Robust growth for online retail sales observed in June

Insight

Forces acting on the AUD (and other commodity linked currencies) independent of USD strength in September were largely China related.

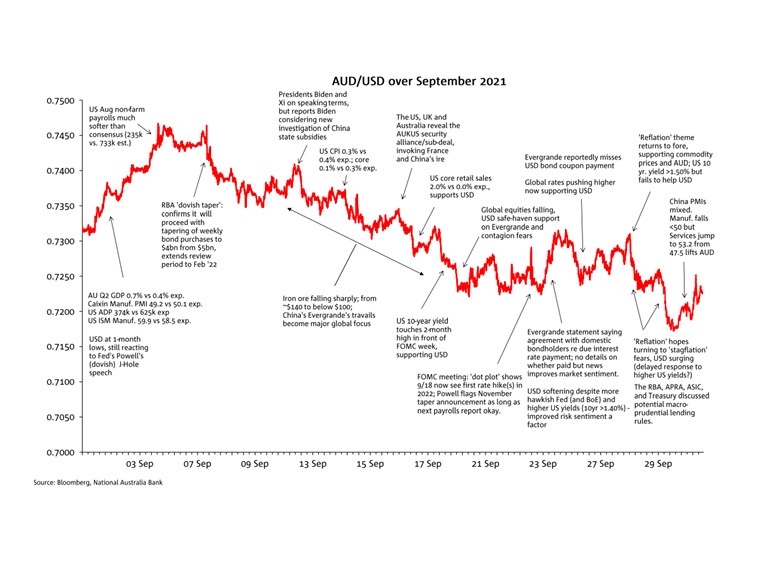

Having ended August at 0.7316, AUD/USD made a high of 0.7478 on 3 September before tracking lower for most of the rest of the month. The AUD low was 0.7160 on 29 September, before pulling up to end the month at 0.7227, for an overall loss of 1.2%.

Early month AUD strength was largely a reflection of USD slippage, following first the response to what was considered a dovish speech from Fed chair Powell at Jackson Hole in late August, followed by a much weaker than expected US non-farm payroll release, the latter putting paid to thoughts that the Fed could formally announce the start of QE tapering out of the Sep.21-22 FOMC meeting.

In the event, the Fed chair Powell did all but announce that tapering would commerce before the end of the year, subject to an okay September employment report (due 8 Oct). The Fed meeting also contained a hawkish tilt, with half of the FOMC members now calling for a first rate rise in 2022. With a short delay, this saw US bond yields commence a significant move higher – by some 20bps over the month at 10-years – and with a further delay, a strengthening in the USD – to its highest levels in 12 months.

Forces acting on the AUD (and other commodity linked currencies) independent of USD strength in September were largely China related. This included the travails of China’s largest property developer Evergrande and what its potential collapse would means for broader risk sentiment (contagion risk), the broader China property sector and the implications for already-slowing China growth as well as commodity demand. Iron ore prices came under acute downward pressure, from highs above $150 a tonne in late August to a low of $90 on 20 September (Singapore futures) – moves aggravated by sharply rising energy input costs for steel production – before recovering to end Sep. nearer $120.

The mid-month announcement of the AUKUS pact including a major new nuclear submarine procurement plan infuriated France and China, France threatening to scupper negotiations over an EU-AU Free Trade agreement, but this failed to have any noticeable negative impact on the AUD.

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.