On a seasonally adjusted basis, the NAB Online Retail Sales Index recorded a drop in growth in July

Insight

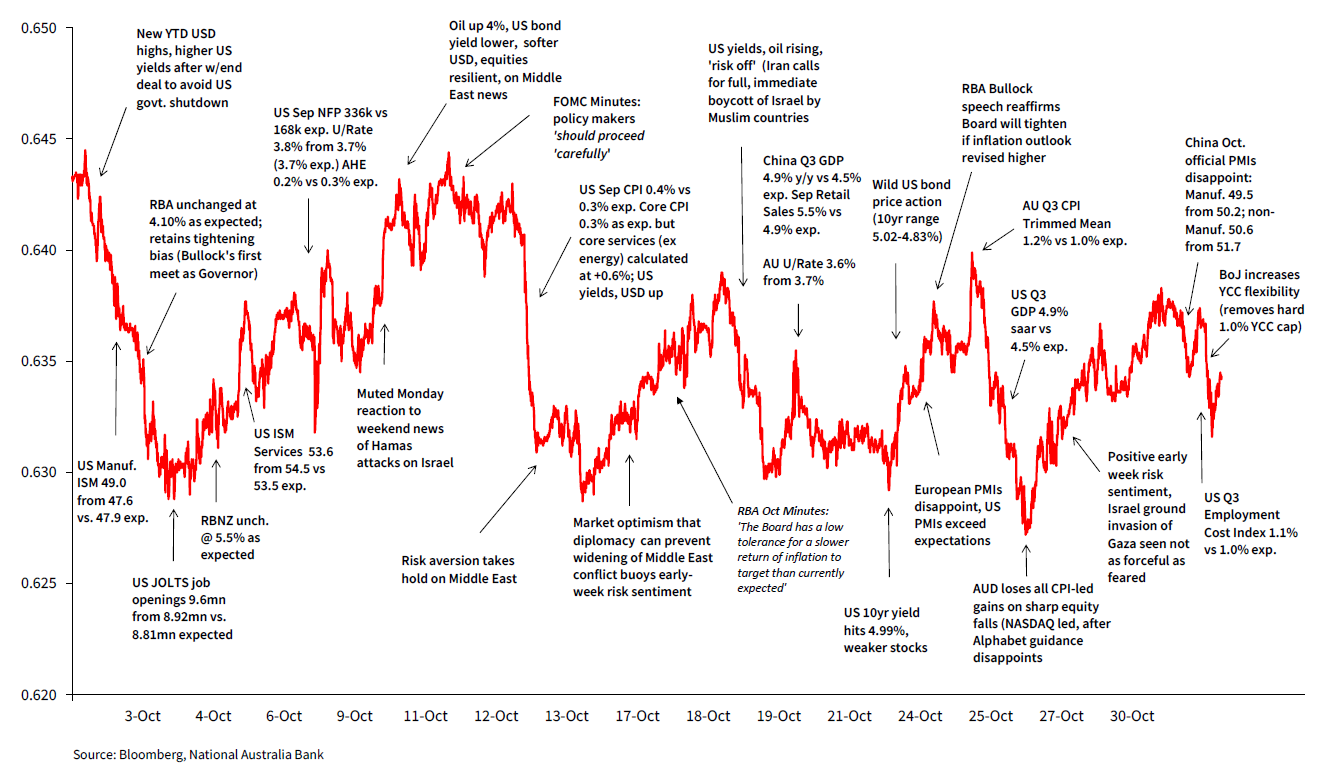

Despite everything happening in the world, the AUD’s October trading range was extraordinarily low.

By just a hairs’ breadth, October’s 1.75 cents AUD/USD range exceeded the 1.74 November 2019 range (latter the lowest since Feb.2017). The month’s low of 0.6270 seen on26 October – after a high of 0.6445 on 11 October matched its post April 2020 (pandemic-era) low, previously seen on 13 October 2022. It seems extraordinary that such a low-volatility month could occur during a period that included: the tragic events unfolding in the Middle East and ongoing attendant risk of a broadening in the conflict (to include, in particular, Iran); US 10-year bond yields hitting new post-2007 highs above 5.0%; the sharp repricing of RBA rate hike expectations following the upside Q3 CPI surprise; and the S&P 500 joining earlier Hong Kong and China stock markets into correction territory (losses exceeding 10% since their July highs).

Low volatility in AUD/USD was not a uniquely AUD phenomenon. The CVIX measure of (G10) FX volatility flatlined in October at the same time the VIX measure of (S&P 500) volatility jumped from multi-year lows in late September to an above average 20. The MOVE index of bond volatility also rose, by about 30%, between late September and early October.

That USD indices (e.g. the DXY and Bloomberg BBDXY) failed to extend their early October one year highs as the month progressed, while AUD/USD fell to its weakest in a year, is testament to AUD’s ongoing ‘whipping boy’ characteristics whenever risk sentiment sours (especially in Emerging Markets). It also exemplifies AUD’s ‘up the stairs, down the elevator shaft’ qualities. Hard fought intra-month gains, including on rising RBA tightening expectations and (at mid-month) better China Q3/September activity data, were quickly undone on ‘risk off’ episodes. Weak China October PMI data right at month-end also undermined earlier AUD gains.

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets. Read our NAB Markets Research disclaimer.

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.