Firmer consumer and steady outlook

Insight

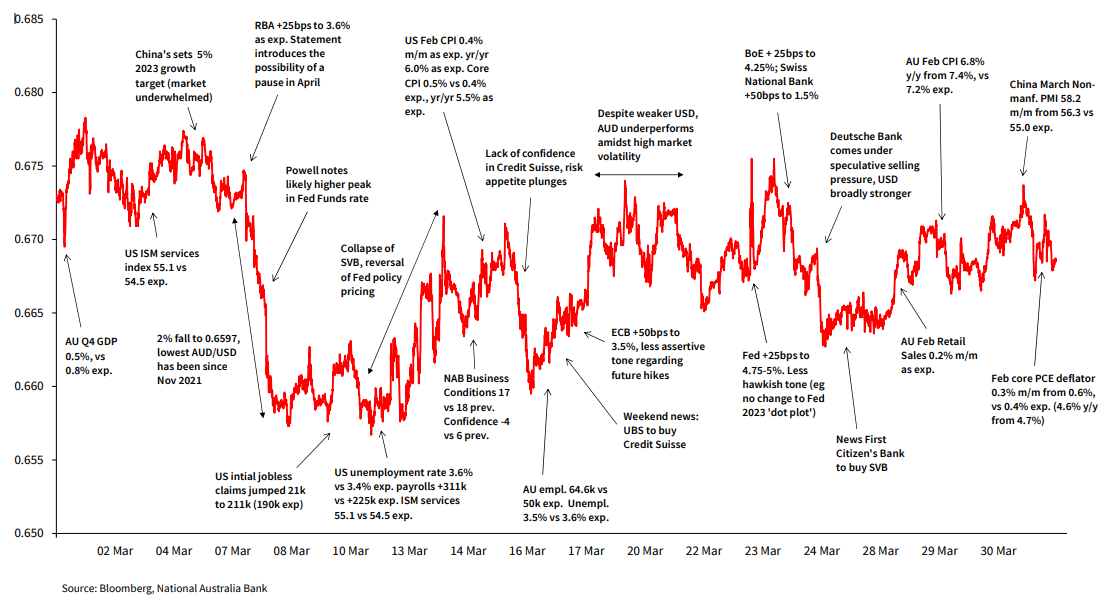

Following two months of well above-average ranges, the AUD/USD range reduced to just 2.2 cents in March, though the currency did hit a 4-month low of 0.6565.

Following two months of well above-average AUD/USD ranges in January and February, the range reduced to just 2.2 cents in March (high of 0.6784 on March 1, low of 0.6565 on March 10, latter the lowest since November 10 last year).

Negative influences in the early part of March included what was deemed an underwhelming (5%) China 2023 growth target, then hints in the RBA’s March 7 Statement – accompanying its 25bps rate hike – of a possible pause in the tightening cycle. Bigger hits came later, from Fed chair Powell’s suggestion of a higher than previously expected peak in the Fed funds rate, quickly followed by USD safe-haven support from the deposit run and collapse of SVB, setting off something of a banking sector panic.

The hit to AUD from the deterioration in risk sentiment (see below) was largely reversed at mid-month, the USD suffering as US interest rates fell sharply on the view that tighter credit conditions would herald an early end to the Fed tightening cycle/earlier rate cuts. Some support for this view came from a less hawkish tone out of the March 23 FOMC, which included no upward shift to the FOMC’s 2023 ‘dot plot’ (against earlier expectations).

Softer than expected local monthly CPI data in late March saw market lift their confidence in an RBA pause in April, hurting AUD, though improved risk sentiment as banking concerned eased, and a stronger than expected China non-manufacturing PMI provided some support, together keeping AUD trapped near the middle of its monthly range.

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets. Read our NAB Markets Research disclaimer.

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.