Total consumer spending grew 0.7% in July

Insight

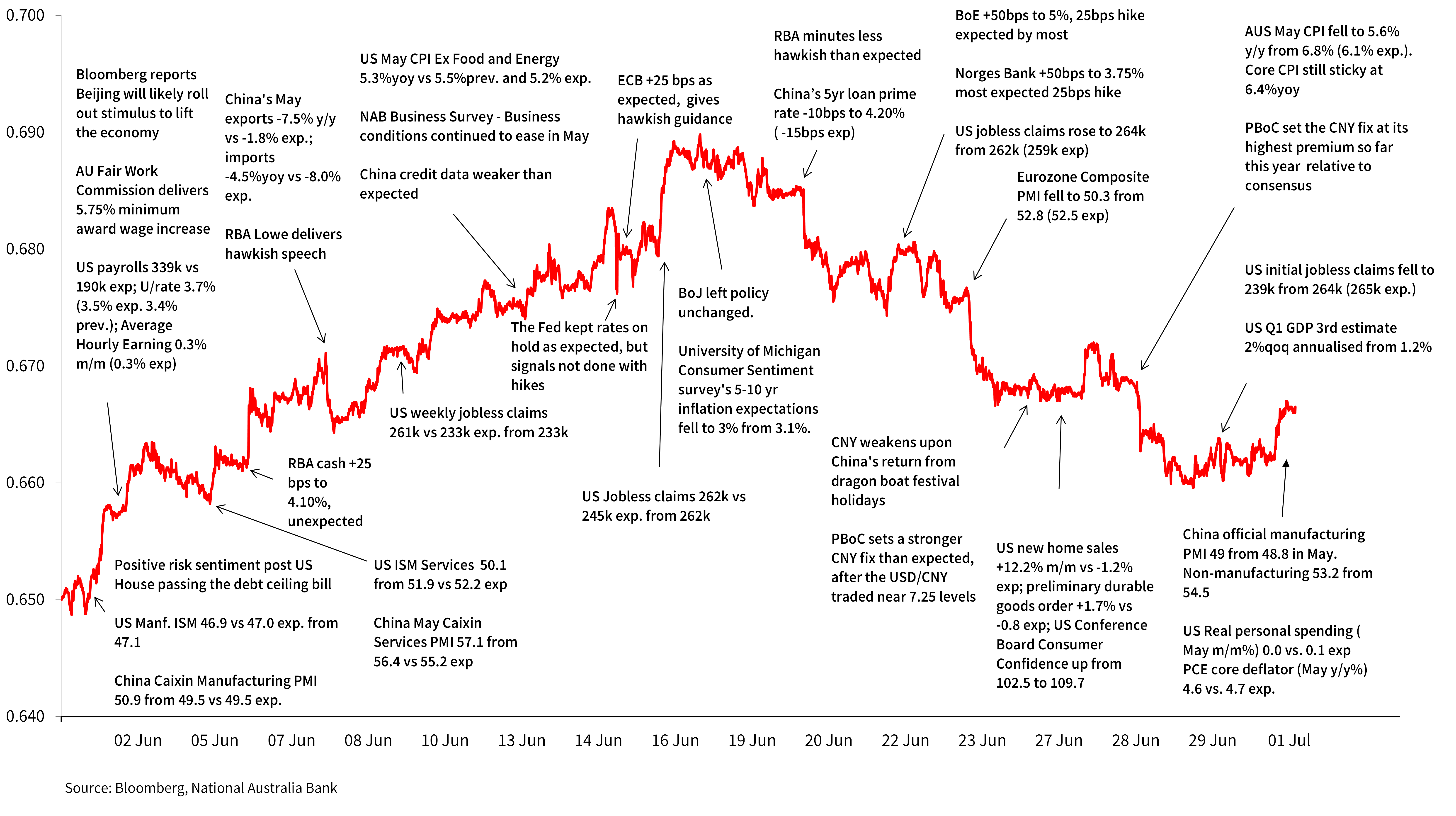

The AUD/USD price action in June was a story of two halves. Soft US data and a cash rate hike by the RBA helped propel the currency to an intra-month high of 69c, but then concerns over China’s growth outlook and better than expected US data releases weighed in the second half of the month.

The AUD/USD price action in June was a story of two halves. After briefly trading below 65c (monthly low of 0.6486 on 1 June) at the start of the month, the currency enjoyed an appreciating trend that lasted until it reached its monthly high of 0.6900 on 16 June. The second half of the June was a deflating story with the currency ending the month 2.4c below its monthly high at 0.66640. Over June the AUD/USD traded in a 4.1c range, slightly above its 10y monthly average of 3.6c (Chart 1).

The AUD/USD started June on the back foot but then early in the month a better-than-expected China Caixin manufacturing PMI helped offset some of the negativity while in Australia, the Fair Work Commission announcement of a 5.75% minimum award wage increase triggered a reassessment of RBA rate hike expectations. On 6 June, the RBA surprised most with a 25bps hike to 4.10%, noting that “some further tightening of monetary policy may be required”. A day later Governor Lowe reinforced this hawkish message at a speech in Sydney.

The move up in the AUD/USD towards 69c on 16 June was also aided by USD weakness amid softer US data releases and the FOMC decision to keep rates on hold on 14 June. A new dot plot revealed another 50 bps of hikes was possible by the end of the year.

In the second half of June the AUD/USD lost altitude with a string of better-than-expected US data releases lifting the USD. Renewed CNY weakness also weighed on the AUD/USD, amid disappointing China data releases and no news on Beijing’s stimulus plan. Australia monthly May CPI revealed underlying inflation remained sticky while retail spending also surged, keeping the July RBA meeting live. Weaker US consumer spending and inflation on the last day of June helped the AUD/USD end the month at 0.6640.

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets. Read our NAB Markets Research disclaimer.

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.