Coming in for landing in a heavy cross wind

Insight

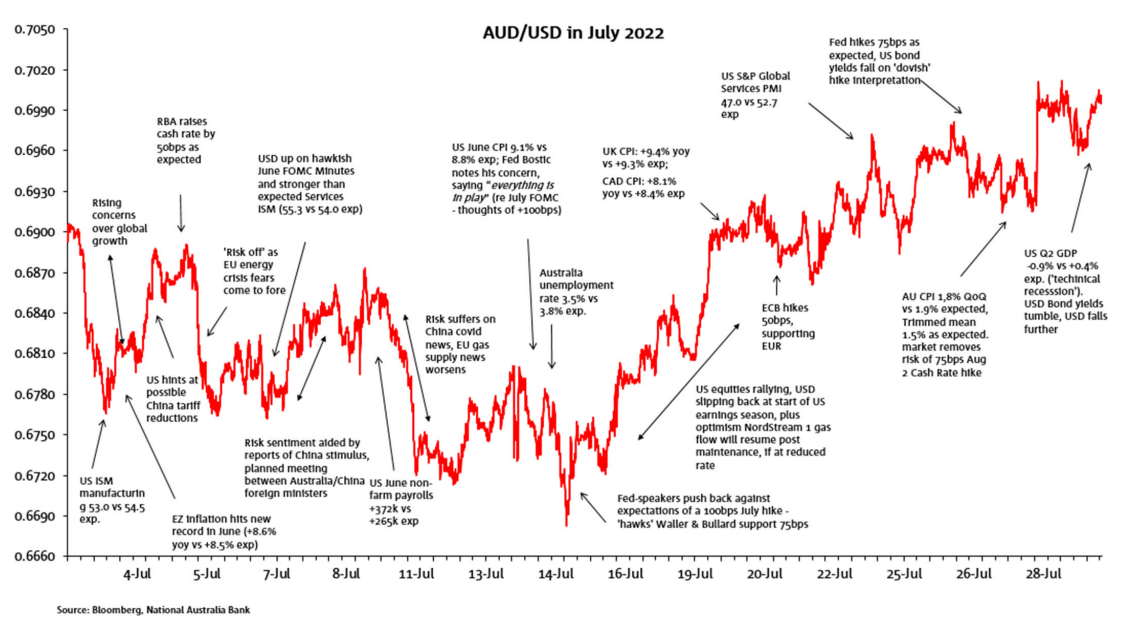

The AUD/USD opened the month at 0.6903, fell to its monthly low of 0.6682 on July 14 and made a high of 0.7032 on July 29 before closing the month at 0.6985.

The AUD/USD opened the month at 0.6903, fell to its monthly low of 0.6682 on July 14 and made a high of 0.7032 on July 29 before closing the month at 0.6985. AUD volatility in July continued to be driven for the most part by swings in global risk sentiment; predominately negative in the first half of July before a reversal of fortunes from mid-month.

Poor risk appetite in the early part of July reflected rising concerns over a significant global growth slowdown/possible recession, accentuated by weaker than expected incoming US economic data (e.g. manufacturing ISM), alongside intensified fears that Russia was in the process of weaponising gas supplies, which could condemn the Eurozone to recession.

The AUD enjoyed a temporary uplift on July 4/5 amid reports President Biden was contemplating rolling back tariffs of Chinese imports and then by the RBA lifting the cash rate by 50bps. This AUD strength proved short-lived as global growth slowdown fears intensified, reflected in Brent oil prices tumbling more than 9%, while the USD drew support from what were seen as ‘hawkish’ June FOMC meeting minutes, which included a reference to upwardly revised inflation projections.

Fresh AUD slippage/USD strength followed the June US CPI report (headline +9.1% vs +8.8% expected) triggering fears the Fed could hike by 100bps at its next meeting (the Fed’s Bostic noting, post-CPI that, “Everything is in play ”). Eurozone inflation then hit a new record high (+8.6%), supporting an eventual 50bps hike by the ECB. UK inflation also surprised to the upside (but not Canada) ahead of Australia’s Q2 CPI report later in the month which came broadly in line with forecasts (1.8% headline, core 1.5%), helping erase market expectations for a 75bps RBA hike in August.

The latter half of July was characterised by improved risk sentiment featuring rising US equity markets, and where for the most part incoming US earnings reports failed to validate fears of earnings misses/sharply downgraded forward guidance. Resumption of gas supply into the EU also helped, albeit at much reduced flow. The Fed delivered what markets took to be a ‘dovish’ 75bps rate hike on July 27 with resulting decline in bond yields/equity gains hurting the USD and lifting the AUD. These FX moves were amplified a day later after the US recorded a second consecutive quarter of negative GDP growth (-0.9%).

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.