Online retail sales growth slowed in May following a fairly strong April

Insight

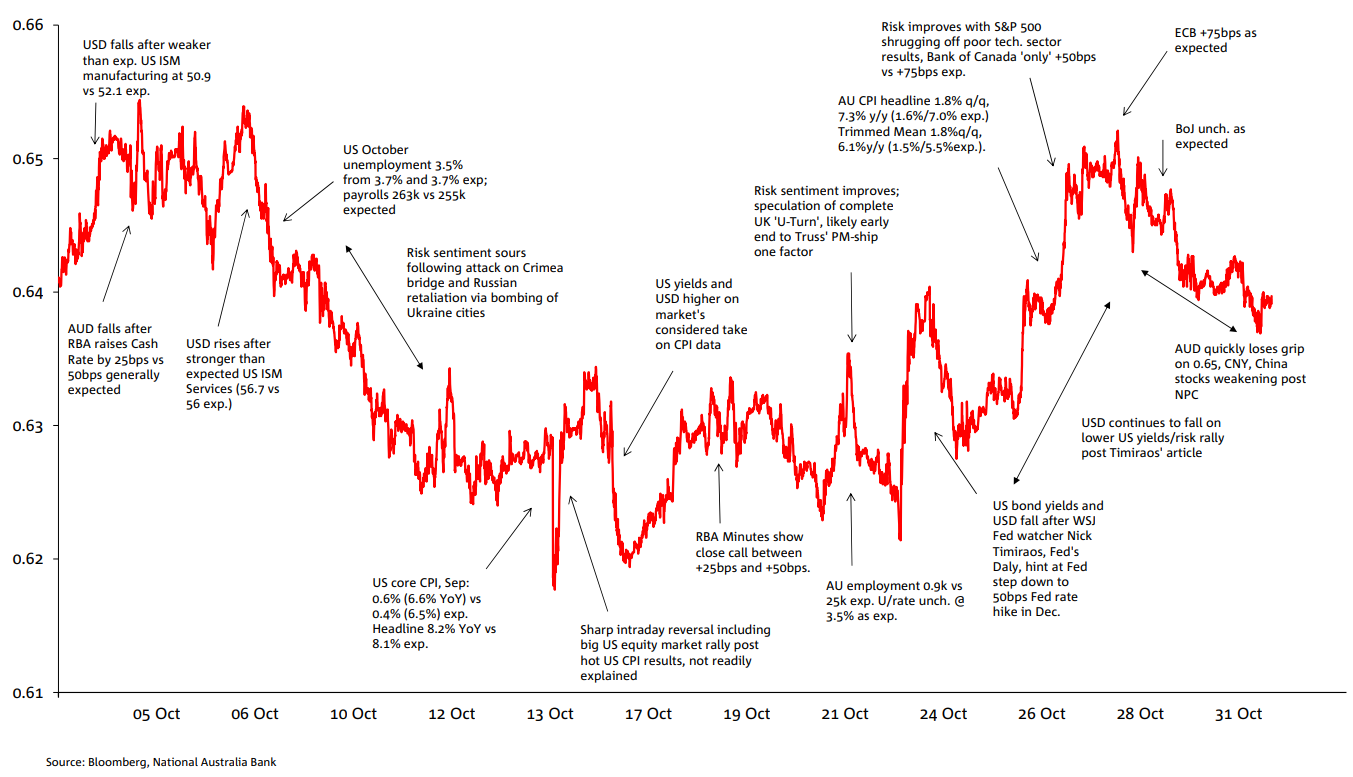

Australia specific influences on AUD once again played second fiddle to broader USD volatility and swings in risk sentiment.

AUD/USD traced out a 3.8 cents or 5.89% range in October, with a high of 0.6547 on 4 October and low of 0.6170 on 13 October. The latter was the weakest since 18 April 2020, when AUD/USD was in the throes of recovering from the March 2020 early pandemic-era crunch lower.

Australia specific influences on AUD once again played second fiddle to broader USD volatility and swings in risk sentiment. That said, a notable feature of October was that a positive month for risk (although more so for US stocks than broader measures of risk appetite) failed to translate into a stronger AUD/USD, which on an open-to-close basis was very little changed, albeit swings in sentiment did generate some of the intra-month volatility in the currency (e.g., down following the attack of the Crimean bridge and Russia’s retaliation).

The Australian specific ‘set pieces’ during October were: 1. The RBA’s surprise decision to raise the Cash Rate by ‘only’ 25bps on 1 October against the general consensus for +50bps, which produced a modest and only temporary, fall in AUD; 2: the subsequent RBA meeting Minutes revealing that the decision to raise rates by 25bps rather than 50bps was a finely balanced one; and then on 26 October, Q3 CPI which sprang significant upside surprises on both headline and core readings, latter up to 1.8% from an upward revised 1.6% against 1.5% expected, leading some to question whether the 1 October RBA decision might, with the benefit of hindsight, have been a mistake.

From the US dollar side of the AUD equation, the AUD suffered for much of the first half of the month from incoming US data that mostly surprised to the upside (ISM Services, unemployment rate down to 3.5% from 3.7% and especially the September CPI report where core inflation rose by 0.2% more than expected to 6.6% from 6.3% in August). The USD-positive/AUD negative influence of the data was subsequently more than reversed – seeing AUD/USD back briefly above 0.65 – by commentary from the WSJ’s chief economic commentator (and San Francisco Fed’s Daly) suggesting the Fed would step down to a 50bps rate hike increment in December.

In the last few days of October, AUD lost its grip on 0.65, losing a cent by month-end, where one factor was renewed weakening in CNY and sharp falls in China-related stocks following the conclusion of China’s NPC featuring the stark consolidation of President Xi’s grip on power.

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.