NAB specialists and clients from across the bank’s Fund Sponsors, Strategic Investors and Alternative Assets (FSA) business gathered over lunch recently to share career stories and advice on promoting greater diversity and inclusion.

The AUD failed to benefit from the generally weaker USD, in contrast to all other major currencies which rose during the last week of July. From mid-month, a very sharp fall-back in iron ore prices, albeit a commodity with a very fickle and sometimes non-existent short term relationship with the AUD, drew attention

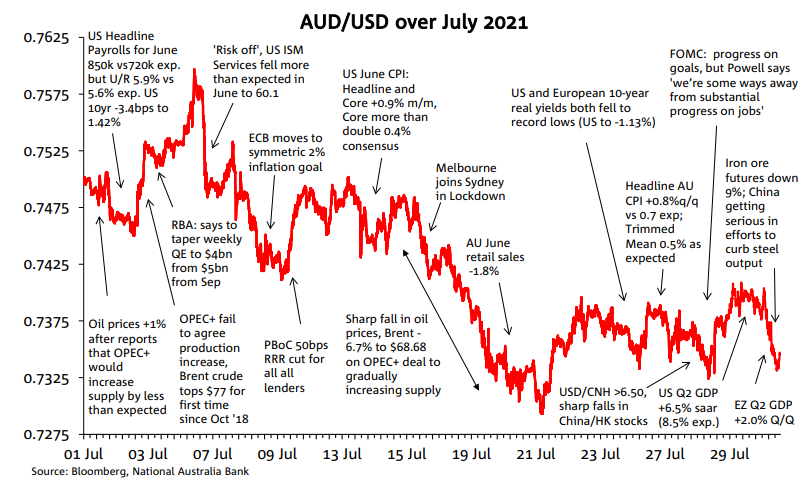

In July AUD/USD traded in a similar range to June, of 3.1 cents (June 3.0 cents) with a high of 0.7599 on June 6 and low of 0.7290 on 21 July, ending the month at 0.7344 so very much near the bottom end of the month’s range.

Of particular note toward the end of the month is that AUD failed to benefit from the generally weaker USD, in contrast to all other major currencies which rose during the last week of July. From mid-month, a very sharp fall-back in iron ore prices, albeit a commodity with a very fickle and sometimes non-existent short term relationship with the AUD, drew attention. So too did the discounting of the economic implications of the protracted covid-related economic lockdown of Greater Sydney – joined for a while by Victoria (and latterly Queensland) and what that might imply for RBA policy.

Earlier in the month, the AUD had drawn some support from the announcement that the RBA intended to taper its weekly QE bond purchases from $5bn to $4bn per week from early September, but the consensus (and NAB view) has now shifted to the RBA likely announcing a deferral of tapering plans when it meets on 3 August.

Also adding weight late in the month was the sharp falls in the Chinese and Hong Kong stock markets, following the latest crackdown on certain sectors of the market by Chinese regulators, in this case in education (private tutoring) as well as much greater scrutiny of Chinese firms’ ability to list in overseas markets, the US especially. This saw USD/CNH spike above 6.50 for the fist time since April, albeit it fell back after various attempts by Chinese officials to calm the equity market’s nerves.

Following another US inflation scare at mid-month (core US CPI 0.5% above the consensus) US real and nominal bond yields tracked steadily lower in the latter half of July, and though weighing on the USD, offered no real support to the AUD.

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.