well as Minutes of the December FOMC meeting which revealed discussion about an earlier/faster Quantitative Tightening (shrinkage of the Fed’s balance sheet) than the prior (2018/2019) experience. US CPI inflation hitting a headline-grabbing 7% in December also added to pressure on US rates – but not the USD, in sharp contrast to the H2 2021 experience.

After a fair bit of head-scratching over US rates/USD divergence – and where suggestions of an ‘overly long’ USD trading market at the start of the year and confidence in a post-Omicron global growth acceleration were among the excuses on offer – the USD recovered its mojo in the second half of the month. It was tempting to attribute this to the market playing ‘catch-up’ to the earlier rise in US yields, though yields were also rising elsewhere in the world, including in Australia. Perhaps more pertinent, the stronger USD/softer AUD had as much or more to do with the sharp, US-led falls in stock markets, themselves a delayed response to higher US yields but also some stock-specific news (e.g. Netflix’s pessimistic outlook for future subscriber growth). That said, comments from Fed chair Powell out of the Jan 25-26 FOMC were deemed hawkish and helped drive the USD above its 2021 highs, before pulling back at month-end. AUD/USD fell below 0.70 to a post-July 2020 low in this context, though month-end rebalancing considerations may have played a part in the out-sized drop, later reversed.

AUD received only temporary support from the higher than expected AU Q4 CPI report on Jan 25 (and before the sharp fall in AU unemployment on 20 Jan), not too surprising given how much RBA tightening was already priced into the rates market.

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.