Robust growth for online retail sales observed in June

Insight

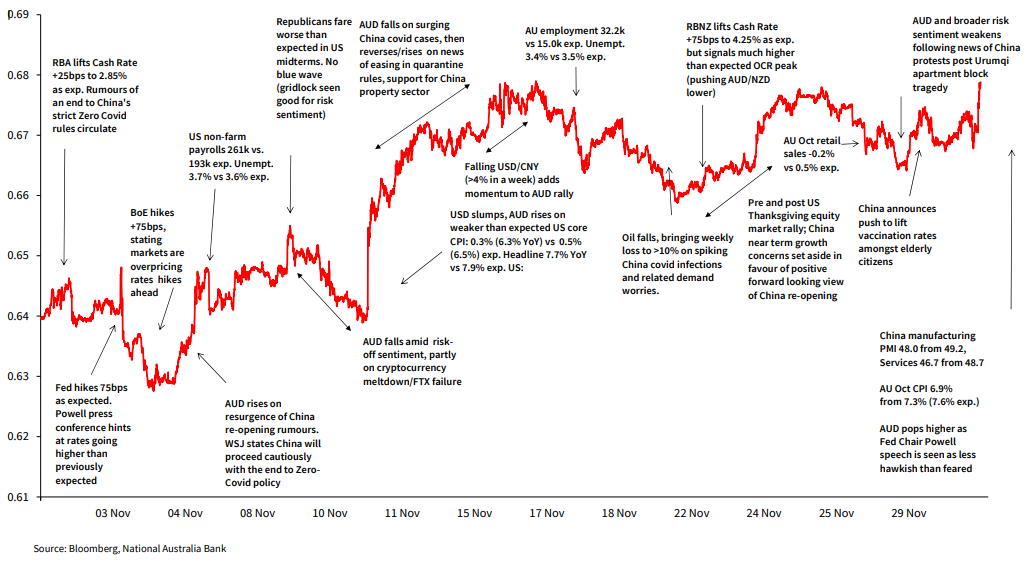

The AUD ended the month in the ascendency, boosted by a less hawkish than feared Fed Chair Powell speech, forcing a broad USD retreat.

A 5.25 cents low-to-high range for AUD/USD in November marks it down as the third most volatile month of 2022 to date. The low of 0.6272 was on 3 Nov. and high of 0.6797 on 15 Nov.

The month started with the RBA lifting the cash rate by a further 25bps taking it to 2.85%. The move was much as expected and so had scant impact on the currency. Rather, two themes dominated in the month – the big USD and China. USD strength/AUD slippage in the early part of the month followed the ‘as expected’ 75bps hike to the Fed Funds rate but which was accompanied by post-meeting comments from Fed chair Powell indicating that, while the Fed could step down the scale of future rises, it now saw a peak (or terminal) Fed Funds rate higher than indicated back in September.

A subsequent mini-revival in the AUD came in conjunction with rumours that China was set to announce a relaxation of some of its strict zero-covid rules. Though denied, the chatter repeatedly resurfaced. It culminated in the announcement (11 Nov.) of a relaxation of quarantine rules, reducing the time in isolation and no longer requiring close contacts of close contacts to isolate. The same day, significant support for the beleaguered China property sector was announced, including the ability of some developers to roll over loans maturing in the coming 6 months. This news, which saw the CNY appreciate by more than 4%, compounded earlier USD weakness from the release of significantly weaker than expected US CPI data – more than 0.2% softer than consensus estimates, inspiring a view US inflation has now peaked.

AUD remained supported in the latter part of the month, albeit beneath the 15 Nov. highs. This was on positive US risk sentiment into and out of US Thanksgiving and, in the face of China covid infection rates that surpassed their April 2022 peak. The latter fuelled the conviction China will ease covid restrictions in coming weeks and months to get its economy back on track and to quell rising social unrest (including via boosting vaccination rates amongst the elderly).

Domestic data, including better than expected labour market data at mid-month, weaker than expected retail sales on 28 Nov. (-0.2%m/m) and much softer than expected October CPI (6.9%yoy from 7.3%) made only momentary impact. The AUD ended the month in the ascendency, boosted by a less hawkish than feared Fed Chair Powell speech, forcing a broad USD retreat.

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.